U.S. Initial Claims show strong and stable labor market, Philly Fed sees a second straight positive, Q4 current account deficit lowest since Q1 2021

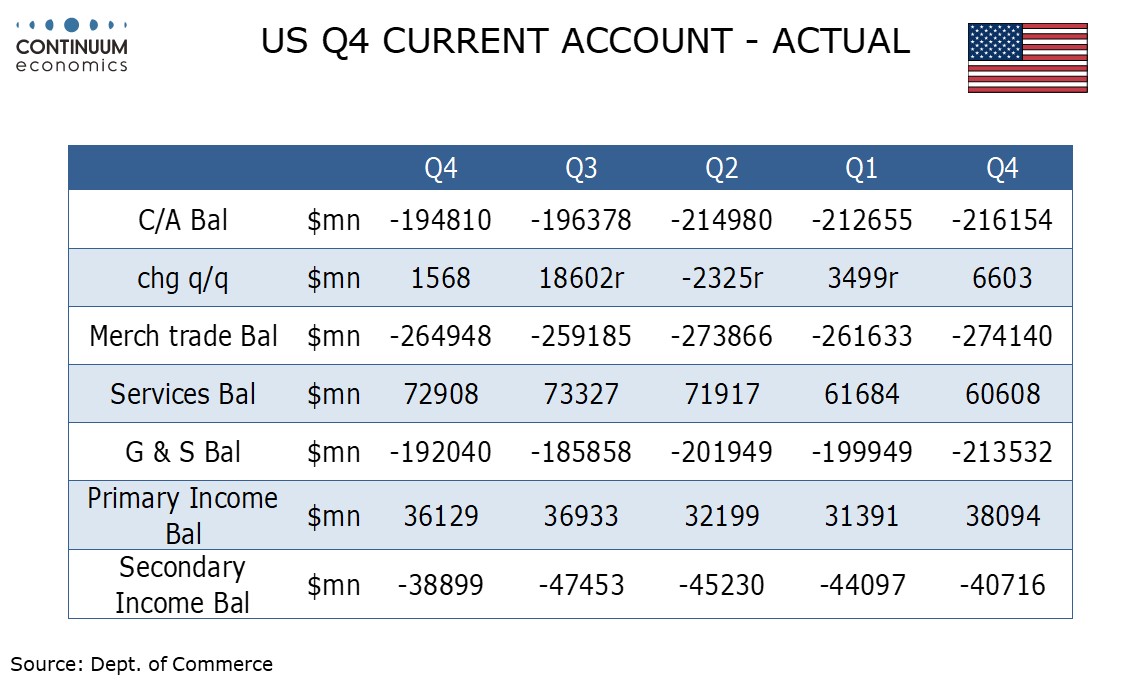

The latest data is mostly positive with initial claims still low in the March payroll survey week if little changed at 210k from 212k, the March Philly Fed still positive at 3.2 if down from 5.2 in February, and the Q4 current account deficit falling to $194.8bn from a downwardly revised $196.4bn in Q3.

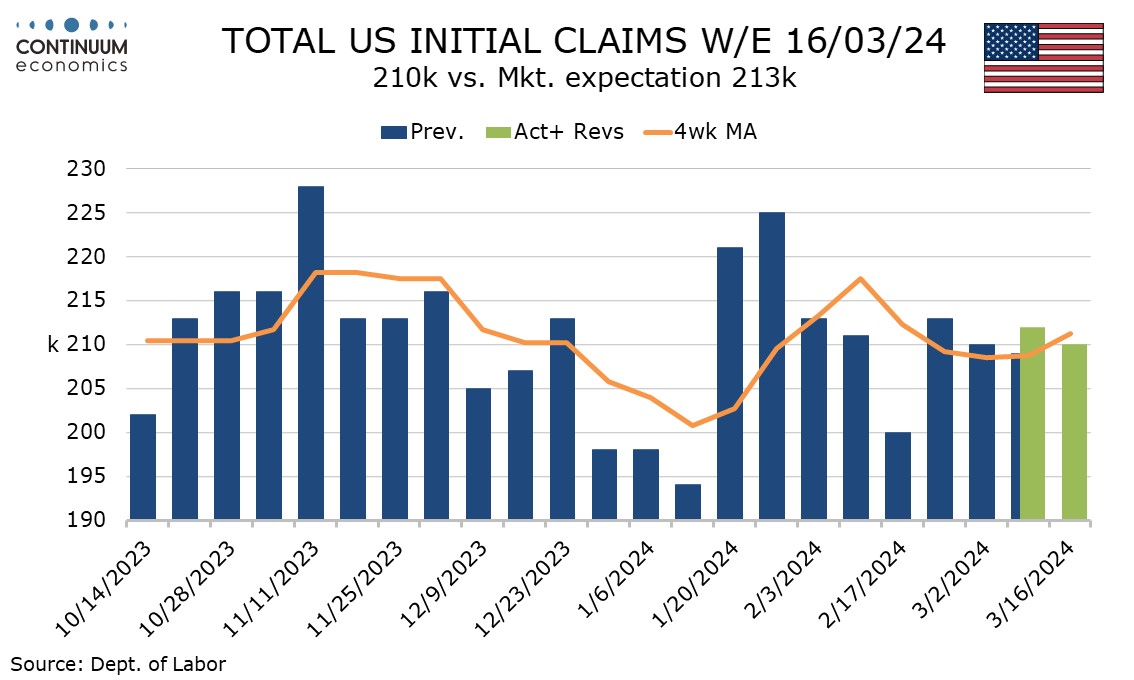

Initial claims ae down only because last week was revised up from 209k but there has been very little change over the last four weeks indicating a stable and still strong labor market. The 4-week average of 211k is down from 217.5k in February’s payroll survey week but above the 201k seen in January’s.

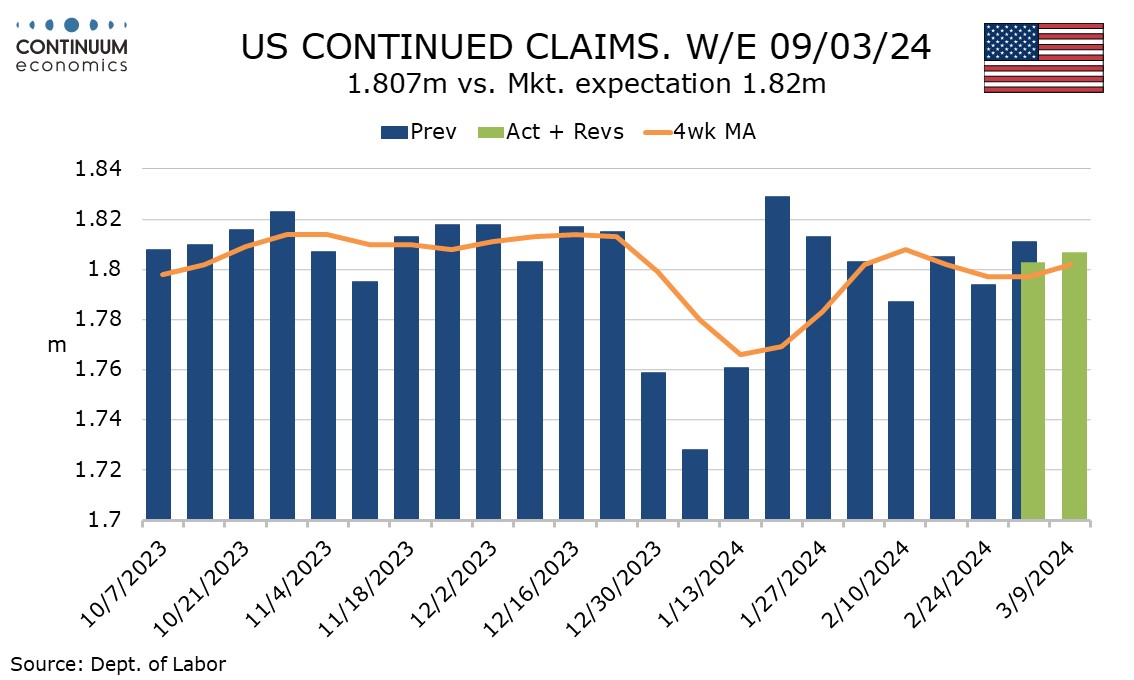

Continued claims cover the week before initial claims and at 1.807k were up from 1.803k only because the preceding week was revised down from 1.811k. The picture here looks very stable too.

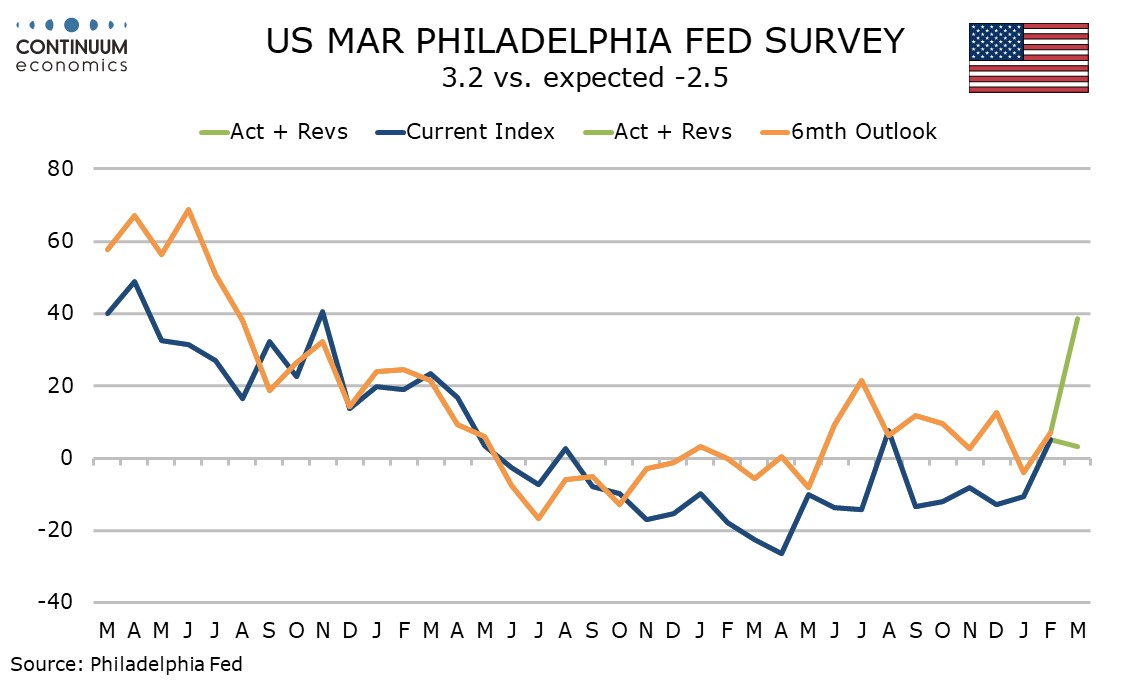

The Philly Fed has recorded two straight positives for the first time since May 2022, albeit modest ones, contrasting a weak March Empire State survey. Details are mostly constructive with new orders turning positive at 5.4 from -5.2 in February and 6-month expectations at 36.6 from 7.2 the highest since August 2021.

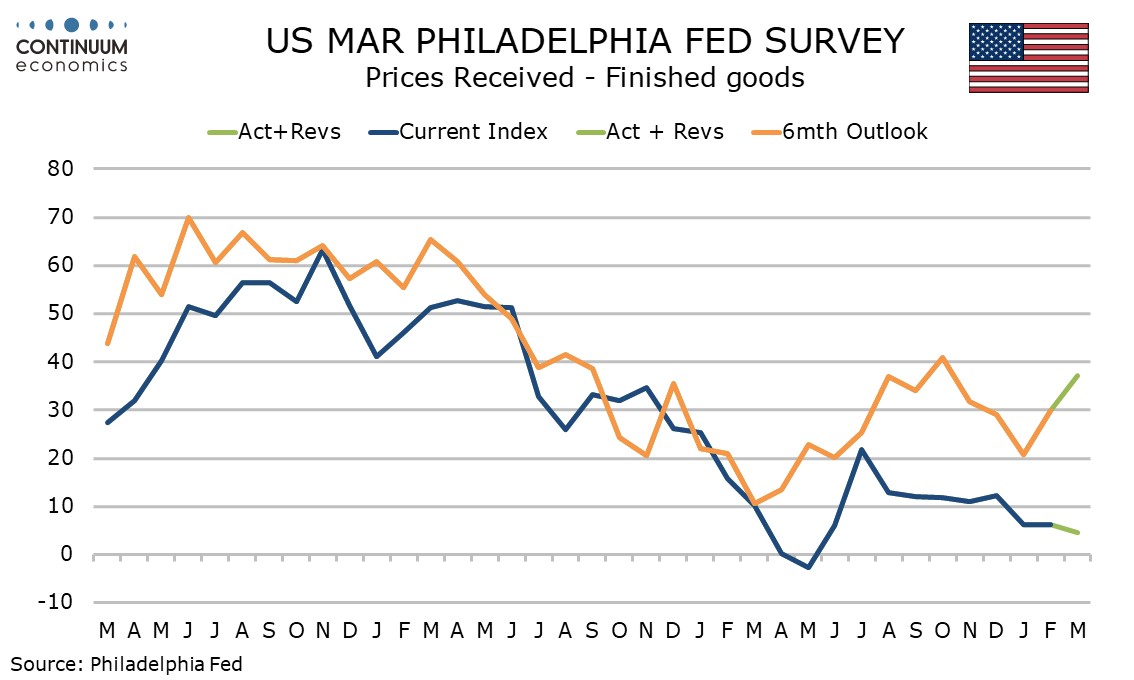

Employment however remains weak at -9.6 from -10.3. Prices paid slowed sharply to 3.7 from 16.6 while prices received dipped to 4.6 from 6.2. 6-month expectations saw prices paid slipping to 38.0 from 41.4 but prices received saw a sharp bounce to 37.1 from 29.9, suggesting that if activity picks up, prices received may do so too.

The narrowing of Q4’s current account deficit to the lowest level since Q1 2021 was due to a narrowing of the deficit for secondary income (government transfers). The goods and services deficit was slightly wider as already reported in monthly data. The primary income (investment) surplus was little changed after an upwardly revised Q3.

.