GBP flows: GBP firmer as BoE hawks hold firm

GBP firmer as BoE cuts but remains gradualist

While the BoE cut the base rate 25bps as expected, the comments around the cut were not particularly dovish and GBP has risen in response. The vote was only 5-4 in favour with no votes for a 50bp cut, and while governor Bailey changed his vote to a cut, he didn’t suggest that the latest data had led to a significant change in BoE thinking. He still suggested a very gradual pace of easing, noting that “most labour market data do not suggest a rapid opening of slack”, and seeing the contractionary effects of the Budget as coming outside the 3 year horizon. We see the latest data as more indicative of weakness, so we still expect more rapid easing than the market is pricing in.

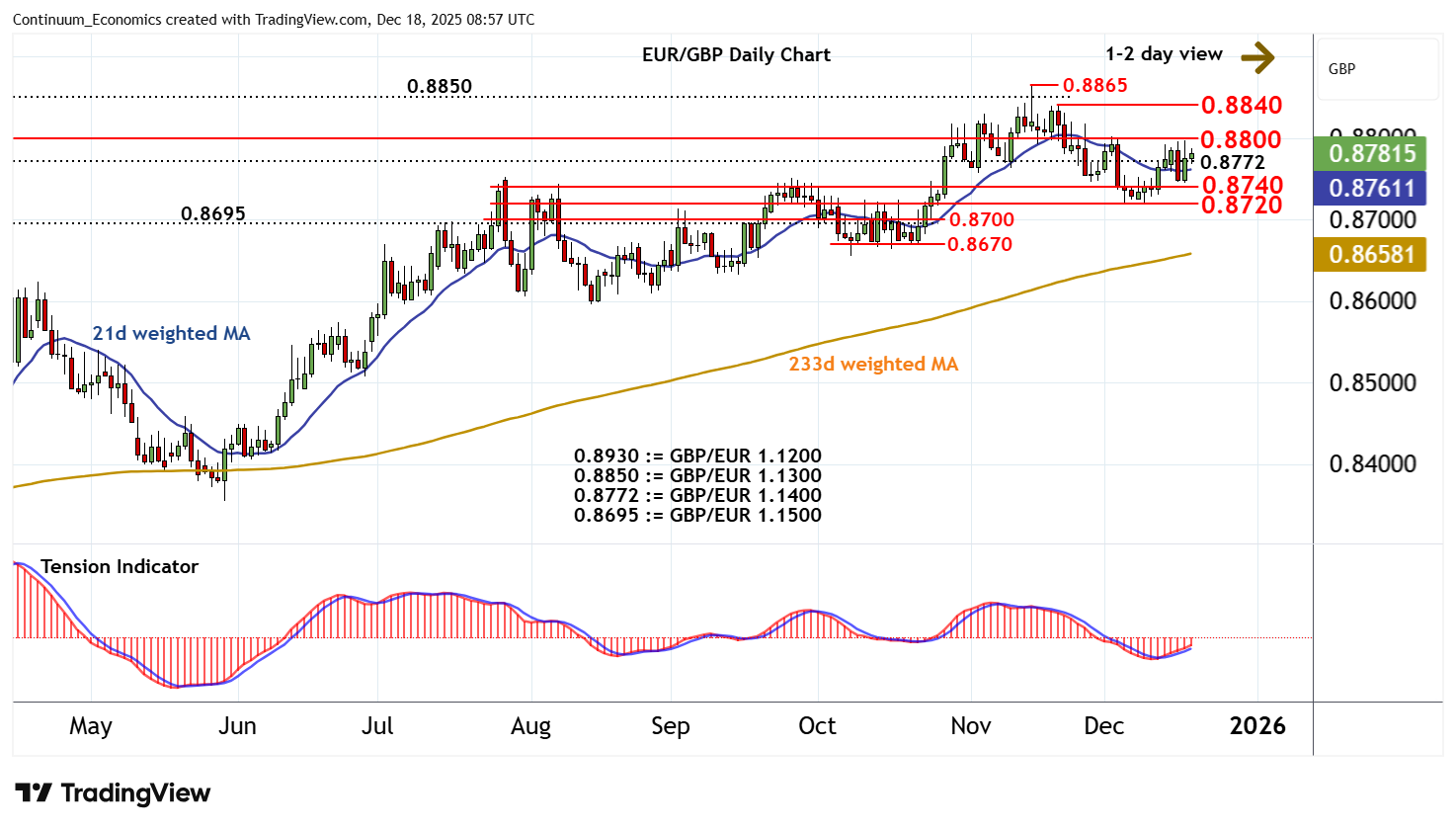

While GBP has gained on the news, with EUR/GBP dropping 20 pips, there hasn’t been any significant move in UK yields, suggesting the rates market was already positioned for a fairly neutral BoE statement. Chances of anything changing this year now look very limited, but we would still expect a more dovish view and EUR/GBP gains n the New Year.