USD, JPY, EUR, AUD, CAD flows: Risk positive tone persists on hopes of US/China trade deal

Reports of progress in US/China trade talks trigger more risk positive moves in equities and FX.

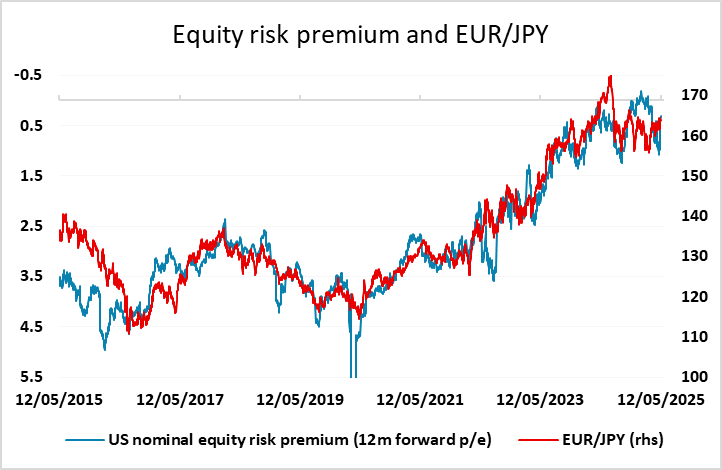

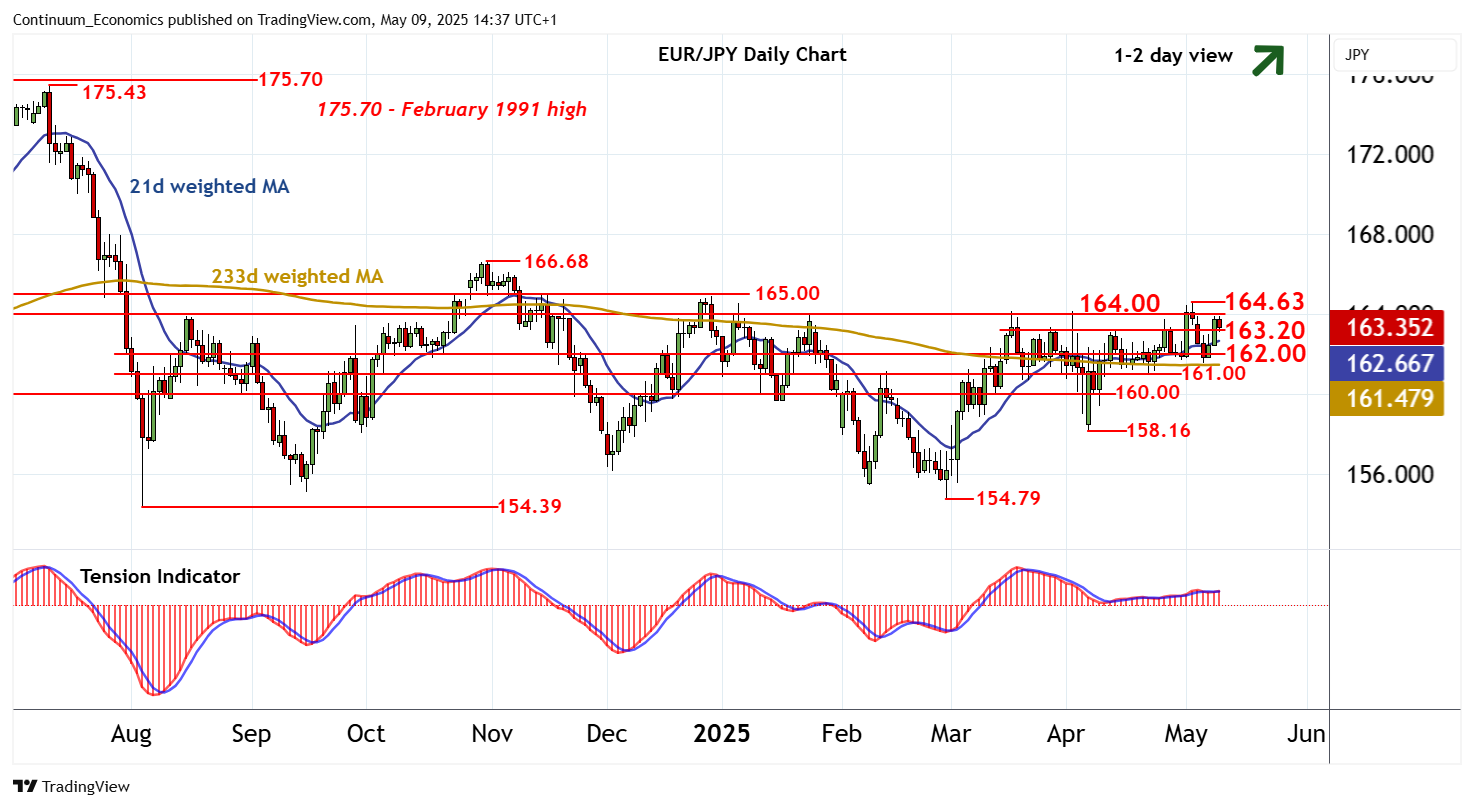

Markets are starting with a risk positive tone on trade optimism. After talks in Geneva, Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer on Sunday said a deal had been reached with China to cut the U.S. trade deficit. Details were scarce but a joint statement is expected today. Whether any deal can justify the scale of the recovery seen in equities in the last few weeks is, however, doubtful. It seems very unlikely that Trump is prepared to roll back all the tariffs, so some negative impact on US and global growth seems inevitable. This looks inconsistent with the scale of the US equity recovery, which has seen the S&P 500 retrace 75% of the declines from the February high and rise above the highs of April 2 when the tariffs were announced. Nevertheless, as long as the positive equity tone persists, the JPY is likely to remain under pressure and the riskier currencies should benefit. EUR/JPY is pressing the key resistance area at 164, and a break is becoming increasingly likely as equity risk premia decline. However, for today much will depend on the details of any US/China deal. We suspect the news will be less impressive than hoped, in which case we could see some reversal of recent equity gains, but without a clear shift to negative sentiment. We still expect a large JPY rise over the course of the year, but this is still likely to require a turn in risk sentiment, which is now only likely to come if we see some clear negative US economic news. This is turn will take time as the impact of tariffs takes effect. In the meantime, long JPY positions could still be squeezed further.

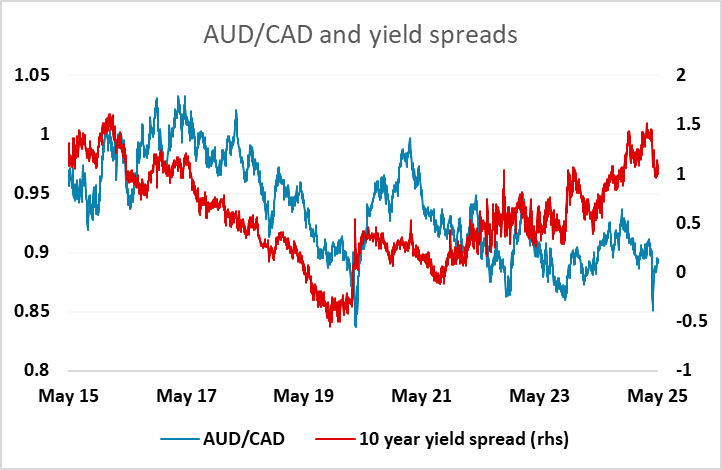

The AUD would likely be the main beneficiary of a significant US-China trade deal. AUD/USD has found support below 0.64, and we see scope for a break up to the high 60s if Chinese equities start to perform well. AUD/CAD may be the best vehicle for AUD bulls, with the CAD still looking expensive relative to yield spreads while the employment data shows signs of turning weaker.