View:

January 22, 2026

FOMC Preview for January 28: No change with early 2026 data awaited

January 22, 2026 6:42 PM UTC

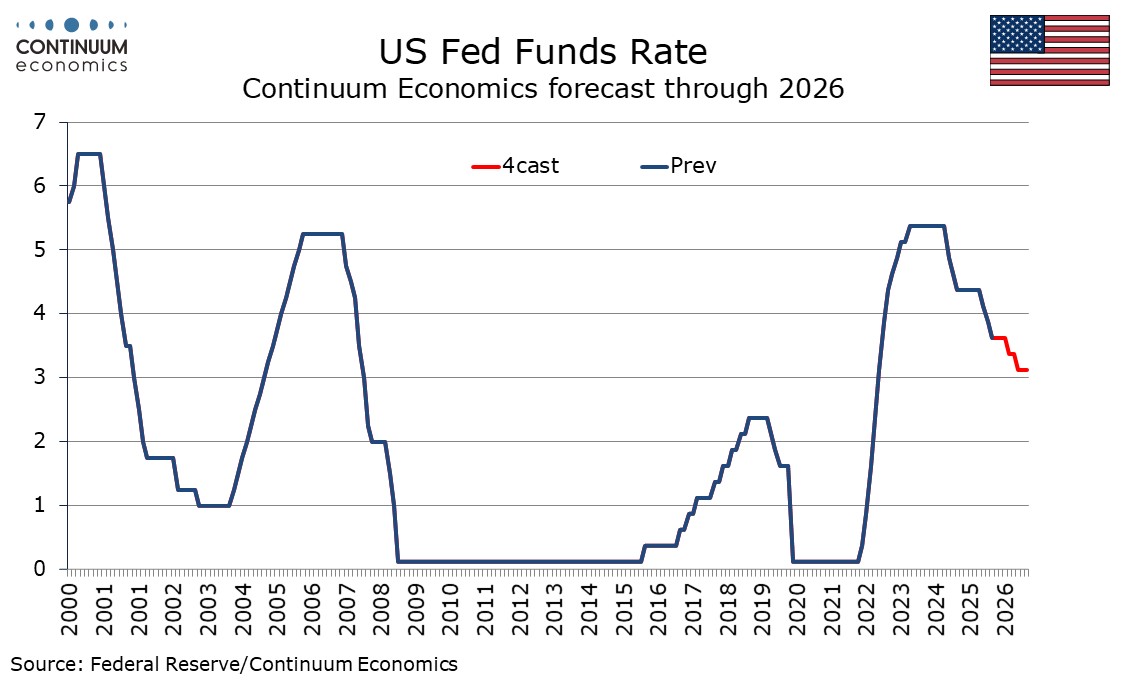

The FOMC meets on January 28 and rates look set to be left at 3.5-3.75%, and while rates are likely to move lower in 2026, they are unlikely to give many hints over what is likely in March, with future decisions dependent on data. The FOMC will not update its economic forecasts or dots at this meeti

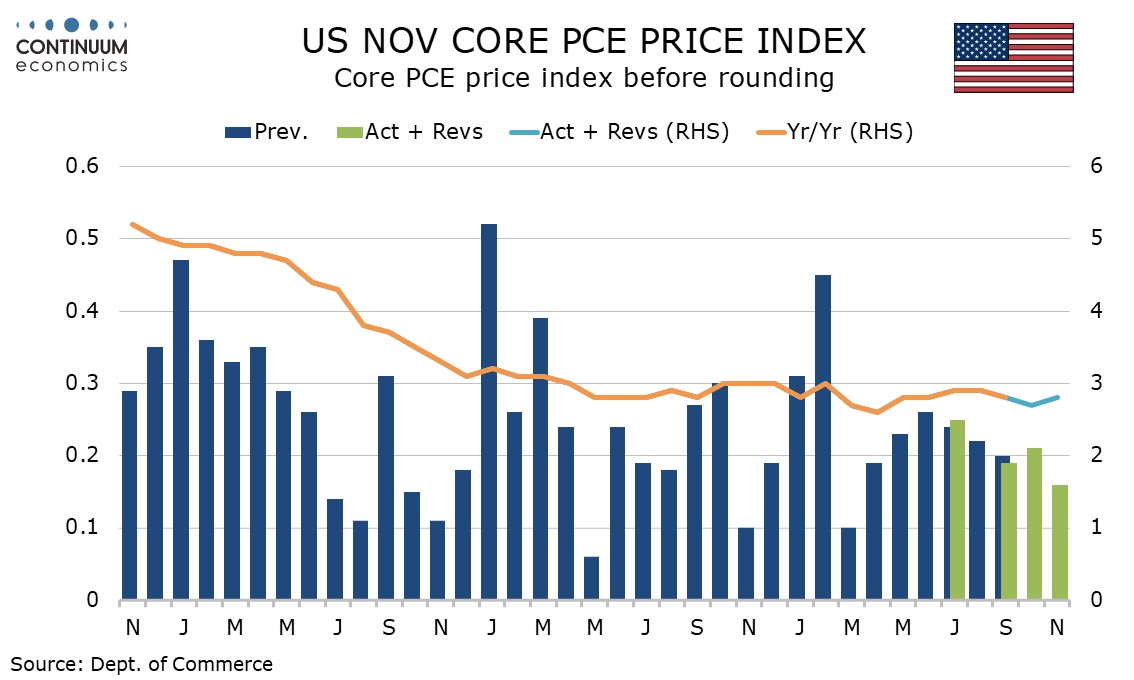

U.S. Personal Income underperforming Spending, Core PCE Prices maintaining trend

January 22, 2026 3:31 PM UTC

The personal income and spending report for both October and November has been released and shows healthy spending, up by 0.5% in each month outperforming income which rise by 0.1% in October and 0.3% in November. PCE prices, both overall and core, rise by 0.2% in each month, modest, but stronger th

U.S. Initial Claims remain low in payroll survey week, GDP revised higher on inventories

January 22, 2026 2:12 PM UTC

Initial claims remain low in the survey week for January’s non-farm payroll, rising by only 1k to a lower than expected 200k. The Q3 GDP revision to 4.4% from 4.3% is marginal, but is even stronger than an already strong pace.

Due to Risks, CBRT Continued Easing Cycle with 100 Bps Cut on January 22

January 22, 2026 12:52 PM UTC

Bottom Line: As we expected, Central Bank of Turkiye (CBRT) reduced the policy rate to 37% during the MPC meeting on January 22, indicating a cautious progress since a slower rate cut than December. With the bank committed to disinflation towards its 5% target, CBRT will likely proceed carefully on