Preview: Due July 1 - U.S. June ISM Manufacturing - Modest improvement from a 6-month low

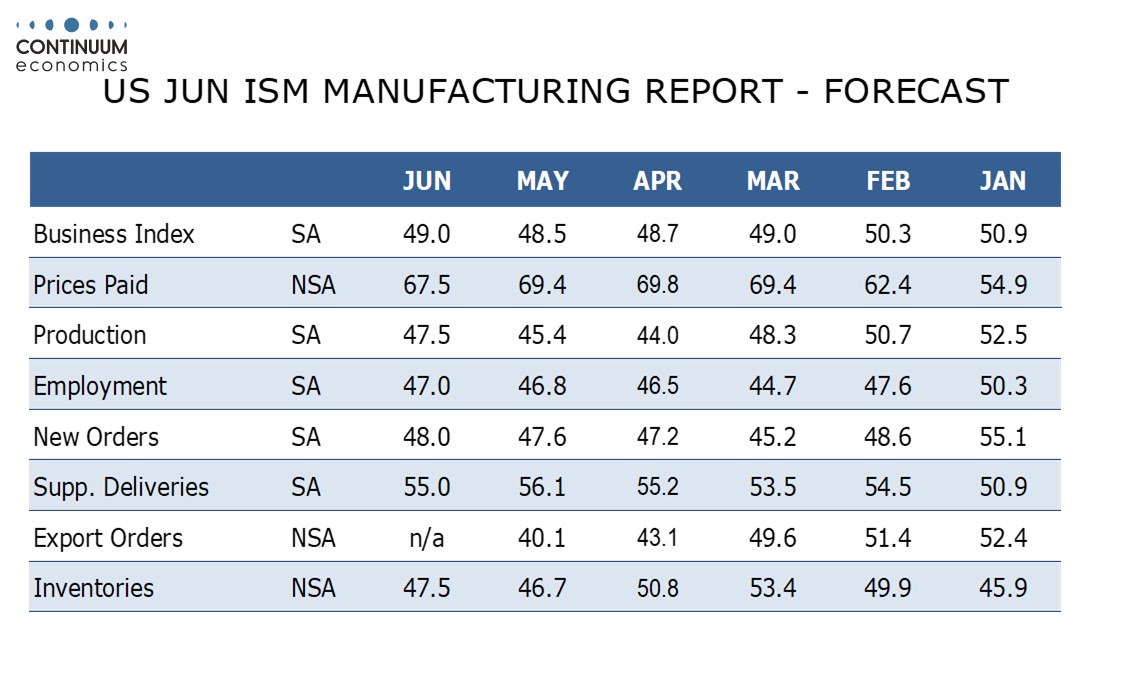

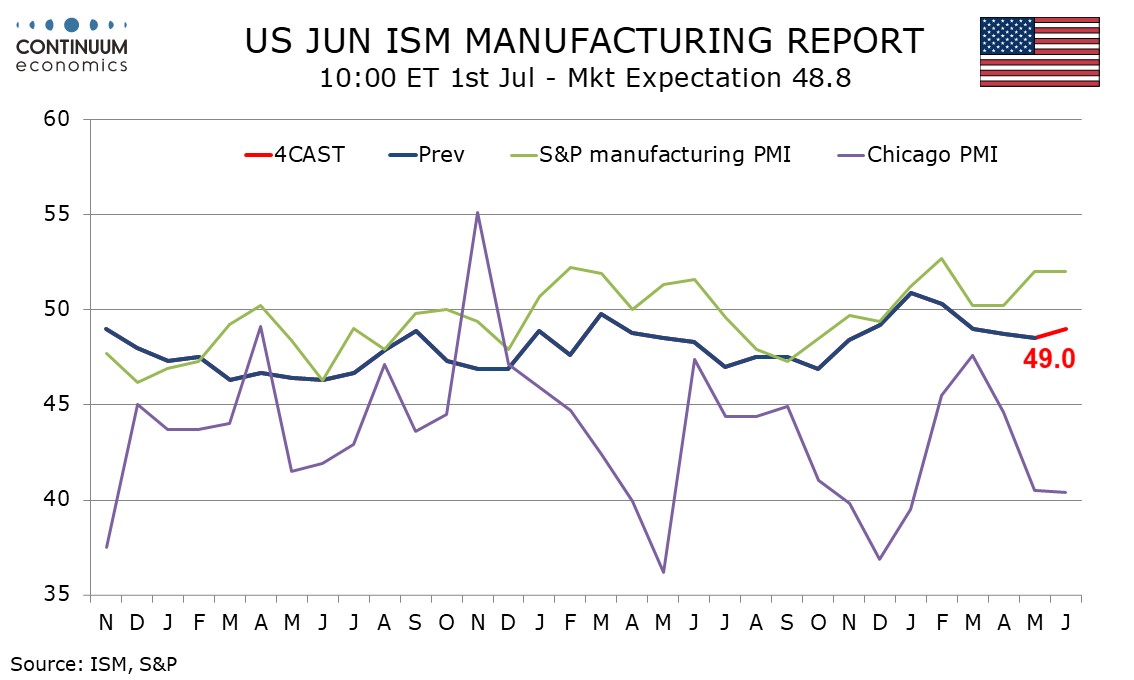

We expect a June ISM manufacturing index of 49.0, which would be a marginal improvement from May’s 48.5, which was the weakest since November 2024. However the index would remain below the neutral 50 which was beaten in January and February for the first times since October 2022.

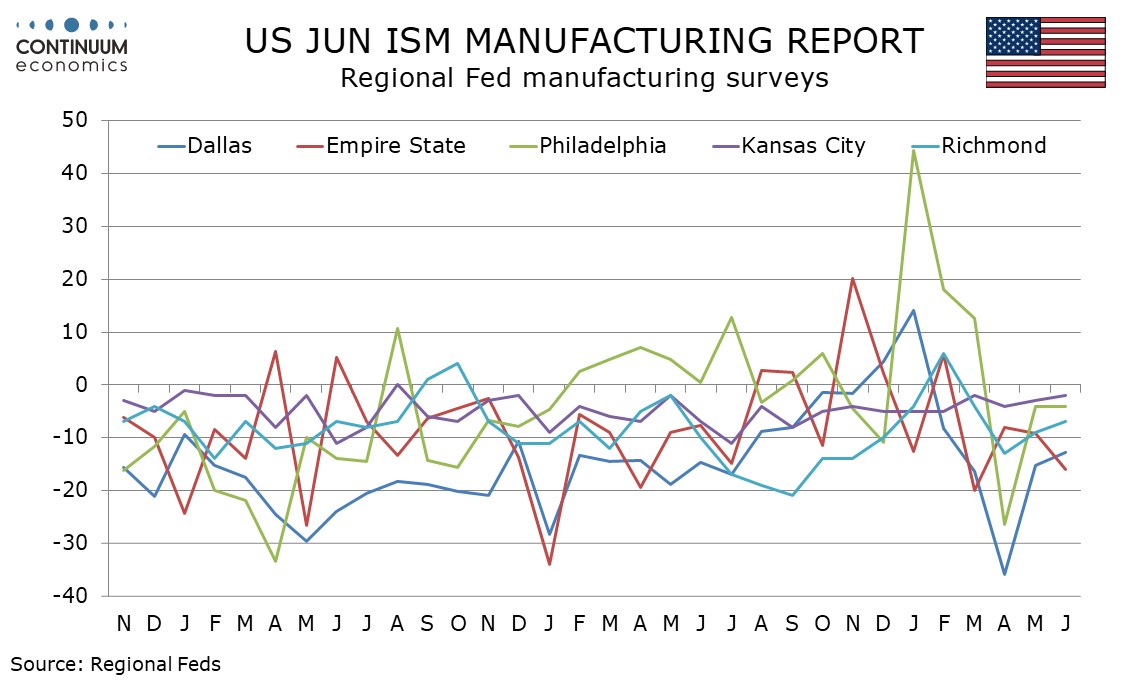

The S and P manufacturing index sustained a May pick up in June, though regional surveys were mixed and generally unimpressive, the Chicago PMI remaining particular;y weak. Still, regional Fed surveys were mostly slightly less negative in May, when the ISM index was slightly more negative, so the ISM index looks due for a modest increase.

May’s ISM manufacturing index slipped due to a sharp slowing in inventories, with the other four contributors to the composite slightly improved. In June we expect deliveries to slip from a strong May reading of 56.1, but inventories to correct higher while new orders, employment and particularly production (which has the most scope to rise) extend their May gains. This will reflect concerns over tariffs being past their peak.

Prices paid do not contribute to the composite. May’s 69.4 was marginally down from April’s 69.8, which was the highest since June 2022. We expect a continued easing of tariff worries to bring a dip to 67.5 in June, though the brief spike in oil that accompanied the Israel-Iran conflict adds to uncertainty.