FX Daily Strategy: Asia, January 29th

FOMC, BOC and Riksbank meetings in focus

Major surprises unlikely, but we favour a mild USD, CAD and SEK downside bias

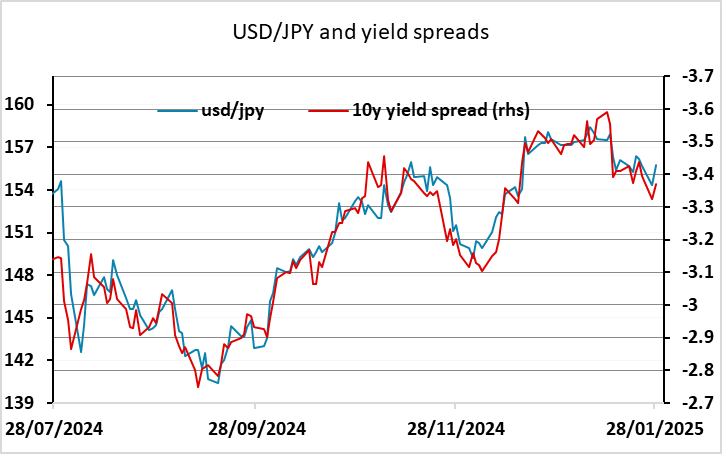

USD/JPY continues to look the most vulnerable

FOMC, BOC and Riksbank meetings in focus

Major surprises unlikely, but we favour a mild USD, CAD and SEK downside bias

USD/JPY continues to look the most vulnerable

A busy calendar on Wednesday with the FOMC meeting the highlight. But this is preceded by the BoC meeting, Q4 CPI in Australia and GDP data and a monetary policy decision from Sweden.

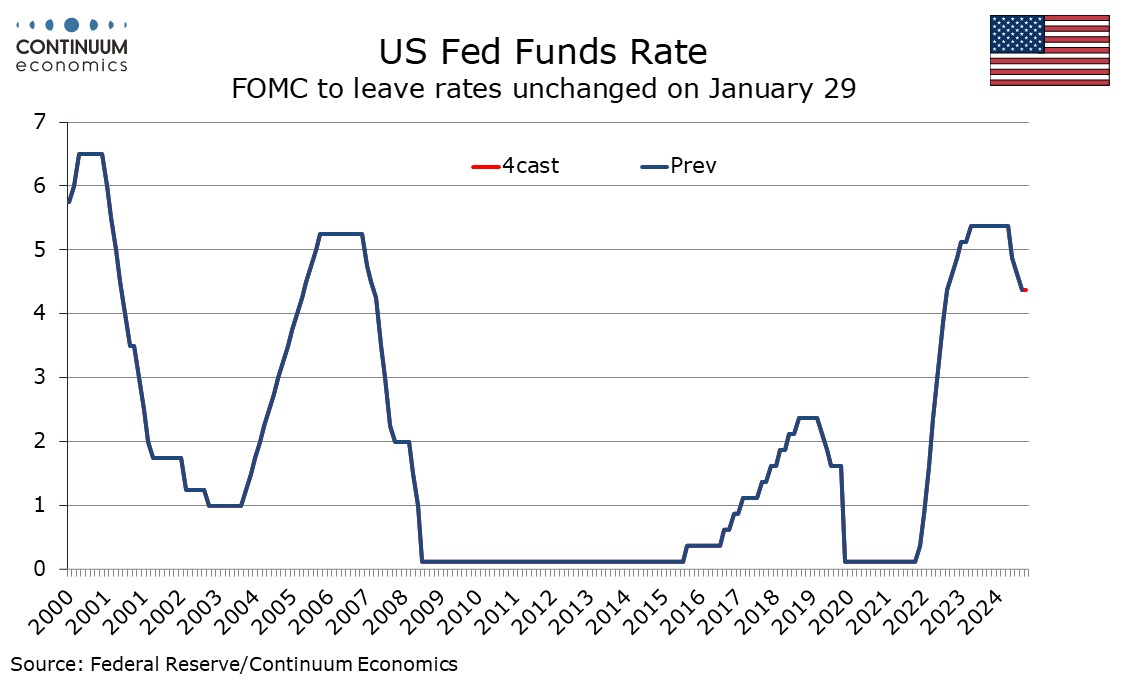

The FOMC looks set to keep rates on hold at 4.25-4.5% at its January 29 meeting. The statement is unlikely to give much away but the message is likely to be one of cautious optimism on inflation, suggesting further easing is likely but dependent on incoming data. Policy uncertainty under the incoming Trump administration will provide further justification for a cautious tone. After December’s 25bps easing, which took the total easing in the final three meetings of 2024 to 100bps, Fed Chairman Jerome Powell stated that the Fed could now be more cautious, while the dots were adjusted in a more hawkish direction, seeing only 50bps of easing in 2025 rather than 100bps. Minutes from the meting showed some debate between keeping policy on hold and the 25bps easing that was delivered. The dots will not be adjusted at this meeting and we doubt the Fed has changed its view much from December, but the more cautious approach suggests a pause in January. The market is pricing in the next cut in June and another in October or November. We doubt the Fed will say anything to change this view, so the meeting may to some extent be a non-event. The lack of any concrete steps from the Trump administration so far means adjustment to the Fed view is much more likely to come at the March meeting.

For the USD, we still see USD/JPY as somewhat too high above 155 given the current level of yield spreads, but it’s hard to see a big move in the EUR on a neutral FOMC unless we see some more volatility in the equity market. Even that could be unclear for EUR/USD, as any EUR strength that might result from further fallout in the US tech sector may be offset by the general risk negative implications. Our models suggest EUR/USD is likely to hold close to 1.04 near term.

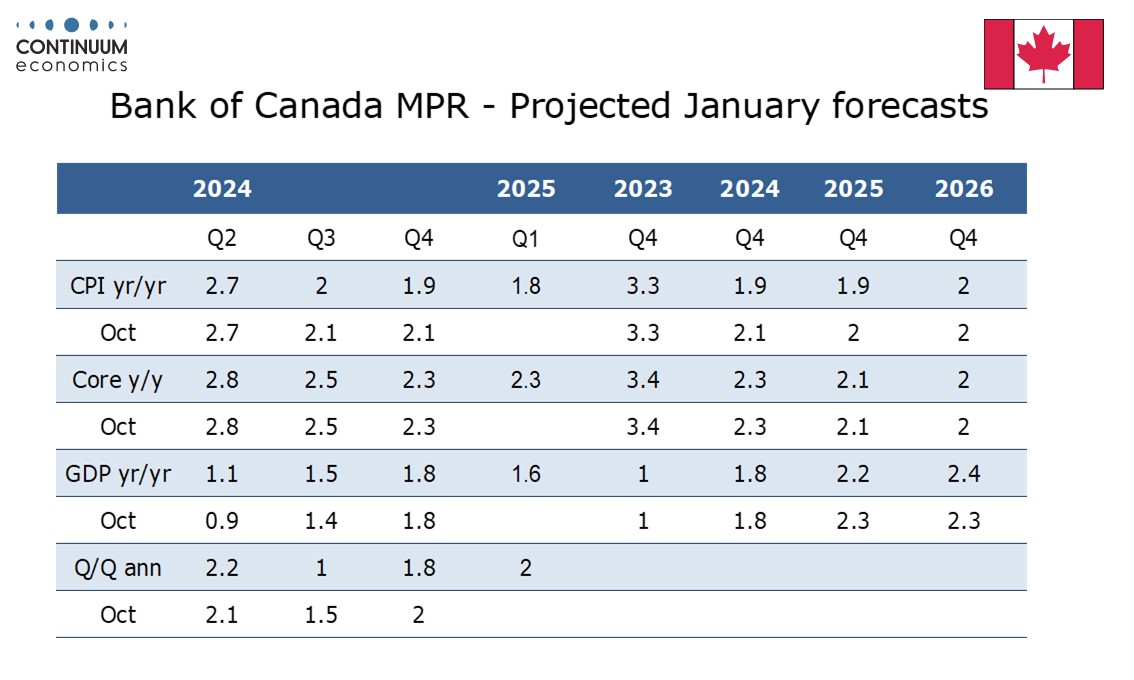

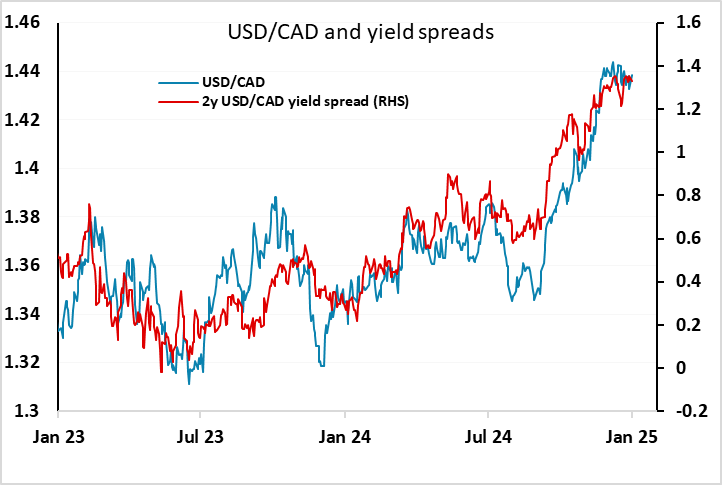

The Bank of Canada will make its decision a few hours before the FOMC. The BoC decision will be following two straight easings of 50bps, though minutes from the last meeting, on December 11, showed a debate between 25bps and 50bps, and that they expected a more gradual pace going forward. We see the Canadian economy as remaining weak enough, and with significant downside risk, to justify a 25bps easing in January, to 3.0%. This is fully priced into the market and anything else would be a major surprise. A further 40bps of rate cuts are priced for the rest of the year, with some uncertainty about the likely timing. March is seen as around a 40% chance for the next cut, and it’s near enough fully priced in for April. December’s 50bps easing moved rates to the upper end of the 2.25-3.25% range that the BoC regards as neutral. With the Canadian economy still seen as in excess supply with near target inflation the case persists for moving towards an accommodative stance, albeit cautiously. We expect Canadian rates to reach 2.5% by mid-2025, as is priced. Should Trump impose 25% tariffs on Canadian exports, Canada would probably fall into recession, so the BoC are unlikely to want to suggest they are done at this stage. The risks may consequently be towards the USD/CAD upside, other things equal, but we wouldn’t anticipate a large reaction.

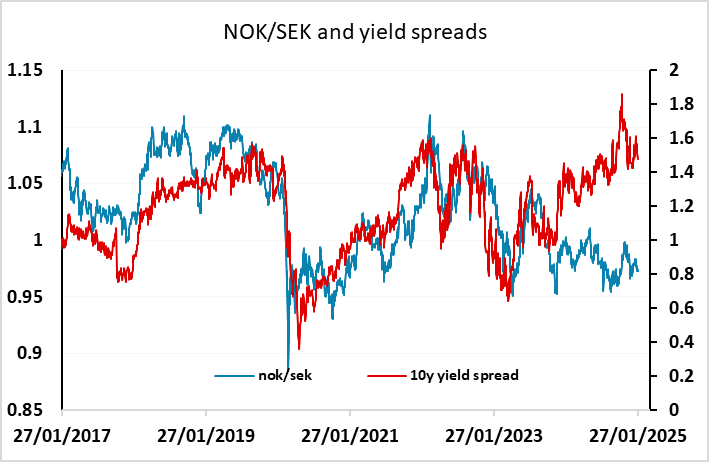

The CPI data from Australia could have an impact, but we continue to see the AUD as very attractive regardless of RBA policy provided that global risk appetite is reasonably well supported. The Riksbank decision is also unlikely to deliver any major surprise, with a 25bp rate cut full priced. The market consensus is for a 0.3% Q4 Swedish GDP rise, and we see some downside risks to this. With the rate cut and downside risks to GDP, we continue to favour the upside for NOK/SEK.