FX Weekly Strategy: Asia, June 24th-28th

JPY weakness reaching uncomfortable levels

SEK may be vulnerable after Riksbank, particularly versus NOK

Politics could start to come into focus

EUR may see some jitters ahead of the French election

Strategy for the week ahead

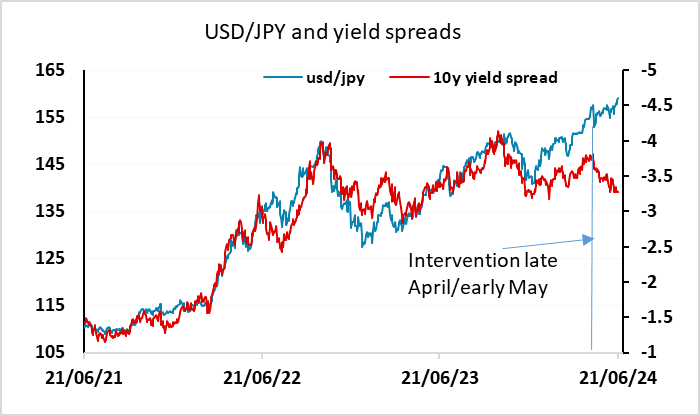

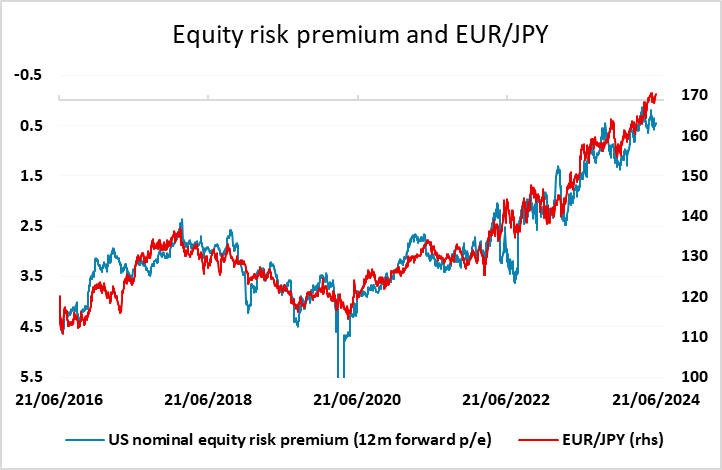

A relatively quiet week for data and only the Swedish central bank meeting means the market will have no obvious drivers in the next week. But there is still scope to digest the implications of last week’s data and central bank decisions, and the concomitant FX reactions. The most notable move was, once again, the rise in USD/JPY, which gained 2 figures on the week while there was no significant move in yield spreads. Some of this was a hangover from the previous week’s lack of BoJ action, and the relative quiet from the Japanese authorities about the latest JPY weakness which led to the market lacking any real fear of intervention. Although the warnings became louder towards the end of the week, the market seems unconcerned about the prospect of intervention, and the trend in USD/JPY continues. But after seven consecutive days of USD/JPY gains, positioning must be vulnerable to intervention close to the 160 level. The Tokyo CPI data will be the main Japanese data focus, but doesn’t come until Friday, and the main FX action may happen before then.

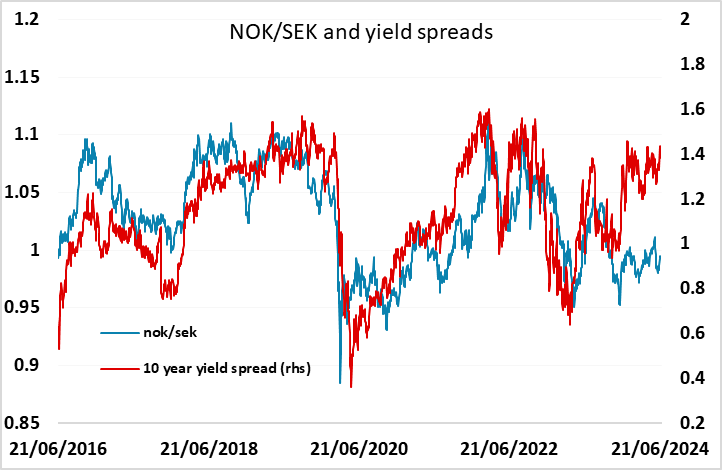

The Riksbank are not expected to make any change in policy, and the market is only pricing in around a 15% chance of a cut after the 25bp cut in May. The market focus will be more on the projected rate path and the prospects for a cut in August, which is currently priced as around a 70% chance. We don’t see a lot of upside for the SEK here, as the Riksbank seem unlikely to change their stance significantly, and the SEK has outperformed in the last few weeks. NOK/SEK still should have scope to trade back above parity after the more hawkish tone from Norges Bank last week.

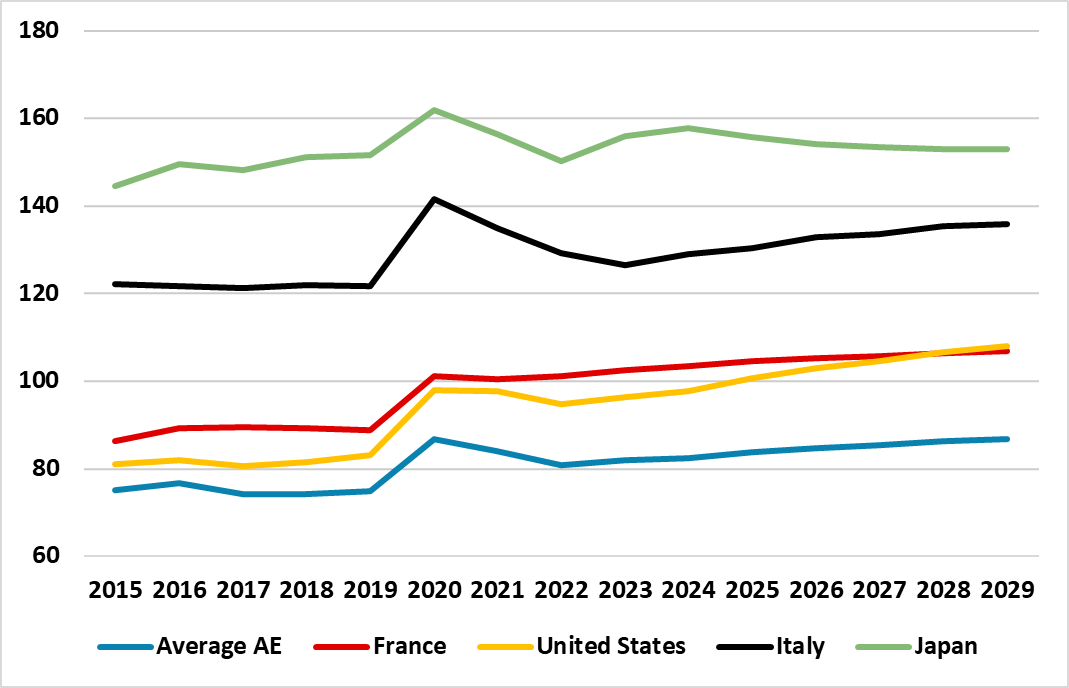

Politics could be more of a focus given the lack of data. There is the first debate between Biden and Trump which may start the market thinking a little more about the US election and potential consequences, although at this stage there seems little reason to find market implications. While Trump was seen as positive for the USD in his last election victory, this time around aggregate fiscal policies are unlikely to be majorly different whoever wins so implications are limited. While fiscal policies will stay expansionary, there isn’t much scope for further expansion, so there are reasons to be more skeptical about the potential for US growth to remain strong whoever is in office. The debate impact is therefore unlikely to be large, but it is unpredictable and could produce an unexpected reaction.

The first round of the French election is set for its first round on Sunday, and the market will be looking at any new poll information. The EUR may well show some nerves towards the end of the week in anticipation, although the bigger uncertainties are around the second round on July 7. The EUR does look a little more vulnerable in any case after the weaker than expected June PMI data, and we could see a test towards support at 1.0650 in EUR/USD, while EUR/JPY should move back below 170.

Data and events for the week ahead

USA

Monday sees no significant US data though Fed’s Daly will speak. Tuesday sees June consumer confidence while Fed’s Cook and Bowman will speak. On Wednesday we expect May new home sales to fall by 1.4% to 625k.

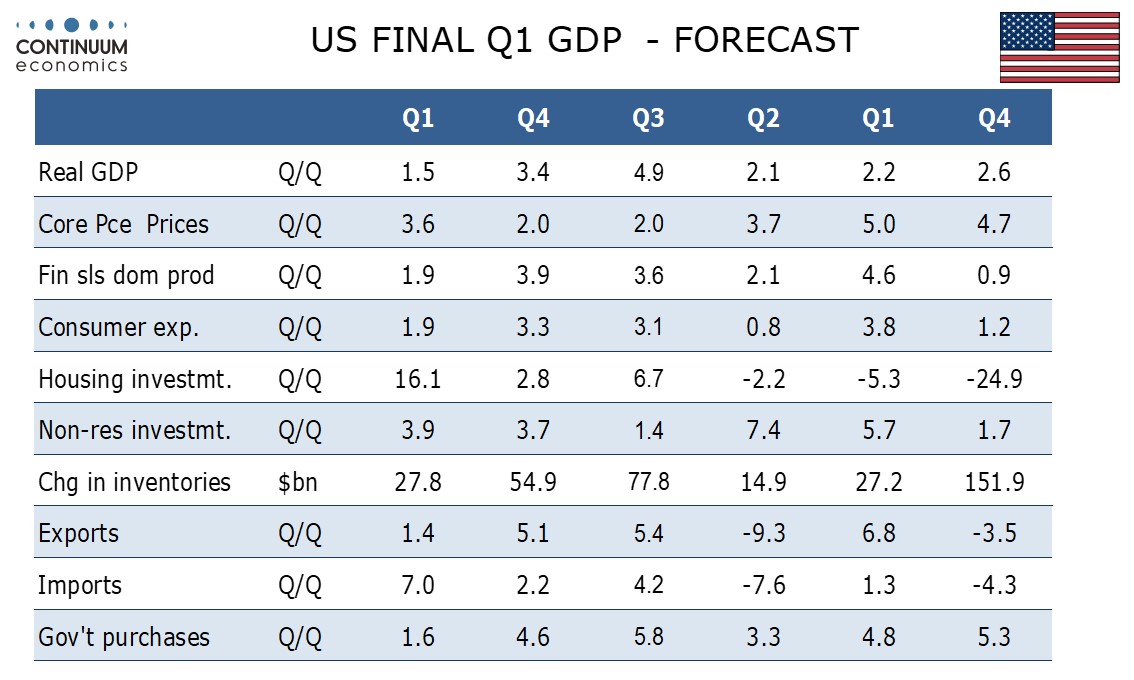

On Thursday we expect Q1 GDP to be revised up to 1.5% from 1.3%, a 1.1% fall in May durable goods orders with a 0.2% decline ex transport, and the advance May goods trade deficit to correct lower to $95.6bn from $98.0bn. Weekly initial claims will be closely watched given recent signs that trend is moving higher. May pending home sales follow. Late Thursday will see a debate between presidential candidates Joe Biden and Donald Trump.

On Friday we expect May’s core PCE price index to be rounded up to a 0.2% increase, consistent with May’s core CPI. We also expect a 0.5% increase in personal income and a 0.3% increase in personal spending. June’s final Michigan CSI will follow, while Fed’s Barkin is due to speak.

Canada

Bank of Canada Governor Macklem will speak on Monday. Tuesday sees May CPI where we expect yr/yr growth to fall to 2.6% from 2.7% with similar slowings seen in the BoC’s core rates. On Friday we expect a 0.2% increase in April GDP.

UK

A quieter week awaits, with CBI industry survey data kicking it off on Monday. There is then nothing of note datawise until Friday when revised national accounts should see no material revisions to the higher-than-expected Q1 GDP jump. Q1 current account data released alongside (showing a likely smaller gap) may underscore to the large degree that GDP growth last quarter was indeed boosted by lower imports. Thursday sees the BoE Financial Policy Committee Summary and Record published. It may reinforce the view it suggested three months ago that ‘conditions remain challenging, where global and geopolitical risks are high and have continued to increase’.

Eurozone

Updates regarding money and credit data will be important (Thu), not least after more mixed data seen of late and the warnings of company loan demand slumping from the last bank lending survey. There is also abundant survey data with the European Commission survey data (Thu) may tell a more downbeat story compared to the PMI composite. Other business surveys are due, including the German Ifo figure (Mon) where some small further improvement may be in the offing. That may also be the case for the ECB consumer expectations survey (Fri) adding to household sector insights. ECB attention may be focused on some Council speakers due, most notable on the contrasting views of Chief Economist Lane (Wed) and Council member Schnabel (Mon).

Rest of Western Europe

In Sweden, there is the Riksbank policy decision (Thu). We see no hurry to ease further implying a stable policy decision after last month’s25 bp cut. Instead, and partly to try and cement the recovery in the currency since the cut, those advertised moves are likely to arrive at policy verdicts scheduled on August 20 and November 7 and this may be more formally flagged in the updated MPR due next week this possibly sketching out a little clearer the outlook for 2025 (and beyond).

Japan

Tokyo CPI would be the highlight for Japan on Friday next week. Headline CPI rebounded and Tokyo CPI would preview the June inflation picture. We forecast the inflation figure would be steadily higher but unlikely a big jump. Retail trade on Thursday would be the second data point for seeing.

Australia

The only important data next week for Australia will be Consumer Inflation expectation. We also have consumer confidence on Tuesday.

NZ

Starting the week with Trade balance on Monday and ending with business outlook and confidence on Thursday.