USD, JPY, CHF, AUD flows: USD soft, JPY and AUD favoured

JPY can close Monday's opening gaps on crosses. AUD/USD threatening top of recent range

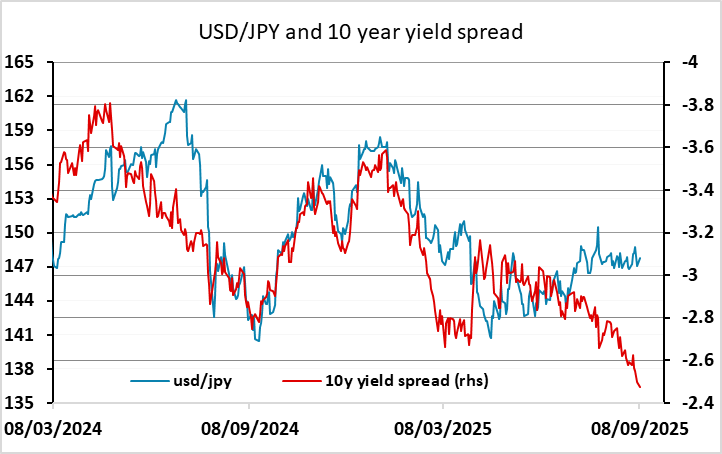

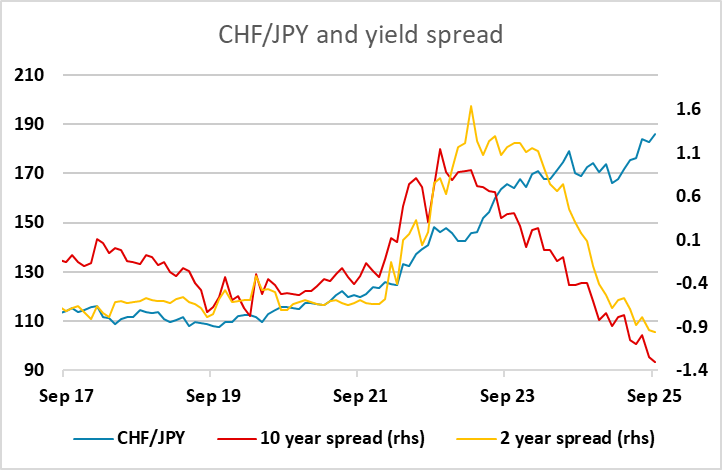

The USD generally lost ground in Asia but has bounced slightly in early Europe. US yields continued to fall back in the US session on Monday and suggest the USD will struggle to make any significant recovery. USD/JPY remains the most out of line with spreads, and lower US yields also mean that the implied equity risk premium is rising, which is correlated with JPY gains on the crosses. While the Ishiba resignation at the weekend turned JPY sentiment negative on Monday, it is hard to see a reason why any new LDP leader will be more JPY negative, as fiscal policy is not going to be tightened whoever is elected as his replacement and may be loosened. It was notable on Monday that while USD/JPY closed the opening gap created by the Ishiba resignation, most of the JPY crosses did not, and we would expect these gaps to be closed. The most notable mover was CHF/JPY, which hit a new all time high at 186.22, but looks ripe for a reversal, especially if the SNB’s Schlegel highlights the CHF strength today and indicates SNB willingness to oppose it.

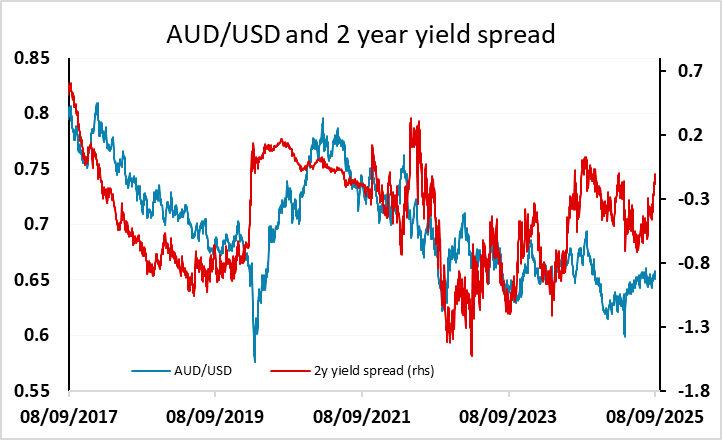

Also significant overnight was the AUD/USD break above 0.66, reaching its highest since the July 24 high of 0.6625, which itself was the highest since November last year. This is now a target and a resistance level. The overnight Australian confidence data was a bit weaker than in July, so the case for independent AUD strength was slightly undermined, but the yield spread picture still suggests that there is substantial AUD upside if regional risk sentiment remains positive.