EUR, USD flows: History suggests modest USD gains

Rising US yields supported the USD in 2016, and are likely to do so again now, but erhpas less substantially.

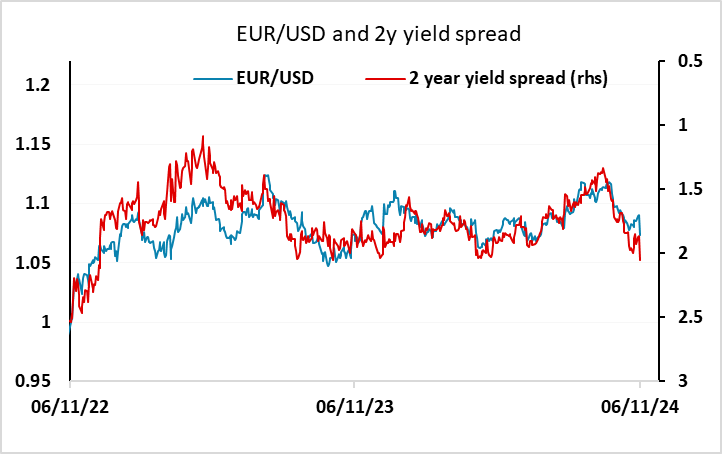

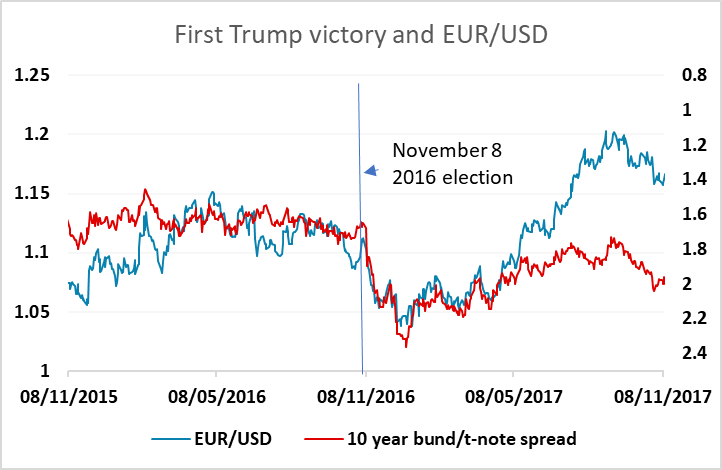

In 2016 DXY rose 5% from the election of Trump on November 8peaking on December 20. The USD’s rise was driven by rising US yields, as it has been this time around. If anything, the USD rose less than the rise in yields suggested. Back then, EUR/USD tended to move more with 10 year yields, while currently it tends to move more with 2 year yields. Spreads have moved in the USD’s favour, and may have scope to move a little further. But at this stage we doubt the Fed will be changing their policy outlook. Trump’s tax cut promises have yet to be enacted, so it isn’t clear that monetary policy will be significantly affected. So while we can see the USD extend gains a little further, we wouldn’t at this stage be looking for a large move.