FX Weekly Strategy: Europe, December 22nd - 29th

Geopolitical Uncertainty Continues in Christmas

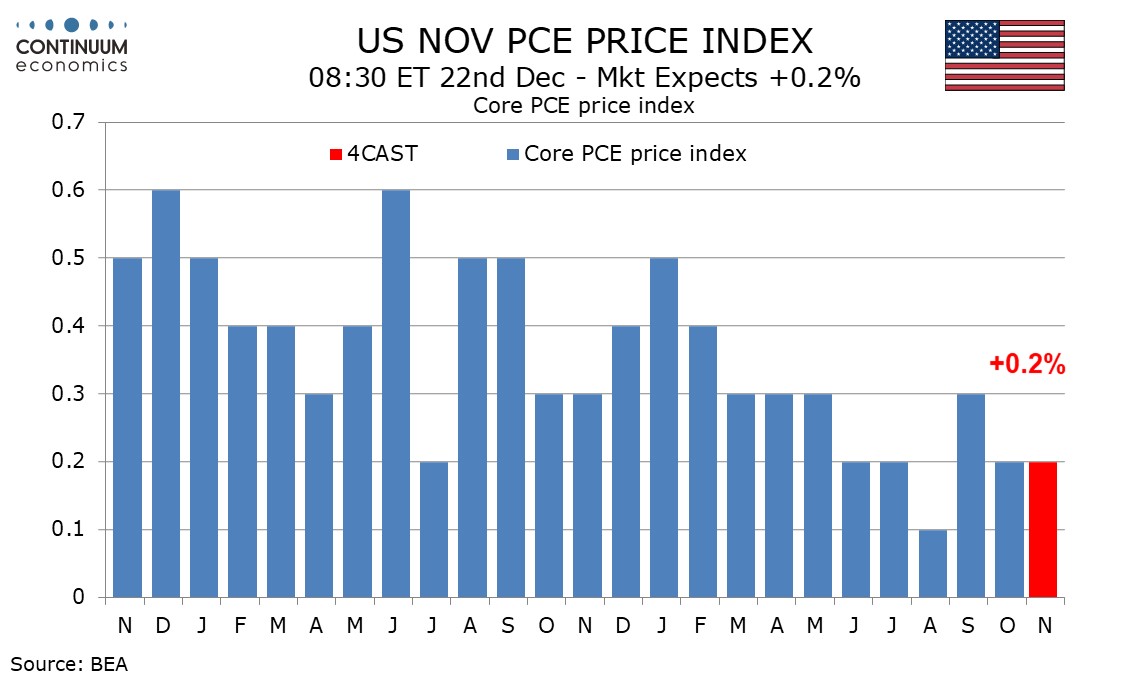

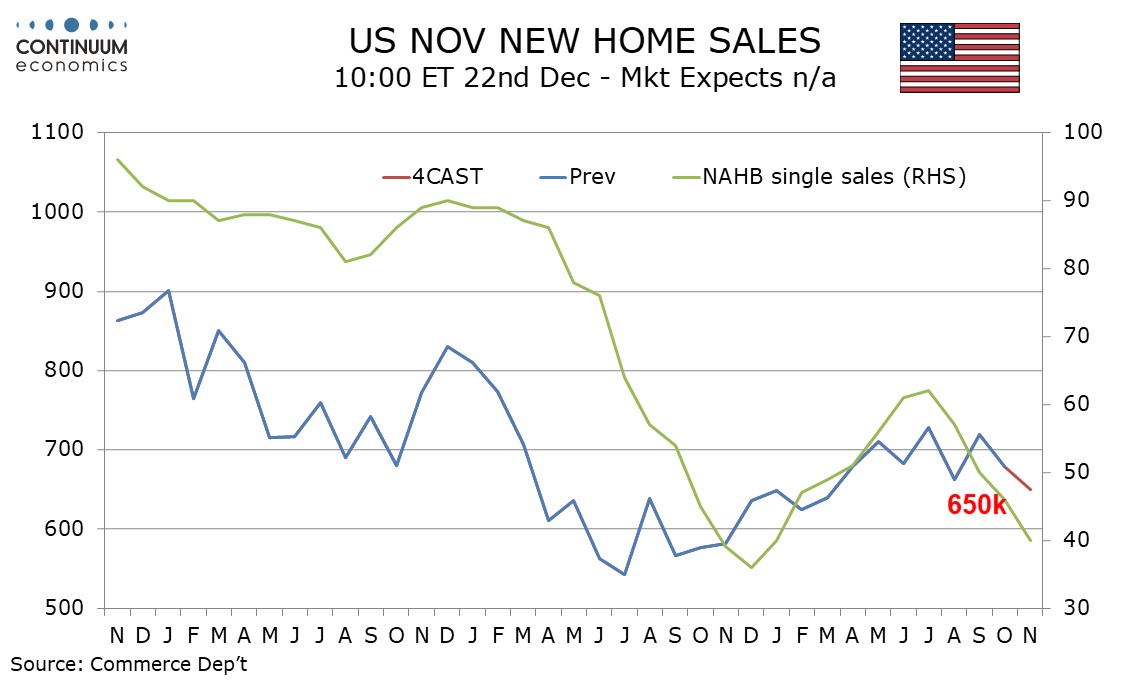

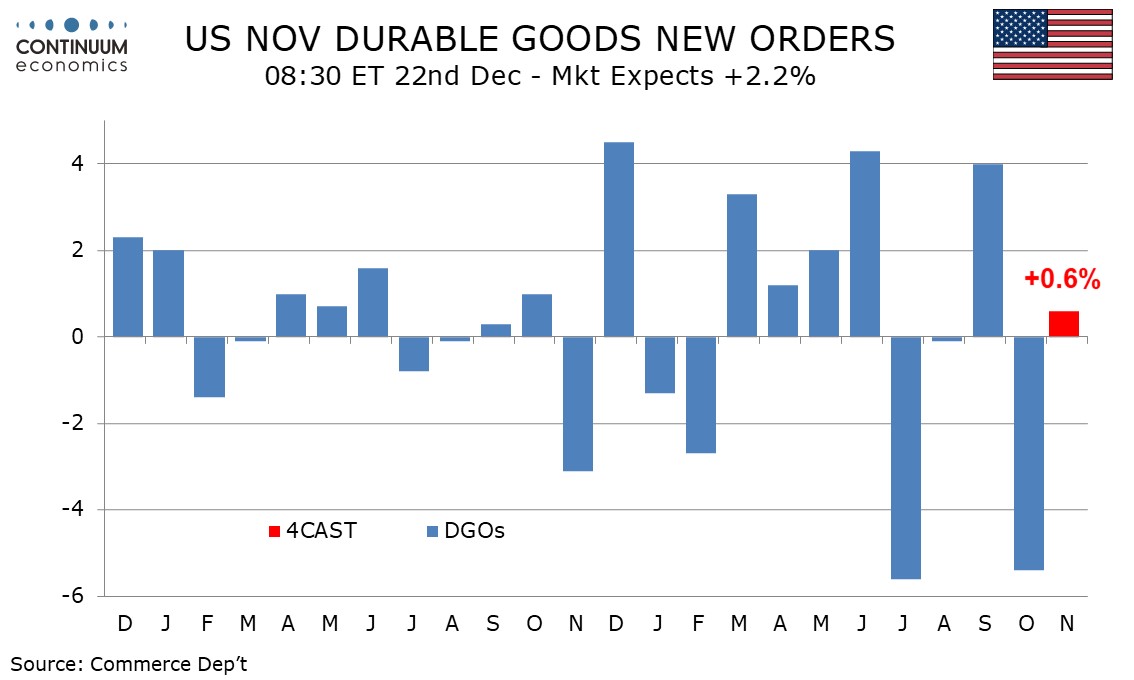

A Slate of U.S .Data before Christmas

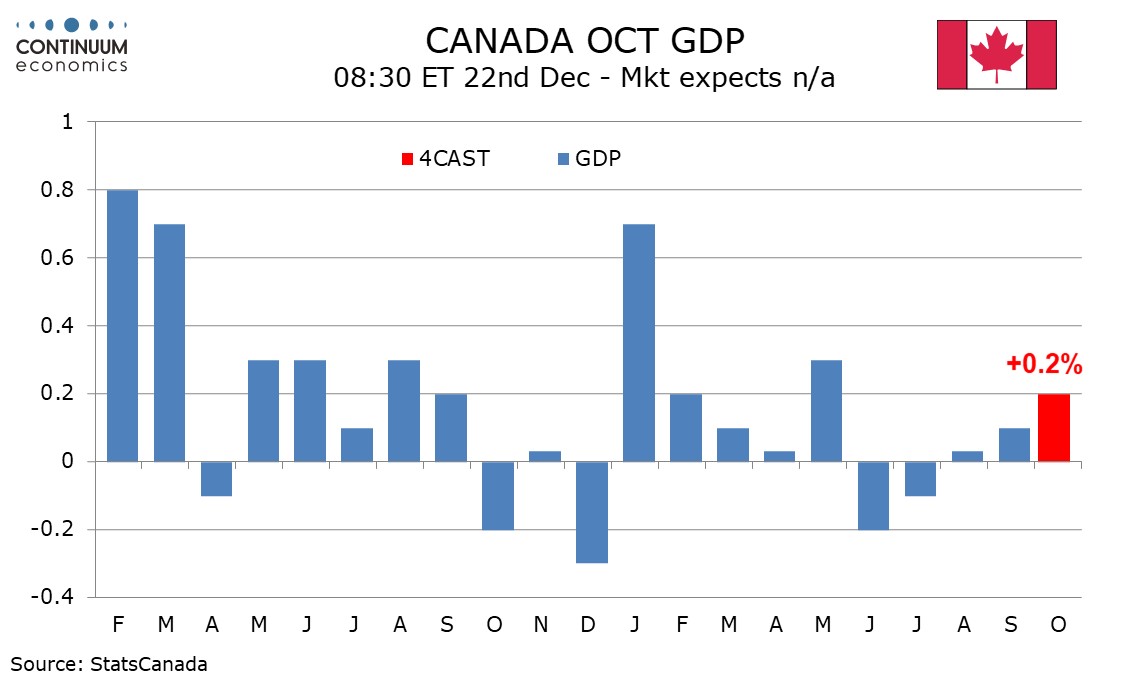

Canada GDP to be Strongest rise since May

Expecting Further USD/JPY Correction

Geopolitical Uncertainty Continues in Christmas

A Slate of U.S .Data before Christmas

Canada GDP to be Strongest rise since May

Expecting Further USD/JPY Correction

Geopolitical tension between Ukraine and Russia, Israel and Palestine continues throughout the new year. While the Ukraine - Russia conflict seems to have dialed down recently with Ukraine side reducing shelling on funding limitation from the U.S. and Europe, it is a rather a pause than stop as the hold up was funding from the West instead of a change in attitude of Ukraine nor Russia. The limited effect to shell in winter maybe another reason. The situation in Middle East has been crossing the wire less but also did not indicate an easing of tension but perhaps a temporary ceasefire to allow passage for refugees. It is a difficult picture to look at but they are likely to linger into the new year and last even longer.

We expect November to see a 0.2% increase in core PCE prices, slightly softer than a 0.3% core CPI, with overall PCE prices up by 0.1%, that matching the CPI. We expect gains of 0.4% in personal income and 0.5% in personal spending.

We expect a November new home sales total of 650k, which would be a 4.3% decline if October's 5.6% decline to 679k is unrevised. This would be the first example of two straight declines since July 2022, and a sign that the resilient trend is starting to weaken. Most housing sector series and surveys have been trending lower for some time, though new home sales have been relatively resilient, probably reflecting improving supply. However the slowdown in demand generated by rising mortgage rates is likely to increasingly weigh, even if mortgage rates have now moved off their highs. We expect the median and average prices to correct higher by 1.0% on the month after both fell by around 7% over September and October. Yr/yr data would then correct higher to -10.6% from -17.6% for the median, and to -6.7% from -10.4% for the average.

We expect November durable goods orders to see a 0.6% increase overall with a modest 0.3% increase ex transport, the latter keeping underlying trend marginally positive after a flat October ex transport outcome. We expect a modest 1.0% increase in transport orders after aircraft reversed a sharp September rise in October. Boeing data suggests aircraft will see little change in November but we expect a rise in autos after two straight declines, assisted by the end of strikes. Defense however, which has a large overlap with transport, may correct from October strength. We expect orders to rise by 1.1% ex defense. The ex-transport series has not seen a move of 1.0% in either direction for over a year with the last decline being seen in April, making October’s unchanged outcome on the low side of trend. A modest improvement in the ISM manufacturing new orders index suggests that November will see the marginally positive underlying trend resume. We expect non-defense capital orders ex aircraft, a key indicator of business investment, to also rise by 0.3%, this correcting to straight marginal declines.

We expect Canadian GDP to increase by 0.2% in October, in line with a preliminary estimate made with September’s data and strongest since May. Risk is for lower rather than higher than the preliminary estimate. We expect services to maintain a very subdued trend with a rise of 0.1% but goods to increase by 0.4%, a second straight increase to follow five straight declines. The goods increase is likely to be led by mining, in a rebound from a weak September, and construction. We do not expect manufacturing to repeat a 0.9% September rise, which was the first in four months. Under our forecast yr/yr GDP growth would rise to 1.0% from 0.6%.

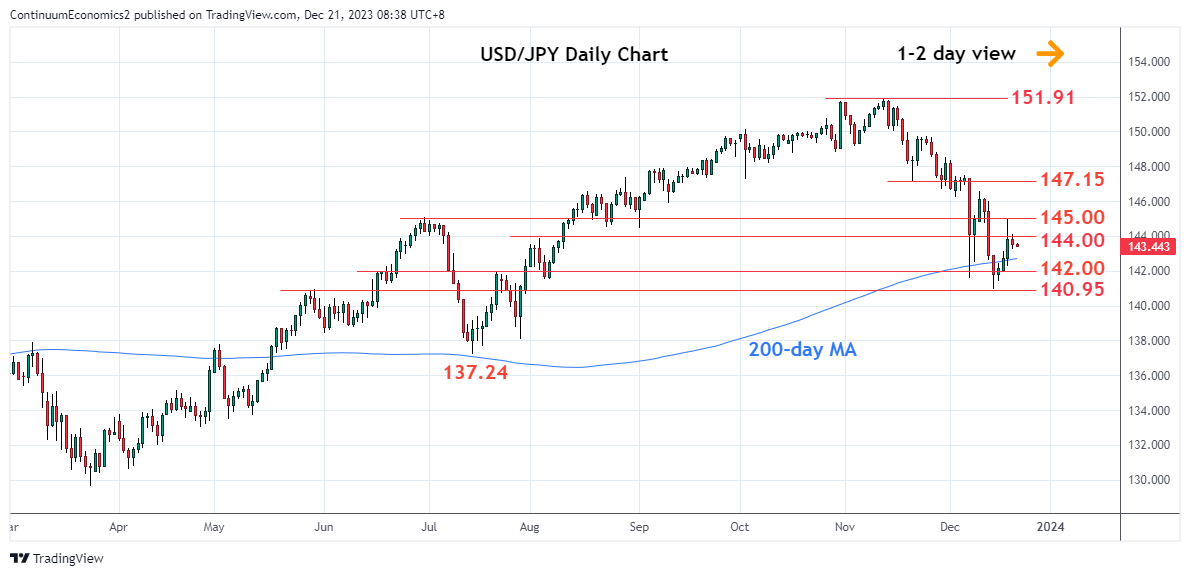

After a brief spike from BoJ's inaction in the December meeting, the pair has rotated lower as market participants came to their senses that despite the can is being kicked down the road, the BoJ is going to exit current ultra-loose monetary policy and the Fed rate has probably peaked. There will be yield differential narrowing inevitably and the carry trades will be less attractive, which could also lead to more potential losses if speculators rewind their carry position. With U.S. equities revisiting recent all time highs, a correction can not be ruled when the economy could not sustain current momentum and take a turn.

On the chart, the settling back from test of the 145.00 level as prices unwind overbought intraday studies following rally from the 140.95 low. Further gains not ruled out and break above the 145.00 level will see scope to the strong resistance at the 146.00/22 congestion. However, gains are seen corrective of losses from the November high and expected to give way to selling pressure later. Meanwhile, support remains at the 143.15/00 area. Break here will return focus to the downside and open up the 142.00 congestion and 140.95 low to retest. Below here will further extend the November losses.