FX Daily Strategy: APAC, Oct 8

Scope for NZD recovery on a 25bp rate cut

JPY weakness remains extreme but lacks a fundamental basis

Scope for NZD recovery on a 25bp rate cut

JPY weakness remains extreme but lacks a fundamental basis

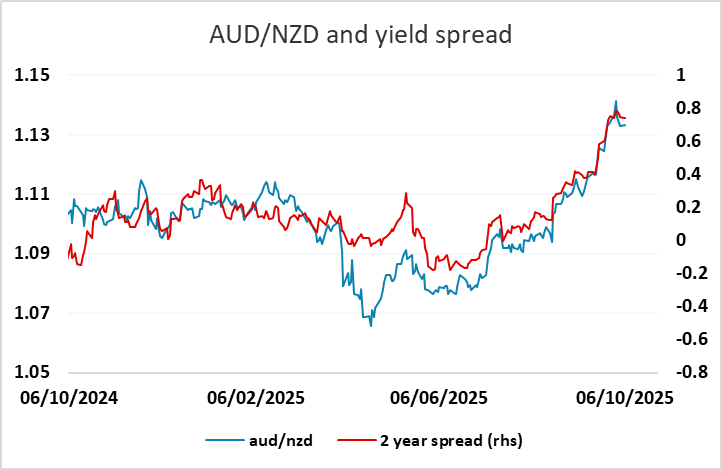

The RBNZ meeting looks like the main event for Wednesday. All forecasters expect a rate cut, but are split on the likely size, with 15 of 26 in the Reuters survey going for a 25bp cut and 11 looking for 50bps. Market pricing suggests it is close to a 50-50 call between 50 and 25. While it is a close call, we would expect a 25bp cut which might allow a modest NZD recovery. AUD/NZD has been in a strong uptrend for the last couple of months as the market has priced in relatively more aggressive RBNZ easing, and the NZD could manage a fairly sharp corrective rally if the RBNZ proves less dovish than expected.

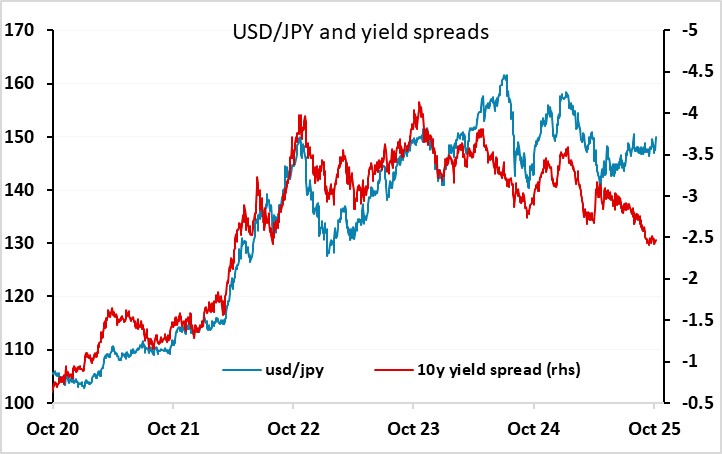

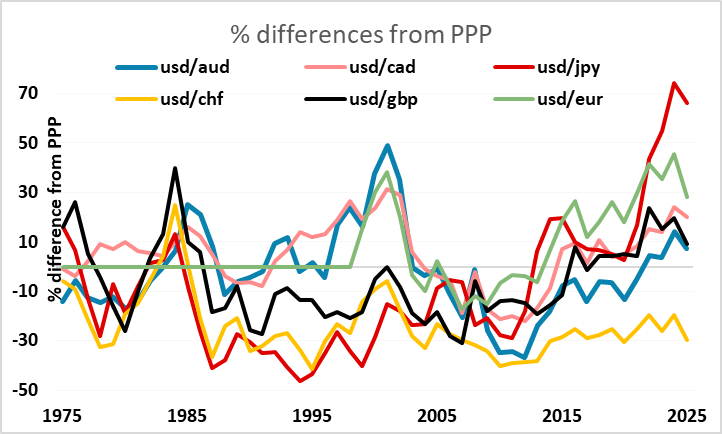

The JPY continued to be the biggest mover on Tuesday, with USD/JPY continuing the uptrend seen since the election of Takaichi as the new LDP leader and PM. The moves looked to be essentially technical, as there has been no policy announcement and no significant further moves in Japanese yields, with 10 year yields still close to 17 year highs and 2 year yields only around 5bps off the 17 year high seen last week. With USD/JPY starting from an already extremely undervalued level, both from a long term fundamental perspective and relative to the usual yield spread correlation, there is clearly no yield based justification for the JPY decline.

Nor is JPY weakness on the crosses consistent with the moves in equity risk premia that have been highly correlated with most JPY crosses in recent years. The JPY weakness consequently looks more sentiment driven than anything else. It is very doubtful that the new PM will seek an even weaker JPY, and we would also doubt that she will attempt to interfere with BoJ independence by looking for easier monetary policy. Indeed, easier fiscal policies that she is expected to follow are likely, in the end, to lead to higher Japanese yields.

So JPY weakness looks entirely sentiment or technically driven. There is an initial retracement level at 151.62 in USD/JPY which might be an initial target for the JPY bears and could see some profit-taking. It is also possible that the Japanese MoF could be considering intervention in support of the JPY near current levels. While USD/JPY is short of the highs, the real effective JPY is now close to all time lows. While intervention is not normally effective if the move is fundamentally driven, in current circumstances it would likely be effective as a signal of government preference for a stronger currency, negating some of the current sentiment.