FX Daily Strategy: APAC, February 2nd

USD/JPY may slip lower on consensus employment data

EUR/JPY vulnerable if equities slip

EUR/USD needs relative US equity weakness to make gains

GBP still vulnerable despite modest post-BoE recovery

USD/JPY may slip lower on consensus employment data

EUR/JPY vulnerable if equities slip

EUR/USD needs relative US equity weakness to make gains

GBP still vulnerable despite modest post-BoE recovery

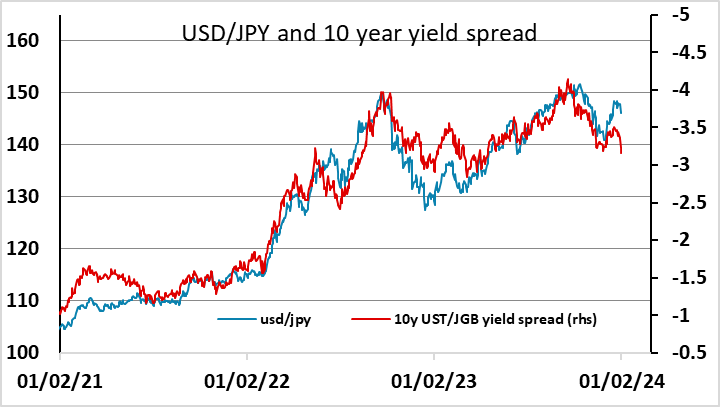

Friday is dominated by the US employment data. We expect a 200k increase in December’s non-farm payroll, with private payrolls up by 150k, slightly slower than December’s respective outcomes of 216k and 164k but stronger than the October and November reports. We expect unemployment to nudge up to 3.8% from 3.7% and a 0.3% increase in average hourly earnings to follow two straight gains of 0.4%. Our forecasts are essentially in line with consensus, so we wouldn’t anticipate a major impact from the data. However, there are anomalies in the market that may be corrected once the data is out, if it doesn’t have a significant impact. In particular, USD/JPY continues to looks substantially too high relative to the 10 year yield spread that has driven the rise over the last few years. If the employment report doesn’t trigger a significant rise in US yields, it should be a green light for the JPY bulls.

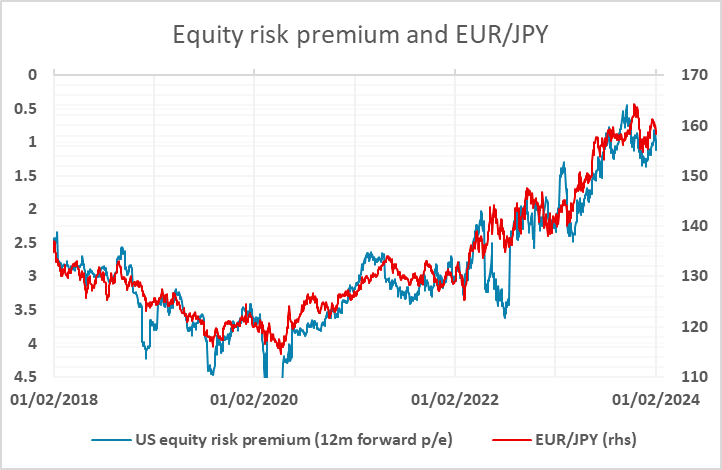

However, it may be that the JPY requires more evidence of weakness in US equities to trigger a more substantial recovery. EUR/JPY has been well correlated with US equity risk premia over recent years, and as long as risk premia don’t rise significantly, EUR/JPY looks likely to stay elevated, even though yields spreads between the Eurozone and Japan suggests there should be substantial EUR/JPY downside. There was some brief JPY strength on Wednesday when US banking concerns re-emerged on the 45% fall in stock of New York Community Bancorp, but it may require more negative equity news to trigger JPY gains.

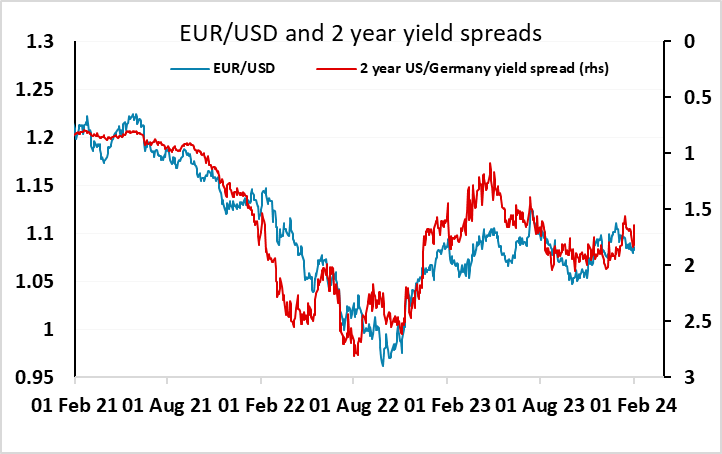

Yield spreads offer less reason for any movement in EUR/USD, which is broadly consistent with the level of 2 year spreads between the US and Germany. But the EUR has tended to suffer from the relative out performance of US equities in recent years, so if we see weakness in US equities – there is also likely to be some impact on EUR/USD. The more contained any problems are to the US, the better the EUR should perform. Weak global equities would tend to undermine the EUR.

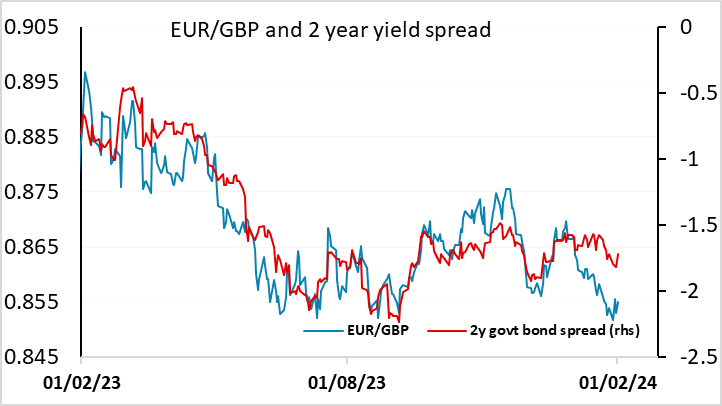

There wasn’t any major impact on GBP from the BoE meeting on Thursday, but the pound did rally modestly as the Bank’s statement suggested they were comfortable with what he market is pricing in in terms of rate cuts for this year. They also actually increased their forecast for inflation in 2 years’ time, presumably partly because of the decline in yields since the November MPR. Even so, with a flat growth forecast and, in our view, a strong chance that inflation actually falls below target in the spring, we think the hawks will struggle to hold onto their calls for a further hike. We consequently believe a rate cut may well come sooner than expected. Dips towards 0.85 in EUR/GBP should consequently be a GBP selling opportunity, with EUR/GBP in any case looking a little rich relative to yield spreads.