FX Daily Strategy: N America, February 18th

RBA cut by 25bps

GBP firmer after labour market data

SEK stays strong after CPI

CAD could slip lower with dip in core inflation rates

RBA cut by 25bps

GBP firmer after labour market data

SEK stays strong after CPI

CAD could slip lower with dip in core inflation rates

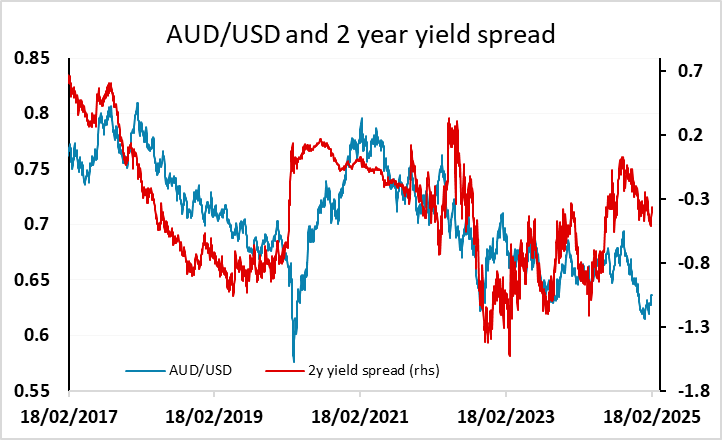

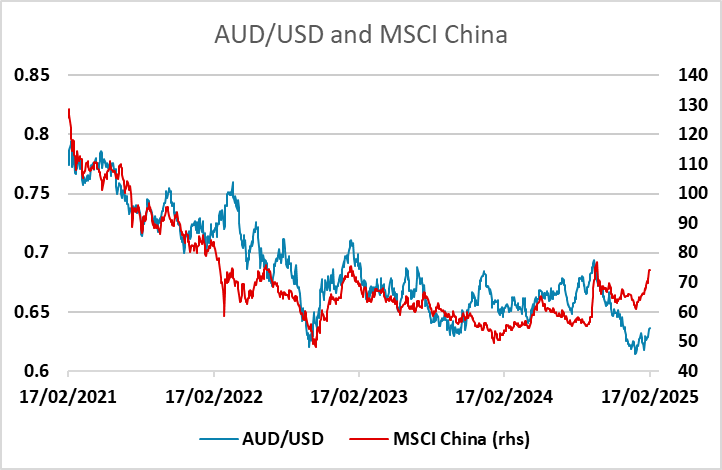

The RBA cut the cash rate by 25bps to 4.1% in the Feb 18 meeting, saying rates remain restrictive after the cut and signals data dependency going forwards. RBA has also revised inflation forecast for the first half of 2025 lower to 2.4% y/y from 2.5%, trimmed mean at 2.7% from 3% but revised 2026/27 headline inflation higher. They see cash rate to be at 3.6% by year end 2025 and at 3.4% June 2026 before returning to 3.5%, a terminal rate so far. The key change of stance from RBA came from softer than expected inflation and GDP growth. AUD a touch lower, but not much change in market expectations of RBA policy, with front end yields a little higher if anything, so risks for AUD still on the upside although 0.64 looks like significant resistance.

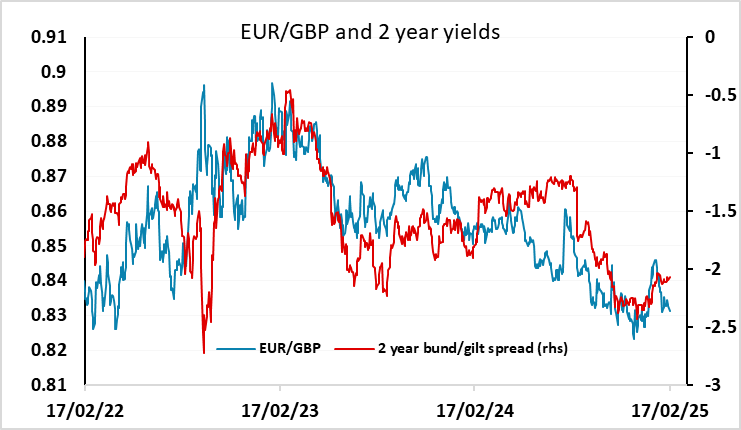

UK labour market data was slightly on the strong side of expectations, with employment stronger than expected on both the ONS and HMRC measures and average earnings growth in line with consensus and still strong at 5.9% y/y. EUR/GBP has dropped 10 pips in response to trade below 0.83, but progress beyond here is likely to be tough. While there is a little scope for the market to reduce expectations of BoE easing from the current 2 ½ cuts this year, current yield spreads already suggest EUR/GBP is a little stretched on the downside.

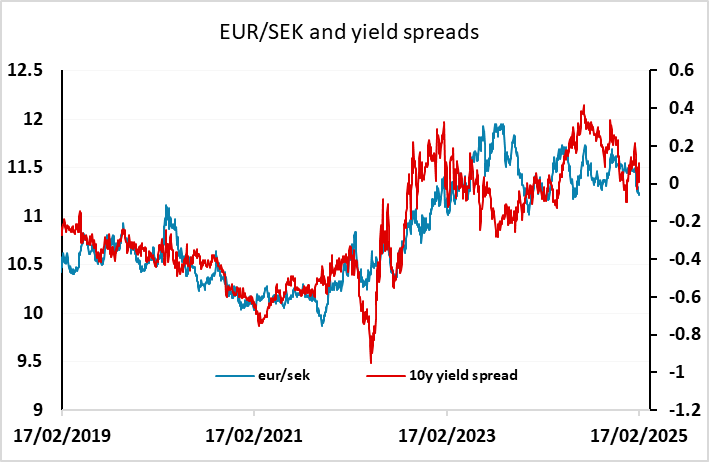

We have also had Swedish CPI data for January, which is in line with expectations at 2.2% y/y for the targeted CPIF measure, up from 1.5% in December due in large part to base effects. The SEK has edged higher in response but with no further rate cuts from the Riksbank priced in this year we see the risks as slightly to the SEK downside after yesterday’s sharp rise in unemployment.

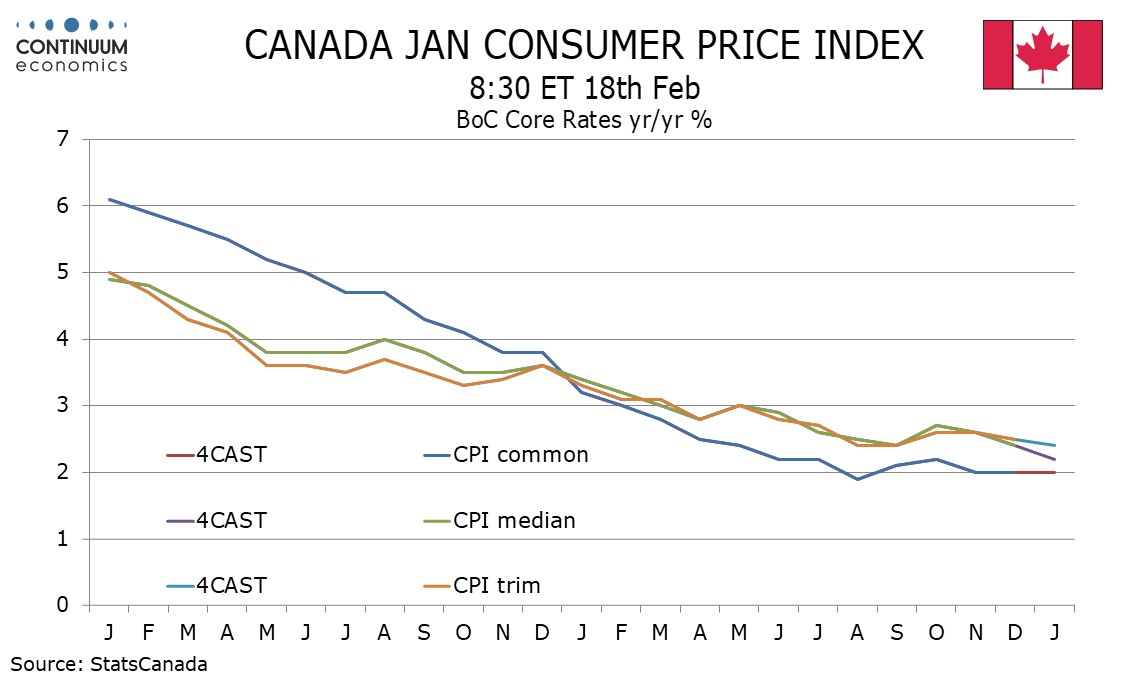

In North America we have Canadian January CPI which we expect to slip to 1.7% yr/yr in January from 1.8% in December, the fall largely due to a temporary suspension of the Goods and Services Tax that will ran from Mid-December through Mid-February. Before slightly disappointing data, Bank of Canada Governor Tiff Macklem stated that the tax suspension is expected to move inflation down to a low of around 1.5% in January. Soft data a year ago will restrain improvement in yr/yr rates. For the BoC core rates we expect CPI-Common to remain at 2.0% for a third straight month, CPI-Median to fall to 2.2% from 2.4%, repeating a 0.2% slowing in December, and CPI-Trim to fall to 2.4% from 2.5%, repeating a 0.1% slowing in December. Our numbers for the core rates are below market consensus, suggesting recent CAD strength could see something of a reversal.