EUR, JPY flows: EUR downside favoured after weak German orders, JPY weakness overdone

EUR to stay soft as German orders add to evidence of slowdown. JPY weakness lacks rationale

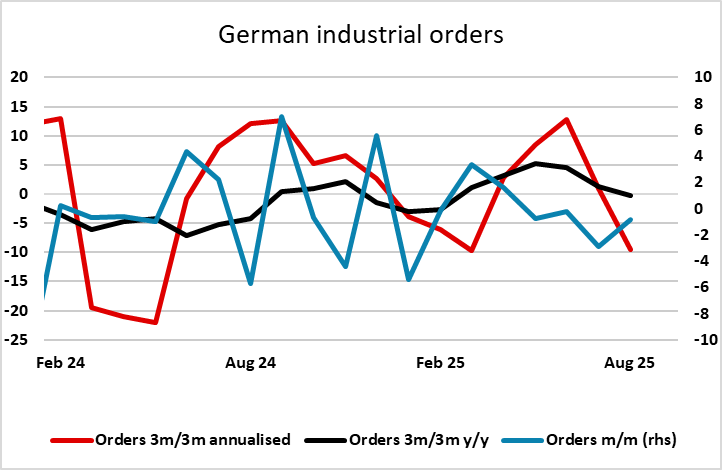

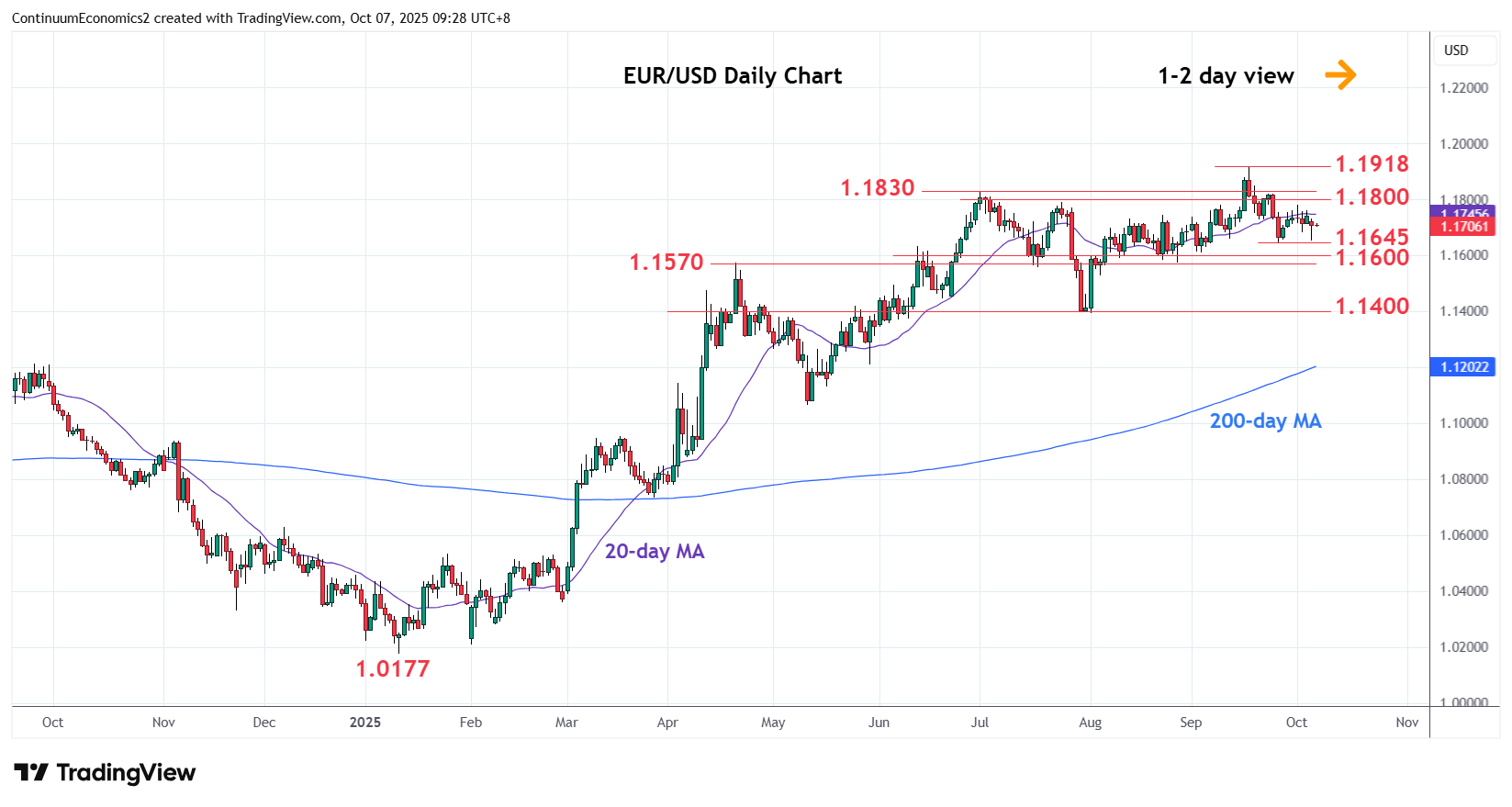

German factory orders have come in weaker than expected in August, falling 0.8% m/m. This is the fourth consecutive monthly decline, and suggests the improving trend seen in the first half of the year has now reversed. EUR/USD has slightly extended the decline seen in late Asia in response to the data, and The EUR ought to stay on the back foot through this morning’s session given the growing evidence of weakening growth and ongoing political uncertainty in France.

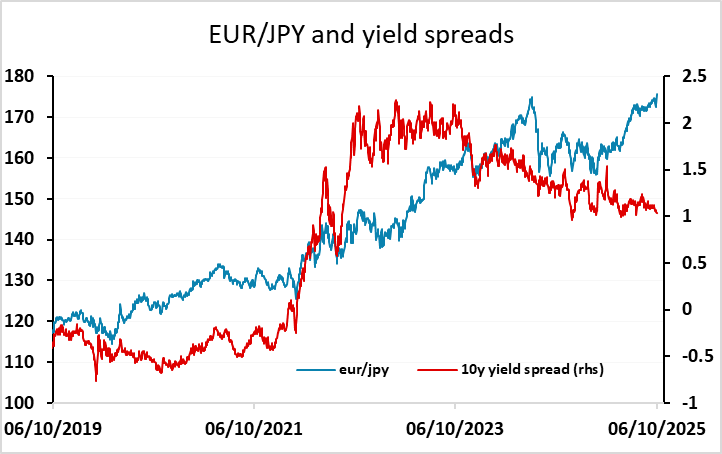

Otherwise, the overnight action saw more weakness in the JPY, with another new all time high in EUR/JPY and CHF/JPY, even though there has been little movement in Japanese yields, with 10 year yields just a tad below the 17 year highs reached yesterday. The case for JPY weakness is based on the election of Takaichi as the new LDP leader and PM, but the precise rationale is unclear. Takaichi is seen as a follower of Abenomics, and thus expected to pursue expansionary fiscal policy. But this is normally currency positive with an independent central bank like the BoJ likely to respond to fiscal easing with monetary tightening. The JPY’s weakness therefore seems to rest on the belief that Takaichi will prevent BoJ tightening, but we don’t see BoJ governor Ueda taking orders from the government. There may be some delay in BoJ tightening as the BoJ waits to see the government’s policies, but easy fiscal policy is, in the end, likely to result in higher Japanese yields and a stronger JPY. The big gap seen at Monday’s open in USD/JPY is likely to be closed by the end of this week, so we see risks to the JPY upside both short and long term.