Published: 2024-03-25T15:08:33.000Z

Preview: Due March 26 - U.S. February Durable Goods Orders - Marginal rise, trend near neutral

Senior Economist , North America

-

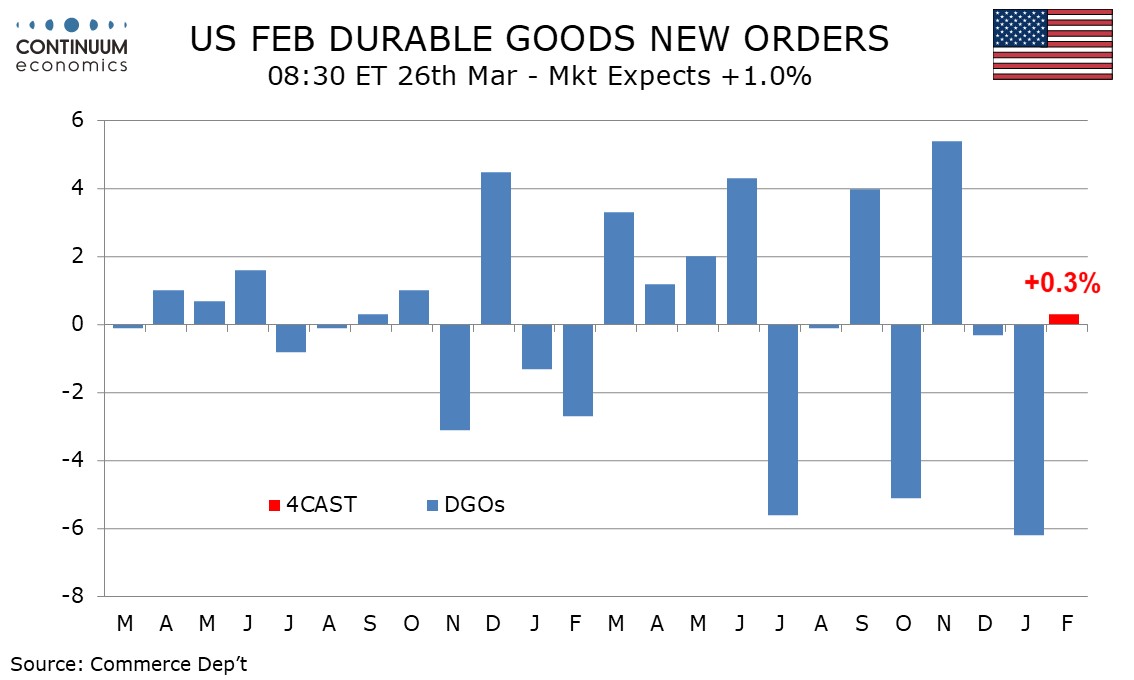

We expect February durable goods orders to see a marginal rise of 0.3% after a plunge of 6.2% in January, while ex transport orders keep underlying trend fairly neutral with a rise of 0.5% after a 0.4% January decline.

January’s plunge was led by aircraft which plunged after a strong November bounce was largely sustained in December. January data from Boeing suggests aircraft orders will remain weak. While we expect aircraft and autos to see marginal February gains we expect transport to be unchanged overall as defense which has a large overlap with transport corrects from a strong January. Ex defense we expect orders to increase by 0.8%.

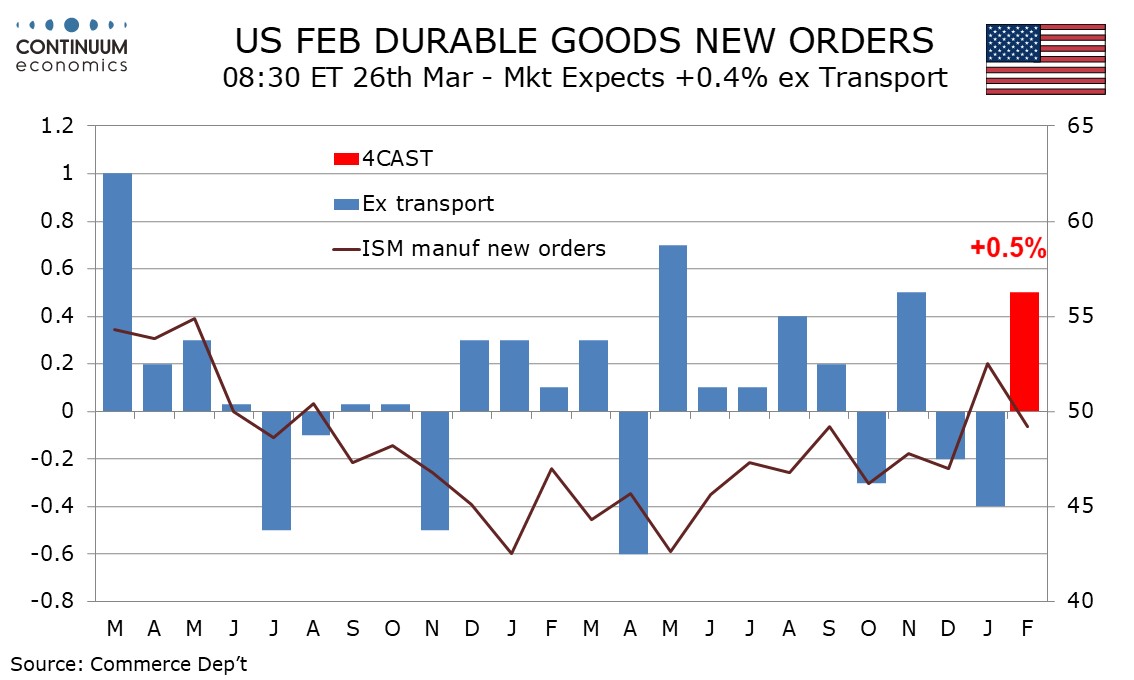

Slippage in January orders ex transport contrasted a rise in ISM manufacturing new orders but was consistent with a weather-related dip in January manufacturing output. February saw ISM new orders correct lower while manufacturing output corrected higher. Trend is fairly neutral with low recent volatility, with no move in either direction reaching 1.0% since March 2022.

We expect non-defense capital orders ex aircraft, a key indicator of business investment, to rise by 0.5%, matching the ex-transport gain. This series is a little more volatile than the ex transport one but trends are similar.