FX Weekly Strategy: APAC, March 4th-8th

Eurozone HICP has little market impact

JPY strength can extend a little further…

…but rise in risk premia needed to trigger a larger recovery

UoM inflation expectations the most likely market moving US data

Strategy for the week ahead

Potential for reversal of February JPY weakness

CHF weakness more likely to be sustained

EUR may have upside risks on the ECB meeting

February was generally a pretty quiet and rangebound month for FX markets. EUR/USD traded a 2 figure range – 1.0695–1.0897, finishing up close to the middle of it. AUD/USD traded 0.6443-0.6610, also finishing close to the centre of the range, and there was a similar story in most pairs. USD/JPY and USD/CHF were the exceptions, both gaining around 3% on the month, reflecting then general rise in yields and the positive tone to equities during the month. Coming into March, the question is now whether this positive risk tone is sustainable. The positive outlook has been built primarily on stronger than expected US data in the last month. Even though that has led to some reduction in market expectations of Fed easing, there is still a belief that inflation is declining sufficiently to allow the Fed to bring rates lower through the second half of the year and 2025, and that this will ensure the US economy stays on track. The risks to this view are that either inflation remains stubborn and prevents the hoped for Fed easing, or that growth starts to weaken under the weight of the past monetary tightening. There are of course other risks, particularly those related to international and domestic politics, but the markets have negotiated these concerns without too much trouble thus far.

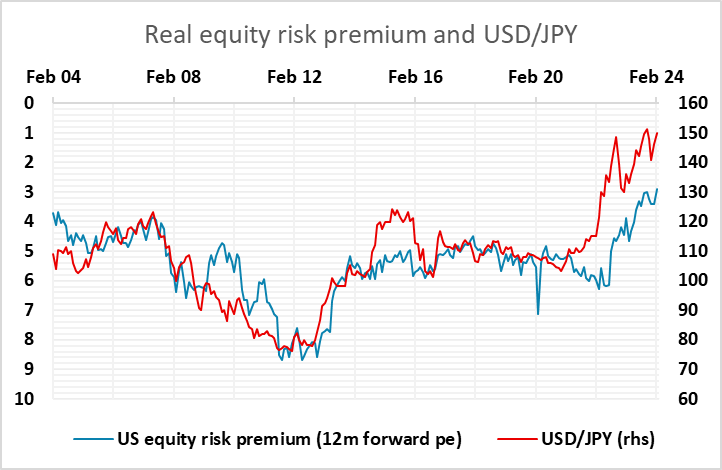

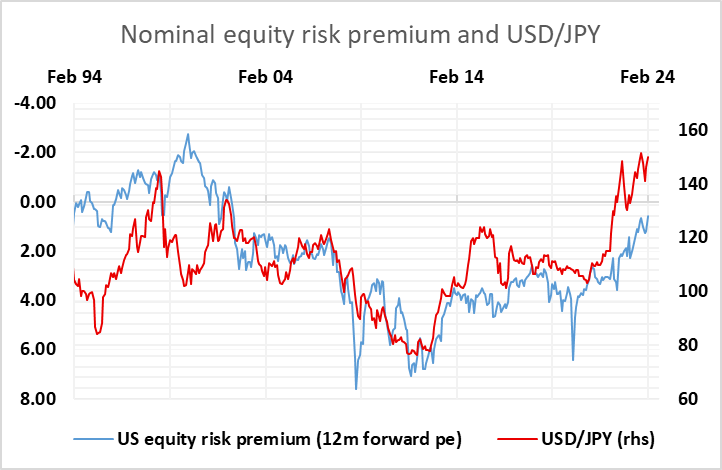

Our concern going forward is that the current market pricing represents something of a Panglossian view. US equity risk premia are at their lowest level since the dotcom bubble at the turn of the century. Given the US economy is close to full employment, it is hard to justify this valuation on the basis of an expectation of strong US growth. While equity markets elsewhere are much more reasonably valued, the JPY in particular is well correlated with the US equity risk premium, so any rise in the premium could be expected to lead to some reveal of JPY weakness. From here, if we see some evidence of weakness in the economy we are likely to see some rise in equity risk premia, either via lower equities of higher bond yields (or both). The JPY is less sure to benefit from higher US inflation, as if that triggers higher bond yields it is possible that equity risk premia stay low, with equities staying resilient to high US yields, while yield spreads will move in the USD’s favour. But the JPY is also at extreme lows in valuation, and we find it hard to see progress back above 150 in USD/JPY is a scenario where the Fed becomes more concerned about persistent inflation We also doubt that the equity market would be as resilient in this scenario.

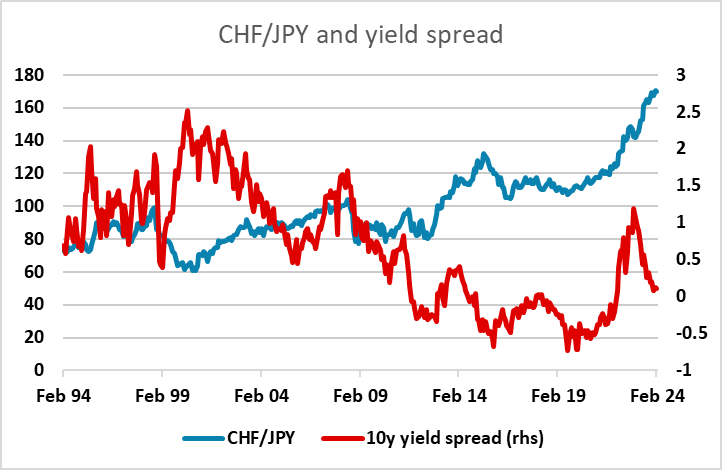

All of this suggests to us that the JPY weakness seen in February is unlikely to be repeated in March. However, if we see a solid US employment report this week without evidence of worrying average earnings growth, we may see the USD hold its own. But both a significantly strong and a significantly weak employment report could prove positive for the JPY. There is also Tokyo CPI and Japanese labour cash earnings data this week which could have a significant impact on USD/JPY, given the market focus on the potential for a spring BoJ tightening. However, we see risks in USD/JPY as weighted to the downside. One thing to add, however, is that the weakness of the CHF through February looks more likely to persist than the weakness of the JPY, as the CHF is starting from a much higher level, and the SNB are on the cusp of starting an easing cycle.

The EUR will be focused on this week’s ECB meeting. While no change in policy is anticipated, this is an important meeting because the market is pricing in around a 25% chance of an easing in the April meeting, while near enough fully pricing in a 25bp cut in June. The Eurozone February inflation data probably reduce the chances of an April cut, with the ECB likely to be disappointed at the lack of a significant decline in services inflation. Last time around, the Council regarded to it premature to discuss easing, but this was only by consensus, implying a minority wanted such a debate. That minority may be larger and more vocal this time. But after the February inflation numbers it’s likely that the ECB will stick to broadly hawkish rhetoric. This suggests some upside risks for the EUR, as the market may price out the risk of an April tightening.

Data and events for the week ahead

USA

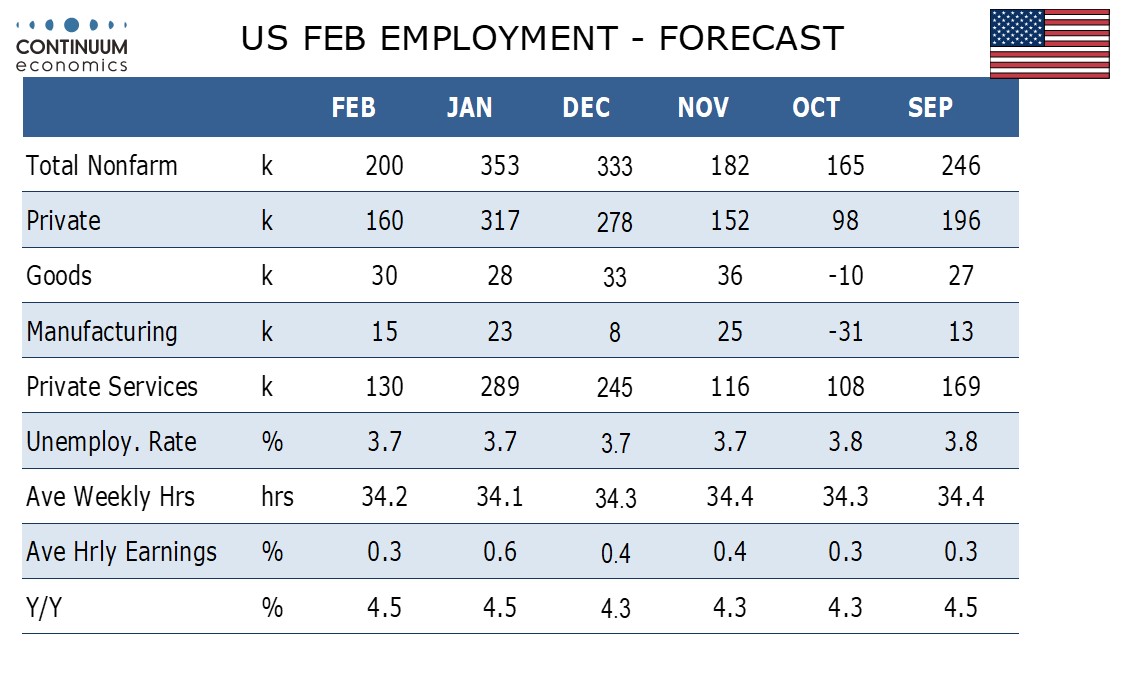

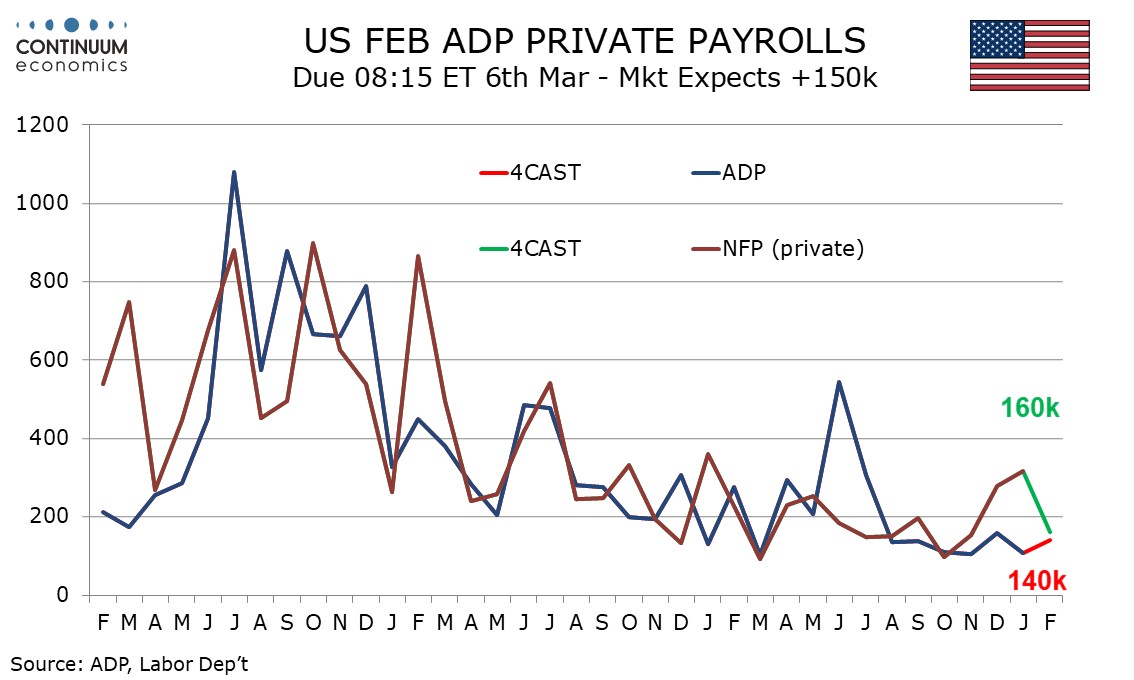

The key US release comes on Friday, where we expect a 200k increase in February’s non-farm payroll, 160k in the private sector, slower than the preceding two months but still showing a strong labor market. We expect unemployment to remain at 3.7% and a 0.3% rise in average hourly earnings after a strong 0.6% rise in January. Wednesday sees ADP’s private sector employment data, where we expect a 140k increase, slightly slower than our estimate for private payrolls though in ADP’s case, a modest acceleration from January. Another important labor market signal will come from Wednesday’s JOLTS report on job openings for January, which will struggle to sustain a December bounce, and on Thursday weekly jobless claims, coming after a below trend 201k outcome that covered February’s payroll survey week.

Ahead of payrolls, Fed Chairman Jerome Powell testifies to the House on Wednesday and to the Senate in Thursday. This will be closely watched, but Fed officials have been giving a clear and consistent message recently, that they expects to lower rates this year but need more data confirming progress on inflation before they act, and Powell is likely to give a similar message. Other Fed speakers scheduled are Harker on Monday, Daly and Kashkari on Wednesday, Mester on Thursday and Williams on Friday. The Fed’s Beige Book is due on Wednesday.

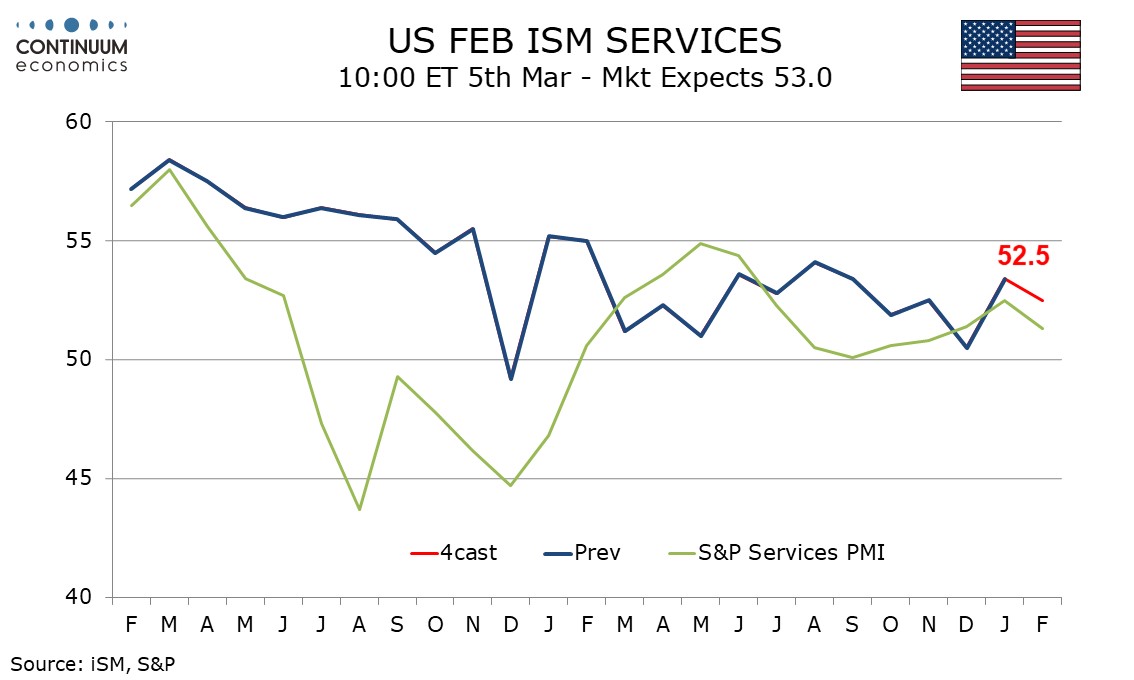

On Tuesday’s we expect February’s ISM services index to slip to 52.5 from January’s stronger 53.4. January factory orders are due at the same time. January wholesale data is due on Wednesday. On Thursday we expect January’s trade deficit to increase to $63.7bn from $62.2bn. Q4 productivity and cost revisions are also due, while January consumer credit follows later.

Canada

The Bank of Canada meets on Wednesday but a change in policy looks unlikely and the BoC is unlikely to change the tone of its statement much with Q4 GDP having exceeded its flat January forecast and inflation progress remaining unconvincing, despite an encouraging report for January. With no Monetary Policy Report due, the meeting may have little impact.

There is plenty of Canadian data due with Friday’s February employment report the most significant release. February’s S and P services PMI is due on Tuesday. Wednesday sees Q4 productivity, followed by February’s Ivey manufacturing PMI. Thursday sees January’s trade balance band January building permits.

UK

Chancellor Hunt’s Budget on Wednesday will be yet another very politically driven affair. It should see gloomier GDP projections but with some tax rate cuts that have been highly-advertised. But the question is whether the implied and contentious government spending restraint and still high (if not record) tax-take are consistent with the debt ratio eventually falling, at least at the end of the rolling five-year forecast period. We think this is unlikely but the OBR forecast may suggest the opposite and this may still be a concern for markets, especially if the OBR are openly critical of the fiscal assumptions the government is offering, most notably on the ability practically to freeze real spending.

The data highlight this week are few and far between, with final PMI data (Tue) likely to show no material revision. Wednesday may see more weakness in the construction PMI while BoE compiled survey data (Thu) may be mixed. Friday sees the REC jobs survey which may add to signs of softer wage growth.

Eurozone

The ECB takes centre-stage this week. Once again the ECB meeting verdict due on Thursday will be notable not for what the Council does (save for downward tweaks to its projections) but rather what is said. A fourth successive stable policy decision is unambiguously expected alongside a reaffirmation that pointing to rates being at levels that maintained for a sufficiently long duration will return inflation to target and that policy rates being at sufficiently restrictive levels for as long as necessary. But ‘sufficiently long’ and ‘as long as necessary’ remain vague, the question being whether this rhetoric is being adhered to because it does provide the ECB some policy flexibility to be as data dependent as it will again boast it is. Last time around, the Council regarded to it premature to discuss easing, but this was only by consensus, implying a minority wanted such a debate. That minority may be larger and more vocal this time. They may even be persuasive enough to leave open the possibility of the first cut at the April meeting, albeit with the majority leaning more to the first move in June and perhaps more explicitly so..

Datawise, the main event are revised GDP figures on Friday which will reveal the Q4 breakdown. Underlying inflation is falling faster and more broadly than had been ECB thinking, and PPI data (Tue) may add to such signs while retail sales figures (Wed) may underscore consumer weakness. Final PMI data (Tue) likely to show no material revision, but the construction data (Wed) may highlight continued sector fragility. In Germany, manufacturing orders (Thu) data should show a bounce after the marked drop seen in October, while industrial production figures (Fri) may fall further, showing no rise for an eighth successive month

Rest of Western Europe

There are key events in Sweden, with m/m GDP indicator due on Friday, albeit the data plagued with volatility and revisions. Otherwise, Deputy Riksbank Governor Bunge will discuss the economic situation and current monetary policy. Switzerland sees CPI data (Mon) and where we see little change to the 1.3% January outcome.

Japan

Tokyo Cpi on Monday March 4, labour cash earning and overall household spending on Thursday March 7 highlight the Japanese calendar next week. While the first is of importance as it provides key inflation metrics, the latter are getting more important in terms of next step of monetary policy and economics growth. The spring wage negotiation seems to be having a positive progress so far but the BoJ would still like to see any good wage growth (as close to 2%) before exiting ultra-loose. Household spending will be catching market participants eye balls because through it we can estimate private consumption growth in the first quarter of 2024. We will also the annualized final GDP for Q4, which would be showing any revision to the technical recession Japan is in.

Australia

We have Q4 GDP on Tuesday, March 5. It is important but has not been market moving for a while as RBA’s eyes remain on inflation. Private inflation survey is on March 3, so as ANZ Job Ad and Building Permit. On Monday, March 4 there will be PMIs and Wednesday March 6 the Trade Balance, which will be more important for us as we see the trend of lower import (weak domestic demand) and improving export to continue.

NZ

No significant data.