USD flows: USD weaker with equities and bond yields

The USD is weakenin gin early US trading with bond yields and equities both lower, although the underlying cause is unclear

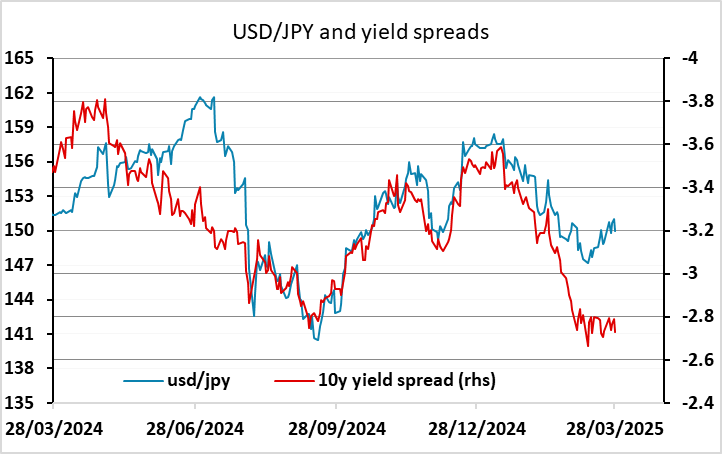

We are seeing lower equities, lower bond yields and a lower USD in early US trading, but it is unclear what the driving force is behind it. The US data was on the strong side, with the PCE deflator above consensus and personal income growth strong, so it’s hard to see the data as the driver. Weaker equities may be the prime driver of both lower bond yields and a weaker USD, but it isn’t clear why equities have turned south. There may be some end of month flow involved, although most models suggested that form an FX perspective, end of month flow would likely be USD positive. So all in all, it’s a confusing Friday, but the decline in USD/JPY certainly looks logical given the current yield spread picture.