JPY flows: JPY reverses initial gains on trade deal

JPY i nitially agins on trade deal, but positive equity market reaction and expectation of other deals helps the USD

The news of a US/Japan trade deal initially triggered USD/JPY losses, but we have seen a rebound back above the pre-deal levels. While Japanese yields are higher, and provide an argument for USD/JPY to move lower, with a greater chance of BoJ tightening now that a deal is on the table, the positive equity market reaction is seen as a negative for the JPY, particularly on the crosses. Equities are higher everywhere, with the deal likely being seen as a sign that other deals will be done, notably with the EU, before or around the August 1st deadline. This is also being seen as generally USD positive, with the prospect of high reciprocal tariffs having been a USD negative since the initial April announcement.

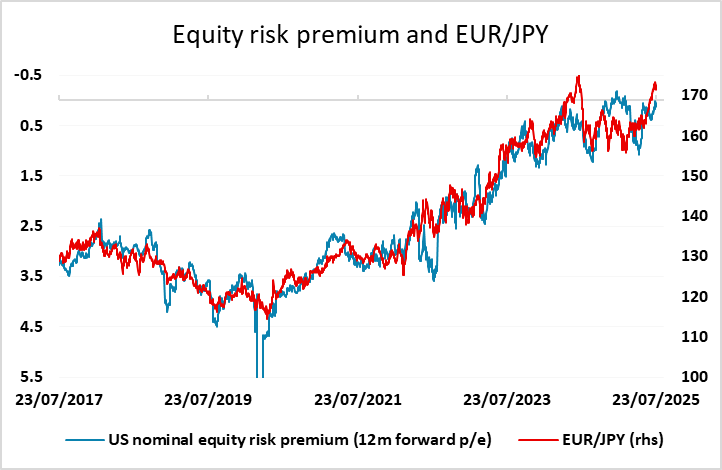

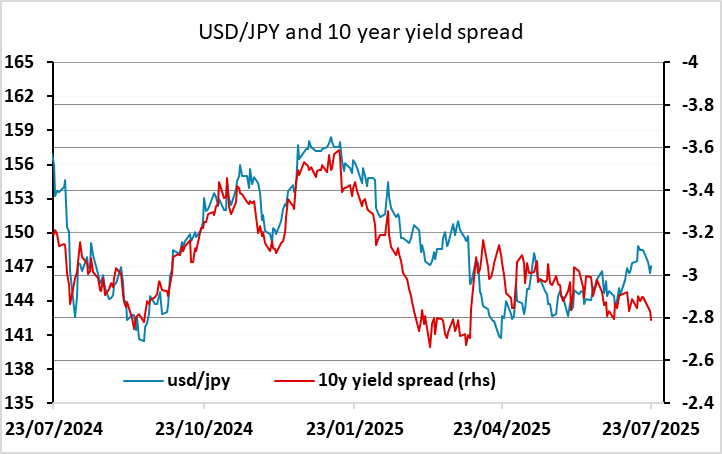

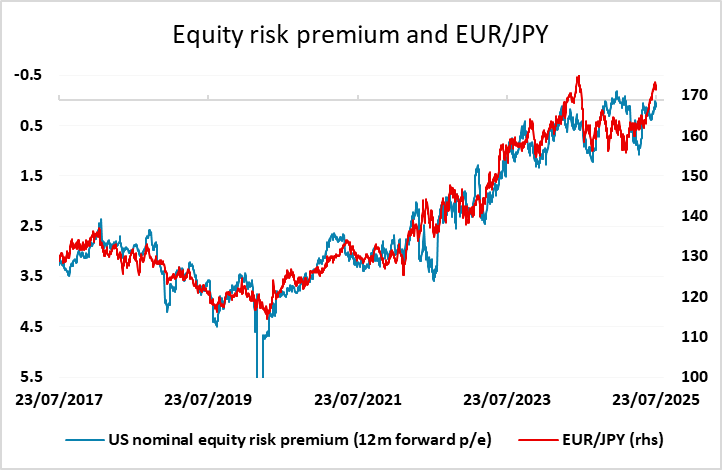

If similar deals are done elsewhere, it is likely to be USD positive, with scope for a substantial USD recovery against the EUR. There is much less scope for gains against the JPY, with USD/JPY already above the levels normally associated with current yield spreads. However, if EUR/JPY continues to trade closely with US equity risk premia, it may not move far from current levels if equities take trade deals as a positive. Longer run, we still see equity indices as overstretched here at this level of yields, so we do see EUR/JPY downside risks, but positive news on trade will liekly prevent any significant short term decline.

If there is no similar deal done with the EU, the history since April suggests the USD can come under more general pressure. Even so, such an outcome would not be positive for the EU and the EUR could be expected to suffer on the crosses, particularly against the JPY.