Preview: Due July 3 - U.S. June ISM Services - Bouncing back above neutral

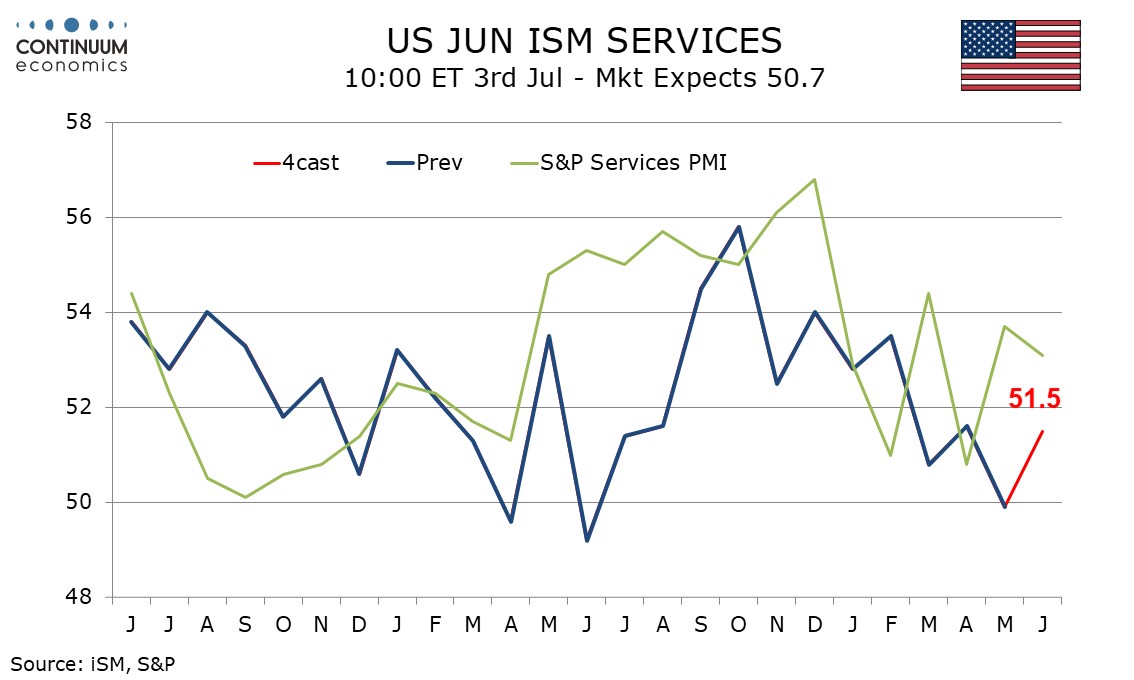

We expect a June ISM services index of 51.5, rebounding from May’s 49.9 which edged below the neutral 50 for the first time since June 2024. The recovery will reflect reduced concerns over tariffs and associated worries in the equity market.

While June’s S and P services PMI slipped on the month it remains resilient at 51.1 and off April’s low of 50.8. Regional service sector surveys from the Empire State, Philly, Dallas and Richmond Feds remained negative but were less so than in May. This suggests some improvement in the ISM services data.

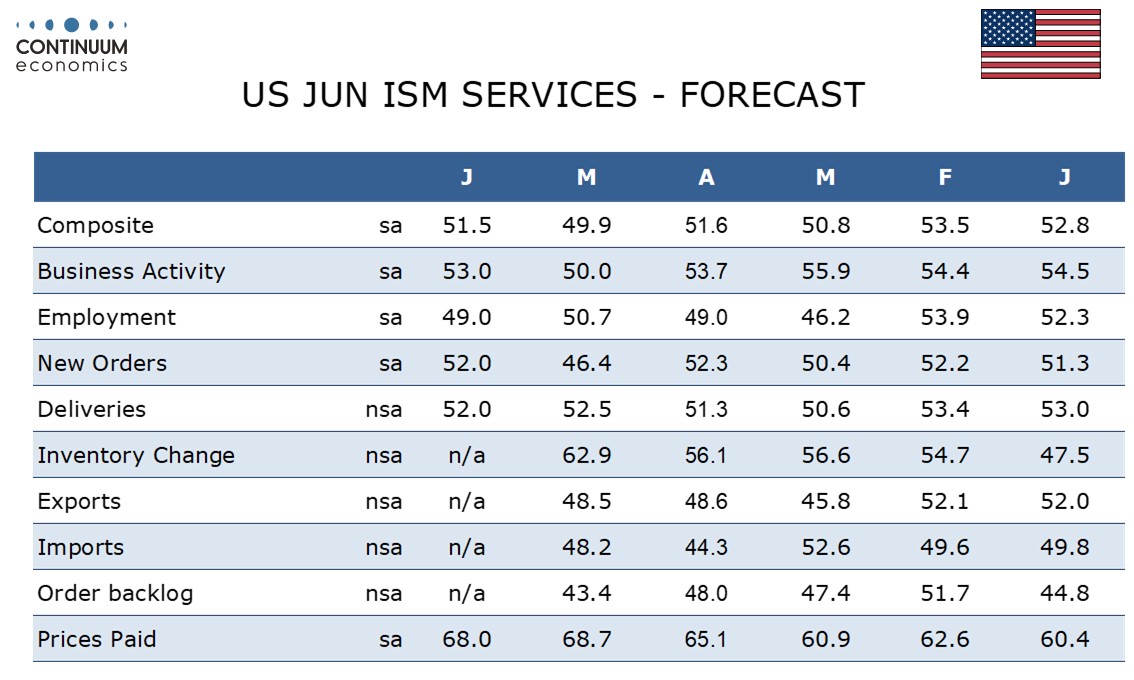

Of the components that make up the composite, we expect gains in business activity and new orders, both supported by seasonal adjustments, but slippage in employment, where seasonal adjustments are negative, and deliveries, which are not seasonally adjusted. New orders have significant scope to bounce after a very weak 46.4 outcome in May, that was the weakest since December 2022.

Prices paid do not contribute to the composite and here we expect a modest correction lower to 68.0 from May’s 68.7, which was the highest reading since November 2022. Tariff concerns have probably peaked but the brief spike in oil prices on the Israel-Iran conflict could have some impact.