JPY, SEK flows: JPY soft, SEK has scope to weaken

JPY weakness looks extended, some scope for correction. SEK strength may falter after higher unemployment

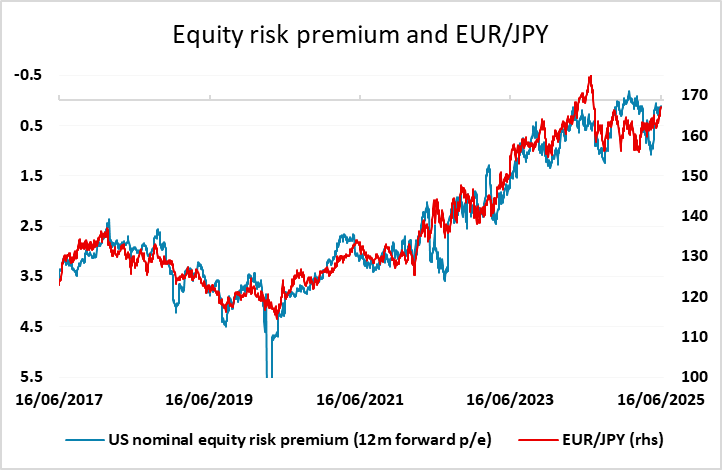

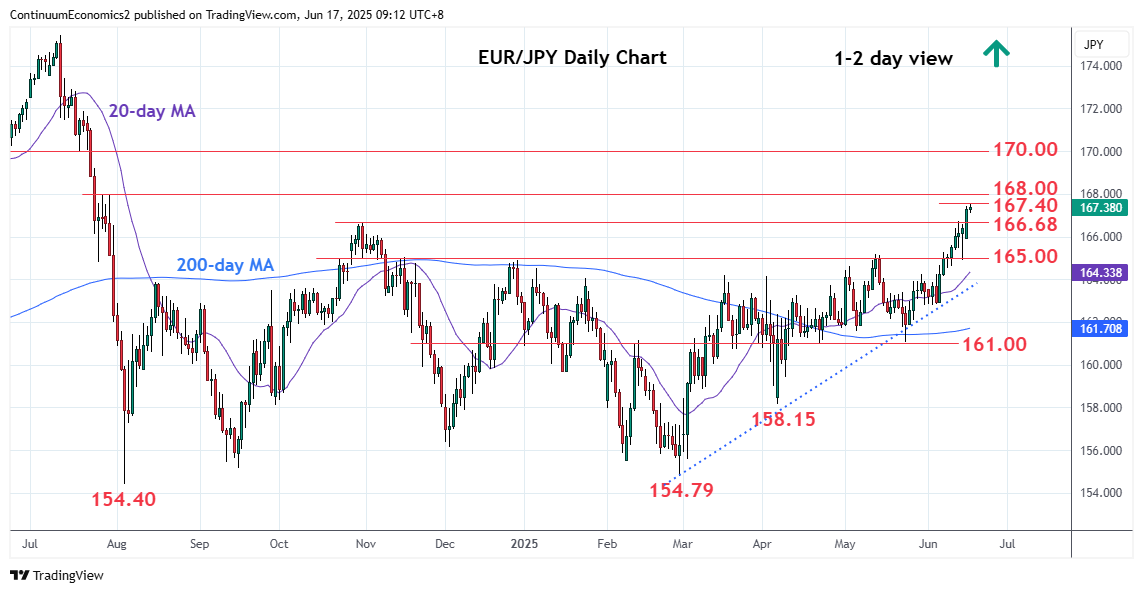

A fairly quiet start in Europe after a similarly subdued Asian session. Europe is faced with most pairs at similar levels to yesterday’s close, although the JPY is somewhat lower. This is not in response to the BoJ’s announcement of a reduction in the pace of QT to JPY200bn from April 2026. This is after all nearly a year away, and was generally anticipated. USD/JPY had, however, made gains in the US afternoon as US yields and equities rose, and remains somewhat higher than it was at European close on Monday. JPY crosses also continue to press higher, with EUR/JPY currently on its ninth consecutive day of gains, and testing a big retracement level at 167.50. JPY weakness remains hard to oppose as long as US equities are firm and US yields edge up, but we see equities and yields as both being toppy here, so would anticipate some modest JPY corrective recovery in the short term, while the long term picture continues to look very JPY positive.

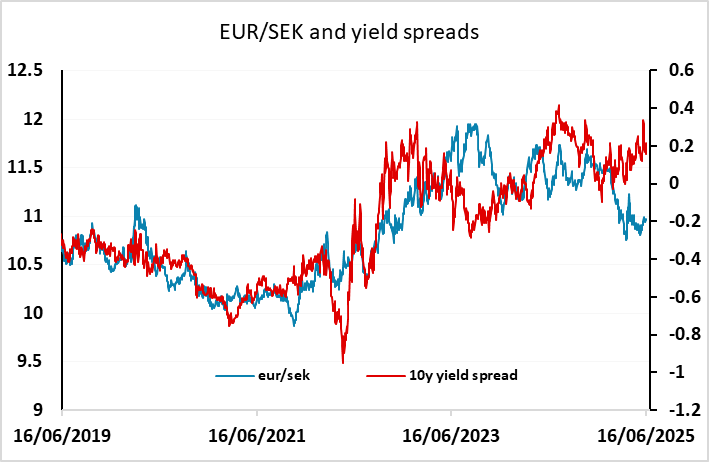

A quiet calendar in Europe suggests a fairly quiet session, but this morning’s Swedish unemployment data came in higher than expected at 9.0% on a seasonally adjusted basis, and suggests that the Riksbank is even more likely to deliver a rate cut on Thursday. The SEK has been the best performer of the G10 currencies in the last couple of months, and has scope to retrace some of the recent gains, especially if European equities show a weaker tone.