FX Daily Strategy: N America, December 20th

US to hold most of its post-FOMC gains

Some scope for EUR recovery based on yield spread metrics

JPY still struggling

GBP has scope to fall further

US to hold most of its post-FOMC gains

Some scope for EUR recovery based on yield spread metrics

JPY still struggling

GBP has scope to fall further but retail sales may be mildly supportive

After all the events of this week, Friday is a much quieter day, with no central bank meetings and no data of any great import, although the November PCE price index and the UK retail sales data will be of some interest.

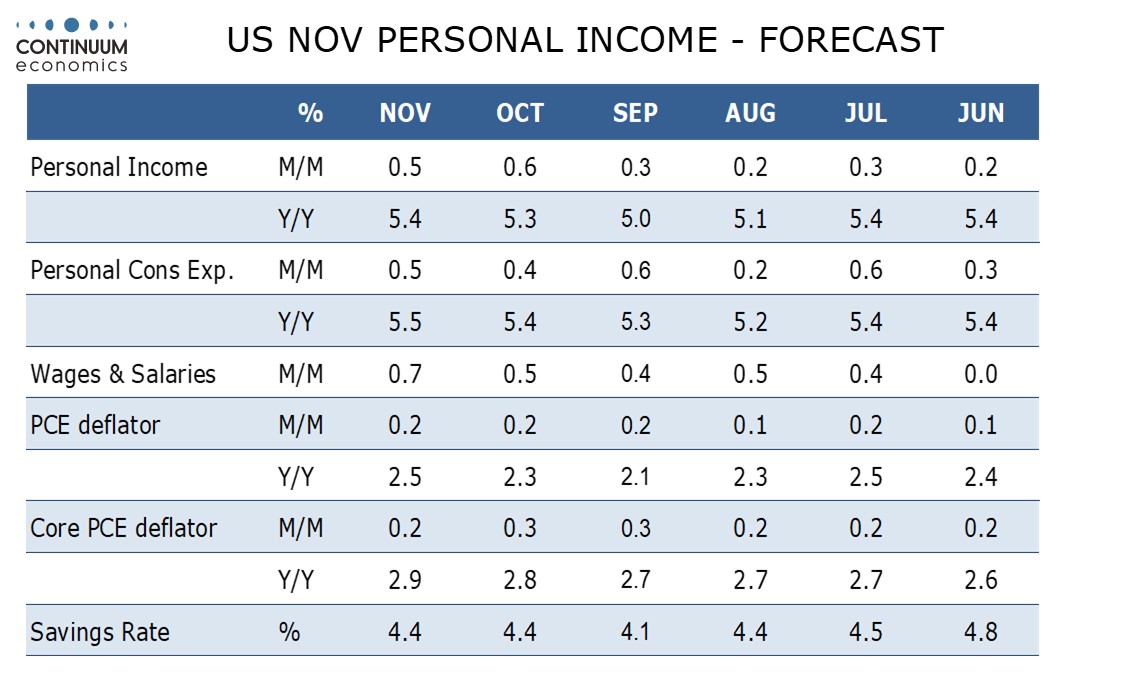

We expect November to see a 0.2% increase in the core PCE price index, underperforming a 0.3% core CPI as is usually the case but was not so in September and October. We expect 0.5% increases in personal income and spending. Core CPI has seen four straight gains of 0.3%. While September and October saw the core PCE price index match the CPI (though marginally underperforming before rounding) August saw only a 0.2% rise in core PCE prices, and lower still before rounding. We expect core PCE prices to underperform the core CPI once again in November. This is in line with market consensus, but may nevertheless serve to pause the rise in US yields that we have seen since the FOMC, which is starting to look a little overdone. There may therefore also be some correction to recent USD strength, although any significant reversal is likely to require a decline rather than a stabilisation in yields.

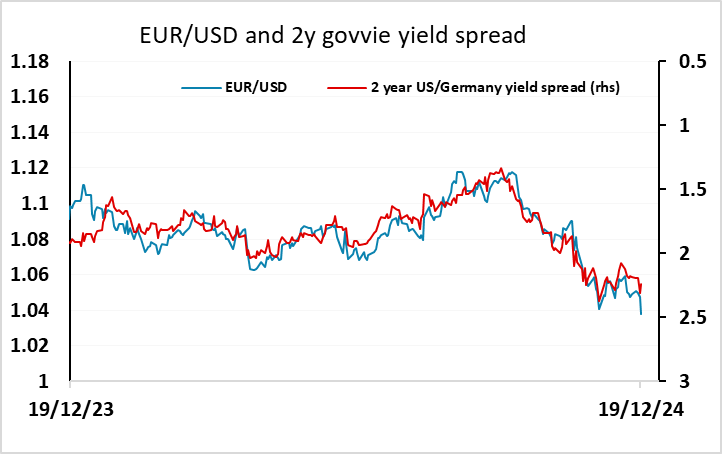

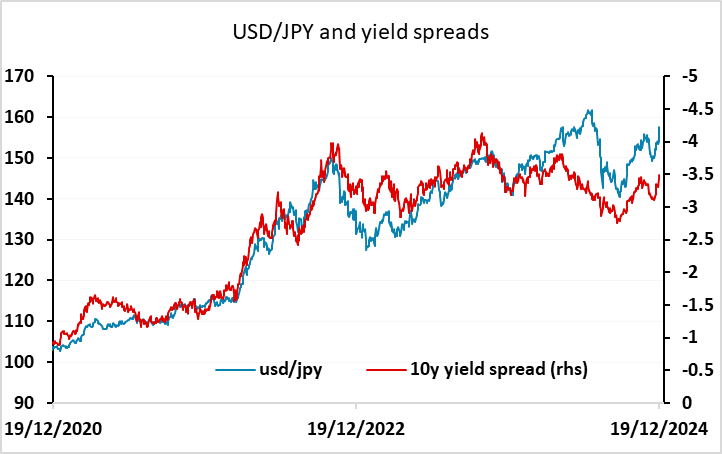

EUR/USD is underperforming the moves in 2 year yield spreads, and may have scope to recover above 1.04. USD/JPY is moving in line with the yield spread correlation that has heled since August, so may not have much downside scope, although longer term correlations suggest current levels are too high. The rise in US yields has also led to a new low in the nominal US equity risk premium, despite the decline in equities that it has engendered, and this is likely to maintain downward pressure on JPY crosses, supporting gains in EUR/JPY. Even though it is hard to be comfortable with USD/JPY at these extreme levels, where the Japanese authorities have been prepared to intervene in the past, the lack of concern from the BoJ at the short term consequences of their rate decision for the JPY makes it hard to believe we will be seeing any official opposition to current JPY weakness.

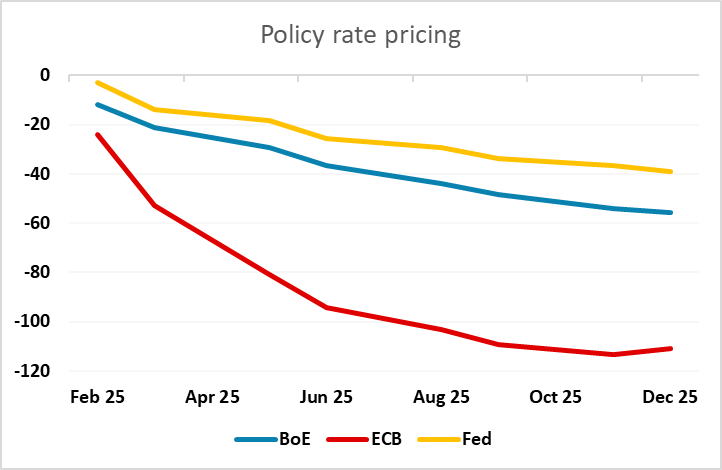

UK retail sales have come in slightly below expectations. GBP has softened slightly, and remains under pressure following the losses after yesterday’s BoE MPC meeting. The meeting undermined the pound both because of the 6-3 vote, which included one more vote for easing than expected, and because the statement downgraded growth expectations, in part due to the Budget measures. The reluctance to ease reflected concerns about the impact of the Budget rise in the minimum wage and National Insurance contributions on inflation, rather than any positive feelings about the economy, and suggests that we could see substantial decline sin rates next year. Thus far,, UK yields have only fallen modestly, but there is a strong case to suggest that BoE policy will look more similar to ECB policy than the Fed-like policy path that is currently priced in, and that would suggest a substantially lower pound.