GBP flows: GBP gains slightly on UK labour market data, but downside favoured

UK labour market data mixed but UK rate expectations look too hawkish

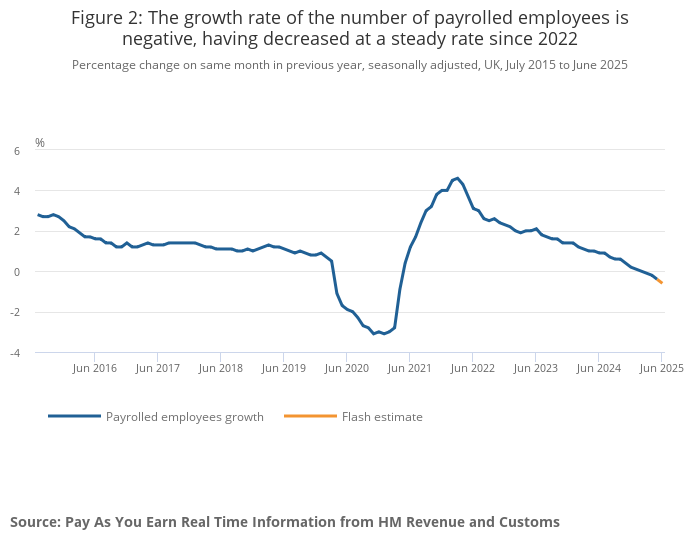

GBP has risen in response to the UK labour market data, although the data can best be described as mixed. While the official ONS data for the 3 months to June showed a larger than expected increase in employment of 238k, unemployment also rose by 59k, reflecting a rise in the labour force, and the HMRC data for July showed anther decline in employment of 8k on the month, although last month’s sharp decline was revised from 41k to just 26k. Average earnings growth was atad weaker than expected at 4.6% y/y in the 3 months to June in the ONS data, but the HMRC data still showed earnings growth at 5.6% y/y in July.

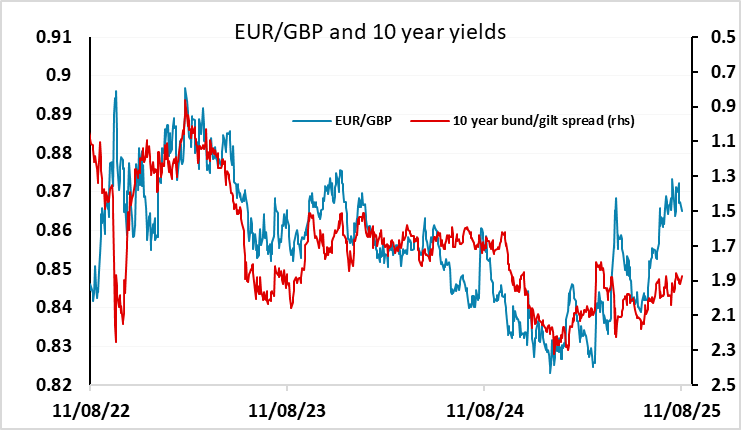

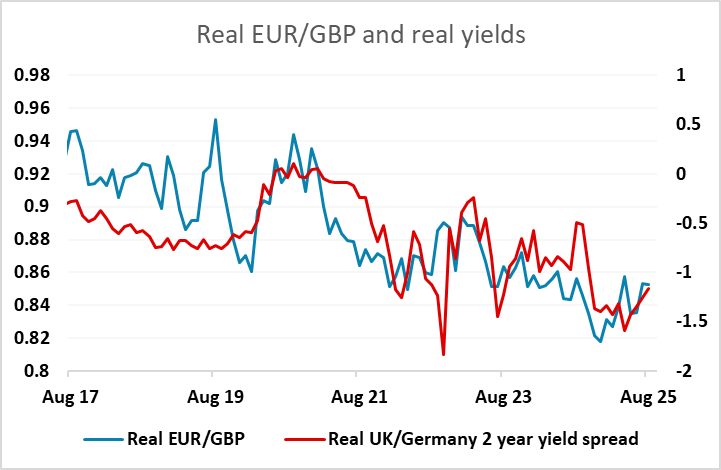

All in all, the data still paints a picture of a softening labour market, but the MPC hawks might still regard the picture as mixed and the earnings growth as too high to be consistent with the inflation target. But with the market not even fully pricing one more rate cut by year end, the risks look to be to the downside for front end yields and consequently also for GBP. It may still require more evidence of weak growth to push the BoE back towards considering a cut as early as the November meeting, but with the budget in October also likely to deliver tighter fiscal policy, the risks should be that way.