GBP flows: Softer after weaker CPI

GBP softer after CPI comes in below consensus, but GBP losses unlikely to extend far

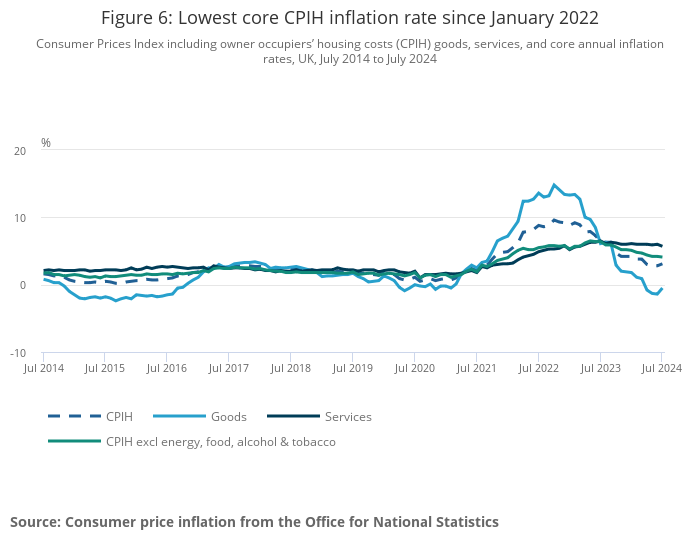

EUR/GBP has traded 20 pips higher to 0.8570 after the weaker than expected July CPI data, which saw the headline y/y rate rise less than expected to 2.2% and the core rate fall more than expected to 3.3%. There was a modest decline in service sector inflation to 5.7% from 6%, and this may be seen as supporting the case for more rate cuts going forward. As it stands, the market is only pricing around a 35% chance of a UK rate cut in September, with November fully priced for a 25bp cut. Today’s data may slightly increase the chances, but at this stage a September move is still probably less than a 50% chance. Recent GBP strength has been as much about optimism on UK economic prospects as about expectations of tight policy, as GBP is trading above the level that looks consistent with recent moves in yield spreads. For the moment, this optimism is likely to be sustained, especially after the lower unemployment rate reported yesterday, so for now we would expect EUR/GBP to hold below 0.86, although in the longer run GBP still looks somewhat overvalued.