GBP, EUR, USD flows: GBP slips on retail sales

GBP/USD drop to 6 month lows on weaker retail sales

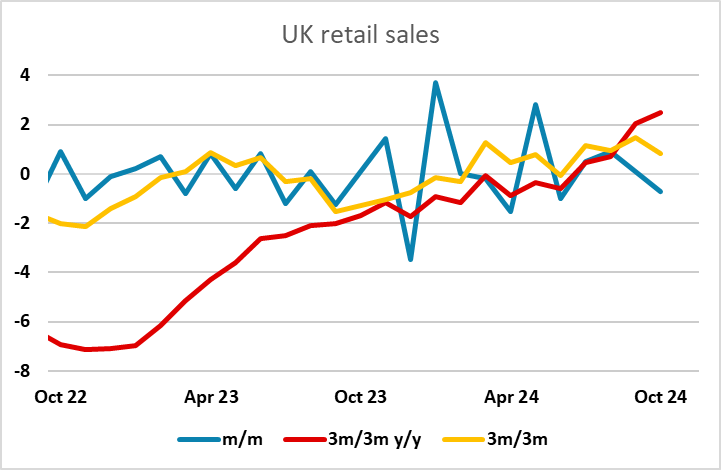

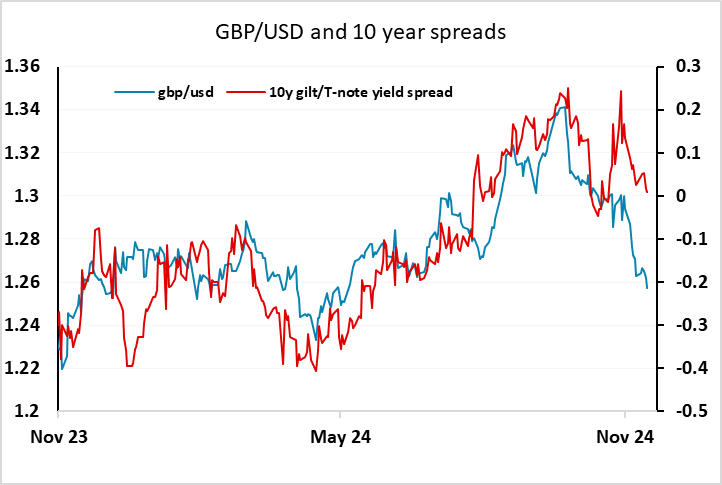

EUR/GBP starting the day a little firmer after UK October retail sales comes in on the weak side of expectations. Even so, it’s hard to characterise them as genuinely weak, as the 3m trend remains fairly steady with the October decline following 3 months of gains, and on a y/y basis the trend looks to be improving. But the data is nevertheless below consensus and should prevent any test of the 0.83 level. GBP continues to look unloved since the Budget, having failed to benefit from the rise in UK yields that followed it, and GBP/USD in particular shows a clear break from the yield spread correlation at Budget time. GBP/USD has hit a 6month low this morning and is hard to like. While the data remains inconclusive, sentiment looks to be soft and we would also favour upside for EUR/GBP from here.

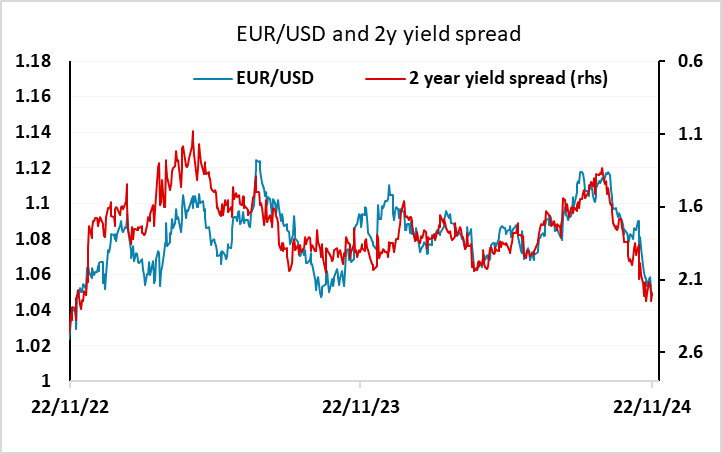

The downward revision to German GDP this morning does nothing to provide support for EUR/USD, but European currencies, GBP excepted, are bouncing a little in early trade. Even so, EUR/USD looks vulnerable here with yield spreads still pointing to downside risks.