USD, NOK, SEK flows: Focus on tariffs, scope for scandi gains

USD may benefit from latest tariff announcement. Scandis have upside scope

A mildly risk negative overnight session on the back of the Trump announcement of tariffs on steel and aluminium, although there is now more scepticism about whether these tariff announcements will translate into action, and initial USD gains were essentially reversed by the European open. However, without much on the calendar today, the tariff announcements are likely to be the main market driver today, and we could see some modest USD strength as a result.

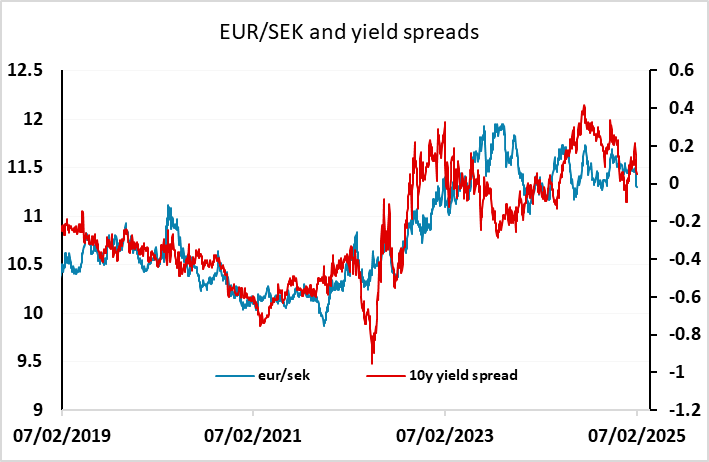

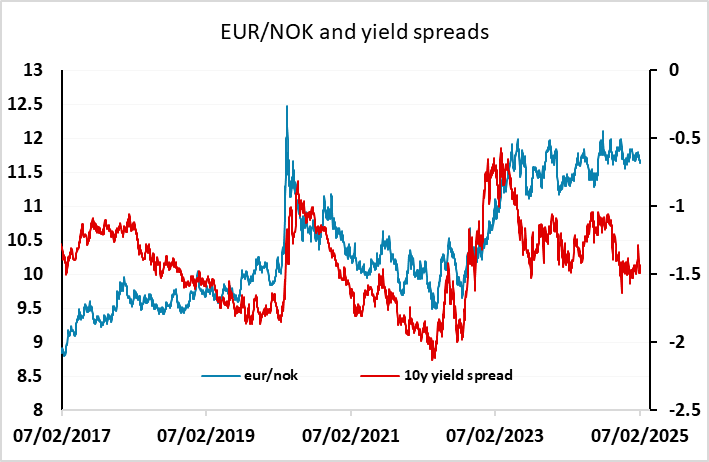

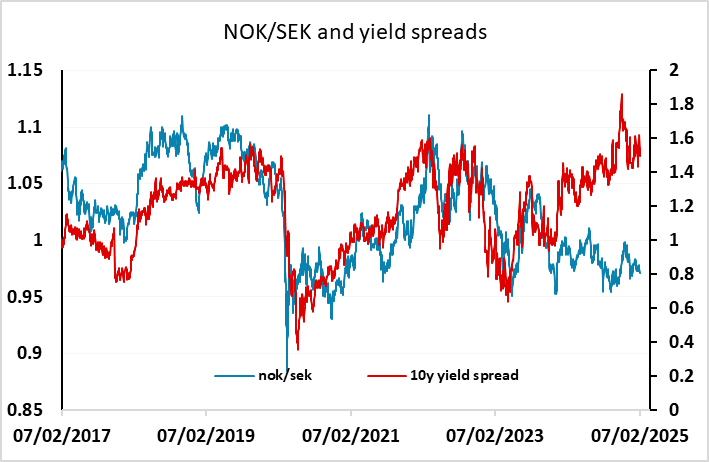

In Europe, some Scandi data provides the news early in the session, with Norwegian January CPI coming in slightly above expectations at 2.3% y/y, and Swedish orders and production data showing some unexpected strength in December. Neither have had any significant FX impact in early trading, but both NOK and SEK look to have potential for some recovery from here against both the EUR and USD, as there are signs that their economies are picking up. In Sweden’s case, the easing cycle may be near and end, while in Norway it hasn’t yet begun, but the NOK has behaved as if Norges Bank have been cutting rates. Norges Bank are likely to cut rates this year, perhaps in March, but the NOK looks overdue a rally regardless.