USD, AUD flows: USD slightly softer after much lower than expected PPI

USD modestly lower as PPI declines in August, new highs for S&P futures

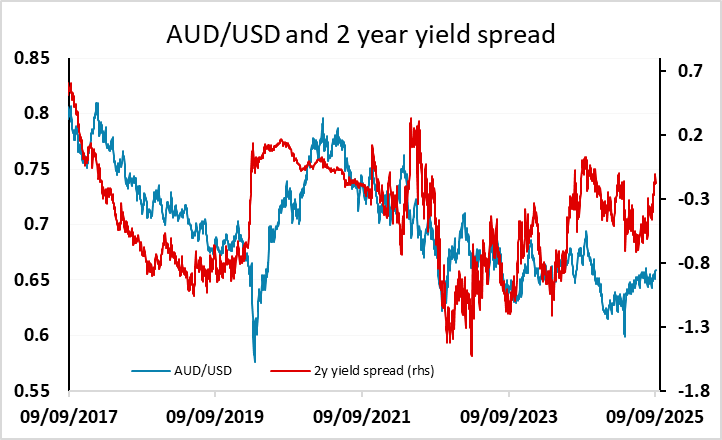

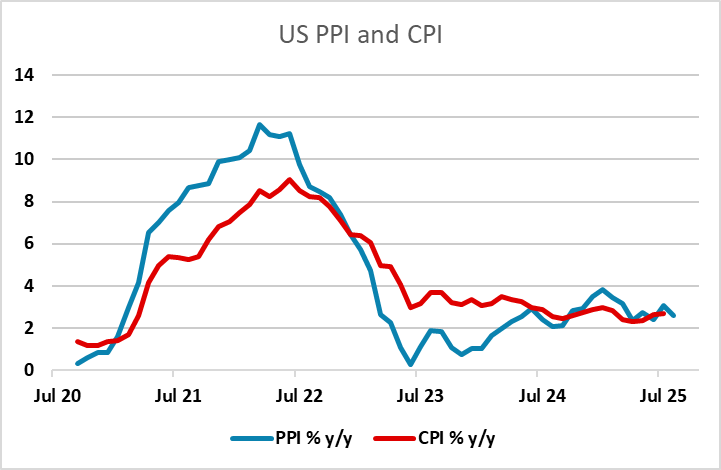

US August PPI has come in much softer than expected at -0.1% m/m, offsetting the unexpectedly strong rise in July, which was also significantly revised down to 0.7% from 0.9%. The net effect is consequently a very much weaker than expected profile over the last couple of months. The initial USD reaction was negative, but has mostly been quickly reversed, with only a very most impact on US yields. PPI is generally treated as second tier data and tomorrow’s CPI will be more important. It’s unlikely anyone will be changing their CPI forecast on the back of the PPI data, but the PPI does increase the risk of a softer than expected CPI. While this should stop any real opposition to Fed easing in the short run, it also suggests that the impact of tariffs is so far modest and should consequently reduce fears of a sharp US slowdown, so the impact on US yields is unlikely to be substantial. USD should retain a mildly softer tone, but riskier currencies may outperform as US S&P 500 equity futures are making new all time high on the news. AUD/USD is testing the 0.6625 July high and may be able to break up to new highs for the year.