FX Daily Strategy: N America, December 10th

RBA unlikely to move rates, but focus on guidance

AUD biased higher on neutral meeting

NOK upside also favour if Norway CPI doesn’t show weakness

JPY weakness starting to look overdone

RBA unlikely to move rates, but focus on guidance

AUD biased higher on neutral meeting

NOK upside also favoured

JPY weakness starting to look overdone

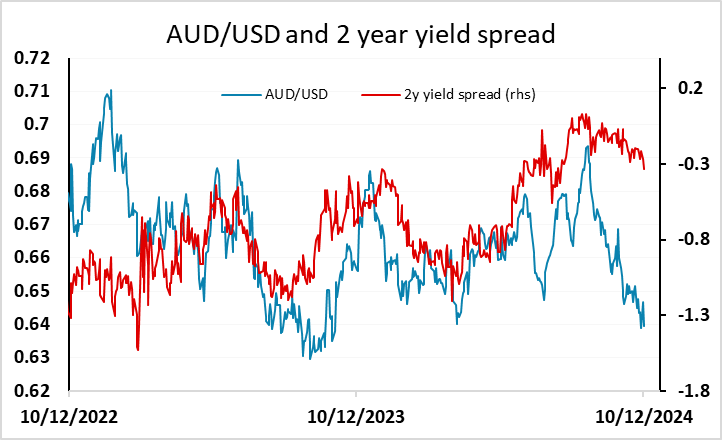

The RBA kept the cash rate on hold at 4.35% as per previewed in the November meeting when the RBA downplayed latest moderation in headline CPI, instead referred to the middle of target range and progress in underlying inflation before the chance of easing. The forward guidance statement did not change from the November statement, citing "The Board will continue to rely upon the data and the evolving assessment of risks to guide its decisions.", suggesting the RBA has not changed their view since. The RBA viewed the headline moderation of Q3 CPI to be partially attributed from the government subsidy of energy prices and stated that underlying inflation did not show the same pace of moderation. However, they also acknowledge that wage growth is slowing despite tight labor market. Combined with the weaker growth in Australian economy, the RBA should be getting ready to ease once underlying inflation shows more cooling. AUD/USD fell back after the announcement, with the market pricing in a slightly higher chance of easing in February, but is still holding above the 0.6350/60 support area and continues to look good value at current levels.

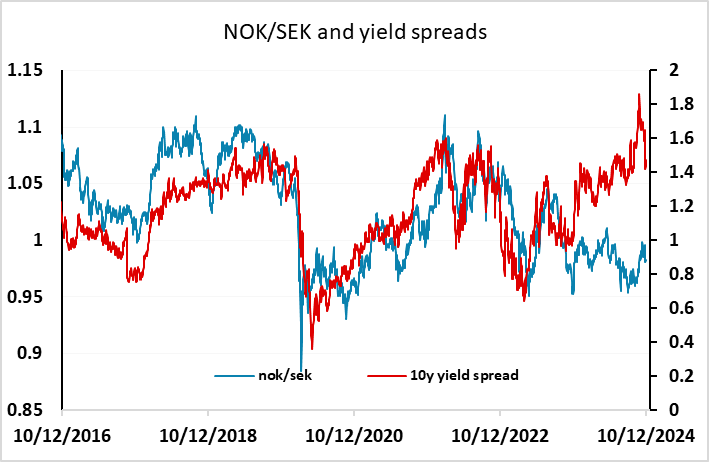

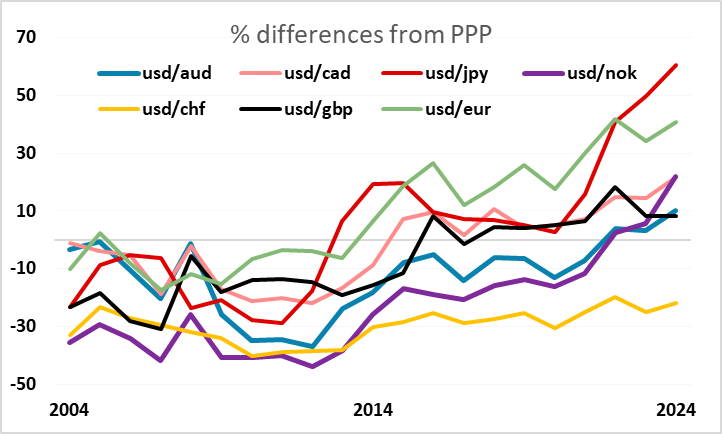

This morning’s Norwegian CPI data has come in stronger than expected at 3.0% y/y for the core, triggering general NOK gains. These gains are so far quite modest, but we see scope for the NOK to extend gains against the SEK to retest parity before the end of the year, and for EUR/NOK to move back down to 11.50. The NOK has remained weak through most of this year, underperforming the EUR and SEK, but for no good reason that we can see. Valuewise, it was one of the world’s strongest currencies 10 years ago, rivalling the CHF, reflecting its huge oil wealth, large current account surplus and comfortable budget position. These fundamentals haven’t really changed significantly even though much of the current account surplus now comes from foreign investments rather than oil and gas, but the NOK has fallen dramatically in recent years, underperforming everything except the JPY, and is now only stronger than the JPY and EUR among the G10 currencies relative to PPP. This is despite the fact that yields remain relatively attractive.

The weakness of the NOK puzzles Norges Bank as much as it puzzles us, but we doubt it can continue indefinitely. The stronger inflation numbers mean that Norges Bank will remain relatively hawkish and we see scope for sustained gains against a range of currencies, with value most obvious against the SEK, and CHF.

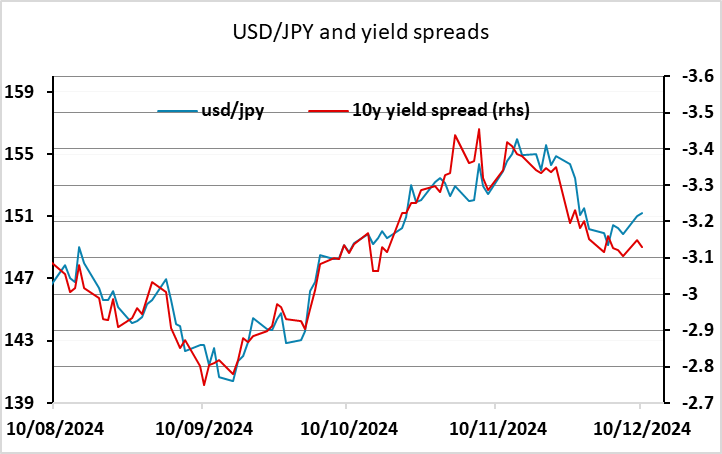

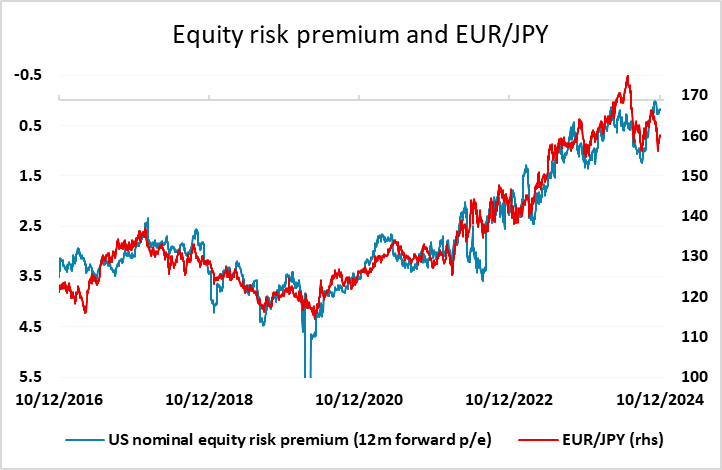

The JPY was the big loser on Monday, undermined by the recovery in regional Asian sentiment leading to general JPY losses on the crosses. As long as risk sentiment remains positive, it will be hard for the JPY to make sustained gains, particularly on the crosses, there the correlation with risk premia is very clear in recent years. But current valuation is still very low, and yield spreads suggest USD/JPY is toppy above 150, so we suspect the JPY will bottom out close to current levels.

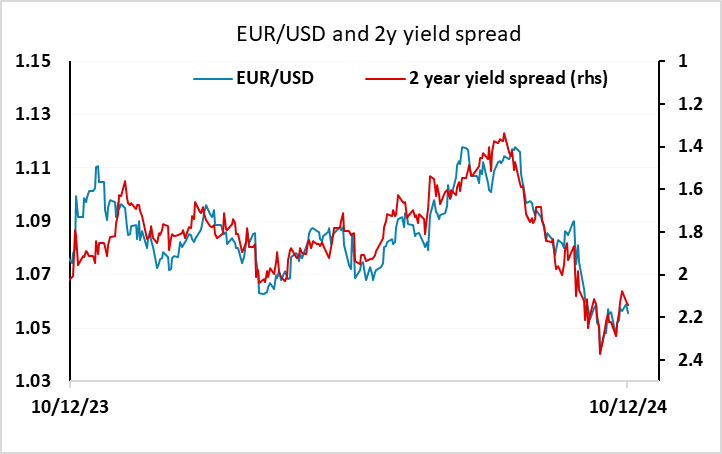

For EUR/USD, yield spreads have moved slightly in its favour in the last few days, and there is scope to retest above 1.06. But there is unlikely to be much near term upside beyond that, as the market has now pared back the probability of a 50bp cut at this week’s ECB meeting to about 15%. There certainly looks to be more of a case for the AUD to outperform the EUR if we continue to see risk sentiment improve.