USD, JPY, EUR flows: USD firm, JPY weakness extends

USD strength and JPY weakness extends. Echoes of early summer and more JPY wekanes looks likely unless we see weaker US CPI data

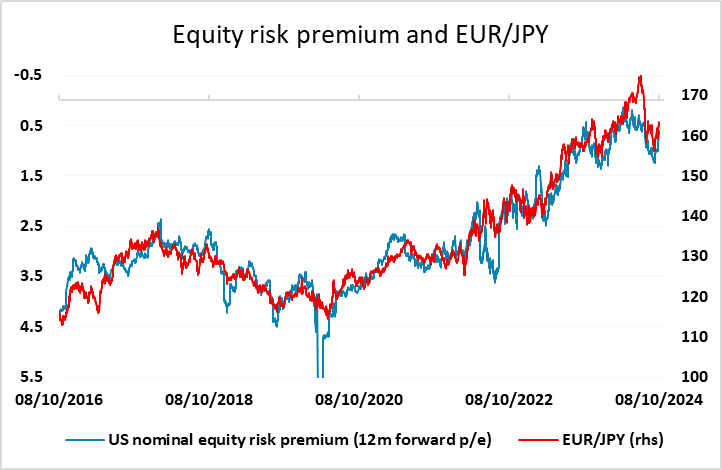

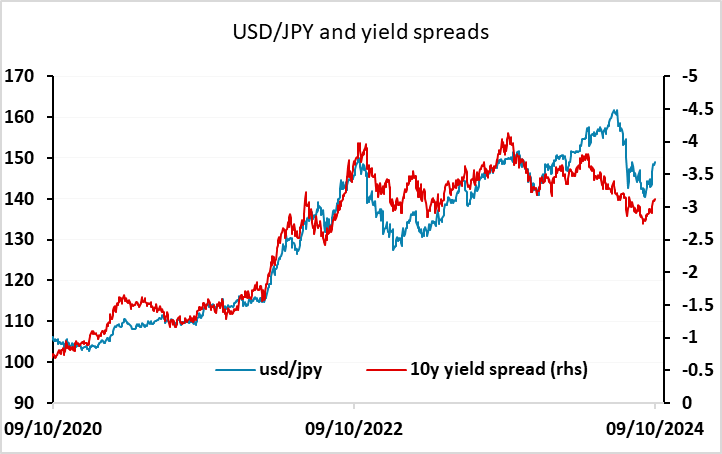

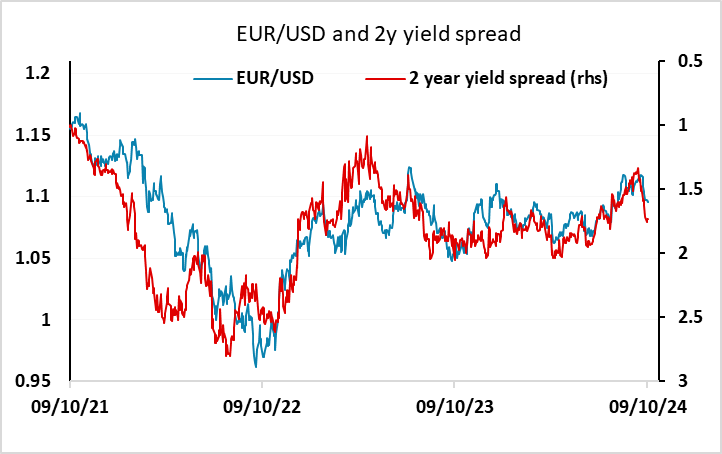

USD showing general strength in early US trading, with USD/JPY as usual leading the way. There is no obvious trigger for the move, although latterly comments from the Fed’s Logan have supported the view of more gradual Fed rate cuts in the coming months. Even so, this hasn’t significantly moved US yields, and spreads still suggest USD/JPY is stretched at current levels, while EUR/USD looks to have some potential to the downside. The implication is that EUR/JPY is overdone above 163, but continues to get support from declining equity risk premia as equities remain solid in the face of rising US yields.

All in all, the situation is similar to that seen before the sharp JPY recovery in the summer, with low volatility, strong equities and carry trades being preferred. It’s hard to see this situation changing radically in the short run unless tomorrow’s US CPI data comes in significantly below consensus. There may therefore need to be some more stretching of the elastic on the JPY, with USD/JPY moving above 150 and EUR/JPY heading above 165 before we have the next snap back.