Banxico Preview: Ready to Start Cutting

The Banxico board will meet on Mar. 21 to decide the policy rate after 12 months of unchanged rates at 11.25%. With inflation now at 4.4% and signs of economic deceleration, a cutting cycle is anticipated. Banxico's exclusion of forward guidance hints at potential cuts, despite possible dissent among members. Labor market heat and inflationary fiscal policies pose challenges, yet a cautious 25bps cut to 11% is likely, maintaining a contractionary policy stance until inflation stabilizes near the target.

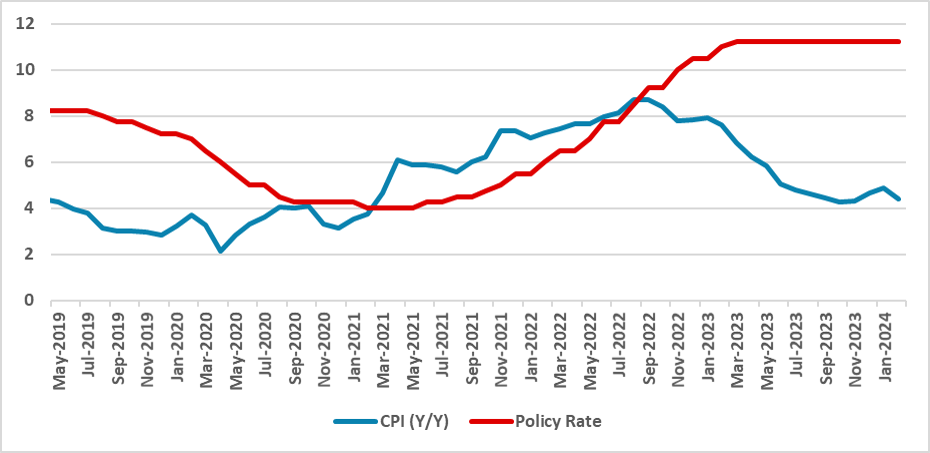

Figure 1: Mexico’s Policy Rate and CPI (%)

Source: Banxico and INEGI

The Mexico Central Bank (Banxico) board will convene on Mar. 21 to decide the policy rate. We believe that after 12 months of keeping the policy rate unchanged at 11.25%, the time to start cutting has arrived. Inflation has fallen substantially, now at 4.4%, while the economy finally starts to show signs of deceleration in Q4-2023. The February CPI, in which most of the inflationary surge on Food CPI was reverted, will boost the confidence of most Banxico board members to start the cutting cycle. Banxico has already excluded its usual forward guidance in December, stating that the policy rate will need to stay at the same level for a certain period, indicating the possibility of cuts depending on the available data.

For the first time since the end of the hiking cycle, we believe there will be conditions for cutting the policy rate. However, this time we believe the decision will not be unanimous, with some members voting to keep the policy rate unchanged. The votes for keeping the policy rate unchanged also have some strong grounds. The labor market is hot, and wage inflation is also a factor that could fuel inflation in Mexico in the short-term. Additionally, the fiscal package for 2024 could have potential inflationary impacts.

However, the discussion is only about diminishing the degree of tightening. As inflation falls and interest rates are kept unchanged, the real rate rises. Therefore, some adjustment in the nominal rate will only keep the degree of tightening unchanged from previous months.

As there will be a need for some caution, we believe most of the members will be in favor of applying a 25bps cut, lowering the policy rate to 11%. The communique will likely be clear about the need to keep monetary policy contractionary in the relevant horizon, as expectations have not yet converged, and inflation is still a bit far from the Banxico target. With neutral rates possibly set at 7.0%, cutting it at a 25bps pace will allow this condition to be met easily.