JPY flows: New all time high in EUR/JPY

JPY weakness extends with little rationale

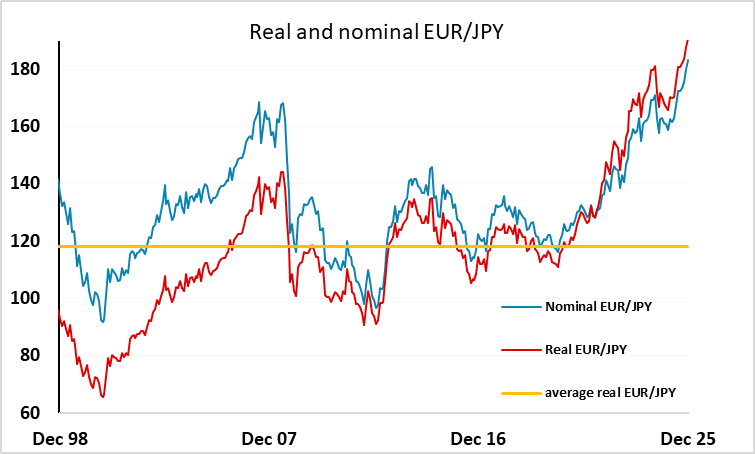

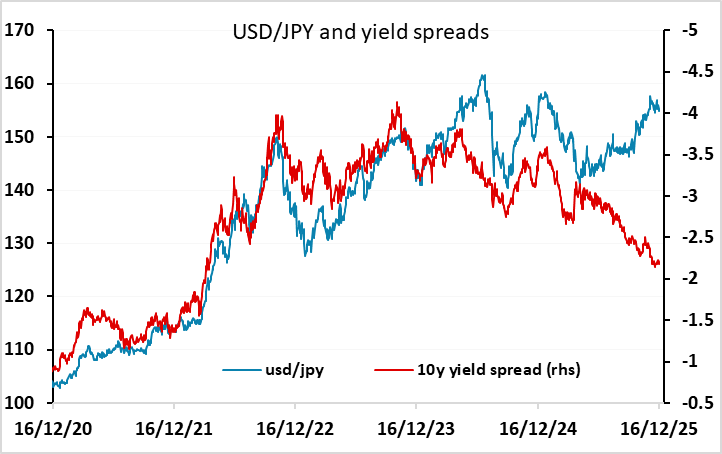

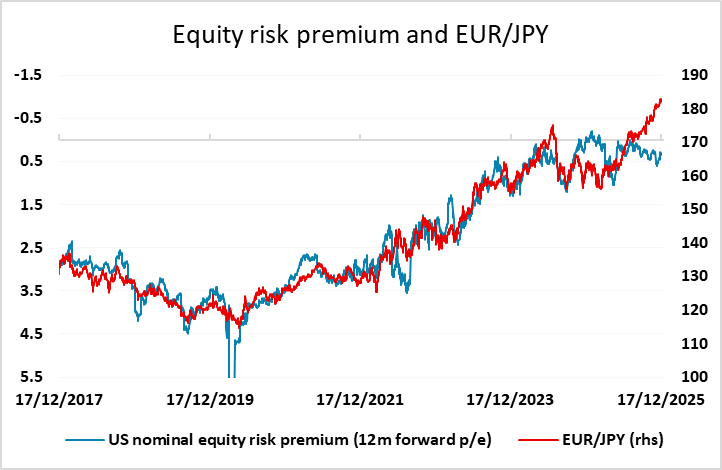

EUR/JPY has hit another new all time high this morning as the JPY has come under general pressure. The rationale for the decline is unclear, with equities on the back foot after the drop in the US yesterday, and yield spreads still edging in support of the JPY from a starting point that already suggests scope for substantial JPY gains. Some are suggesting that the concern is that there will be some dovish forward guidance at tomorrow’s BoJ meeting which could be JPY negative even though the BoJ are likely to raise rates 25bps. This is frankly fishing for an explanation, because yield spreads already suggest the JPY should have gained substantially in recent months, but the JPY has remained weak regardless.

In the end, the JPY weakness looks to be more momentum driven than anything else. Short JPY positioning has been profitable for the last few years, and until the trend is clearly broken JPY bears are unlikely to be discouraged. Verbal intervention from cabinet secretary Kihara overnight failed to have any impact, as has consistently been the case with verbal intervention, and the Japanese authorities will likely need to act decisively with physical intervention if they want to turn the trend. They are no doubt reluctant to do so ahead of tomorrrow’s BoJ meeting, but if a rate hike fails to turn the trend, and the JPY sells off again, we would expect intervention. If it doesn’t come, the market will see it as a green light for more JPY selling.