USD, JPY, CHF flows: JPY weaker on tariff threats, strong equities

JPY weakens as Trump threatens 30% tariff

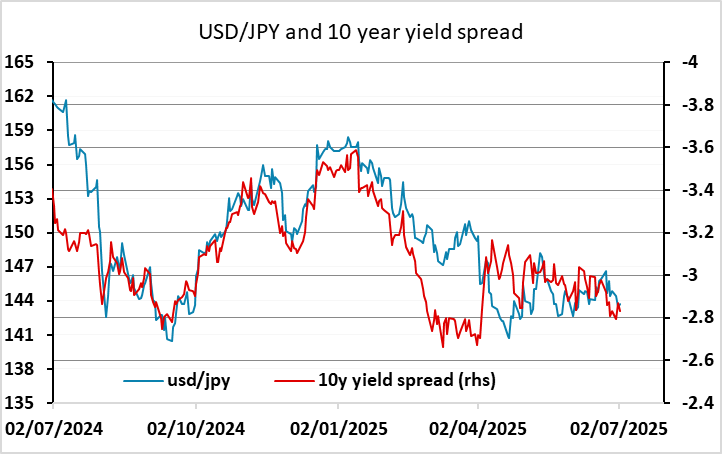

Wednesday’s calendar is light, and the data focus is on the US employment data on Thursday. In the meantime, the latest news on tariffs and the continued strength of the equity market are likely to be the dominant forces. S&P 500 futures made another new all time high overnight, and the JPY has weakened on the crosses in response, helped also by the recovery in US yields in the US session on Tuesday helped by better May job opening data and mildly hawkish Powell comments. The JPY also hasn’t been helped by Trump saying he didn’t expect a trade deal with Japan and that Japan could pay 30-35% tariffs, so for today the JPY looks likely to remain on the back foot.

The strength of equities suggests that there should be some upside risks in EUR/CHF, and with Trump also indicating there will be no extensions to the July 9th deadline there may be some concerns from the EU in general about tariffs, although for the moment Trump’s ire looks to be focused more on Japan.