GBP flows: GBP falls on weak GDP, but...

GBP declines as GDP comes in weaker than expected, but weakness largely due to cyberattack so likely to be reversed

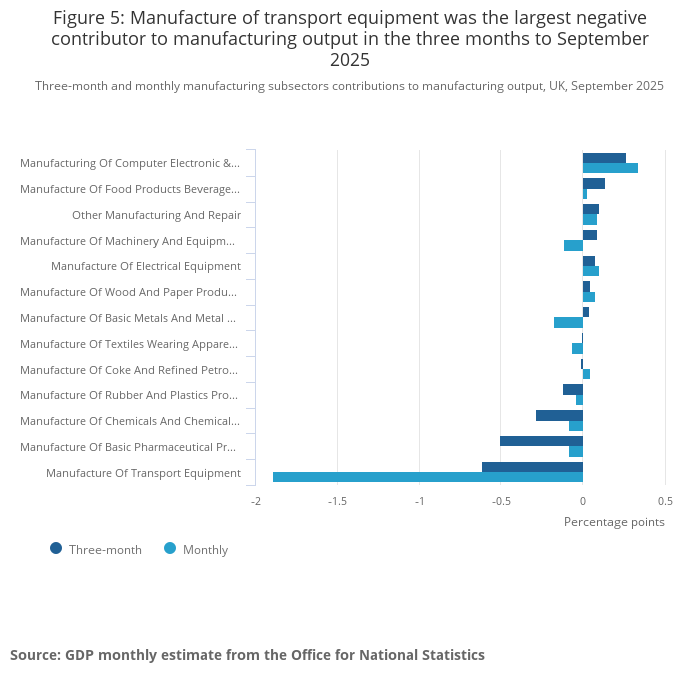

GBP has fallen back in response to the weaker than expected GDP data seen this morning. However, the weakness looks to have been almost entirely due to the auto sector, where Jaguar Landrover suffered a shutdown due to a cyberattack. This has now been dealt with, so a sharp rebound is likely in October. The decline in auto production in September led to a 2.0% decline in manufacturing output on the month and a 0.1% decline in GDP, so that Q3 recorded a slightly lower than expected 0.1% gain.

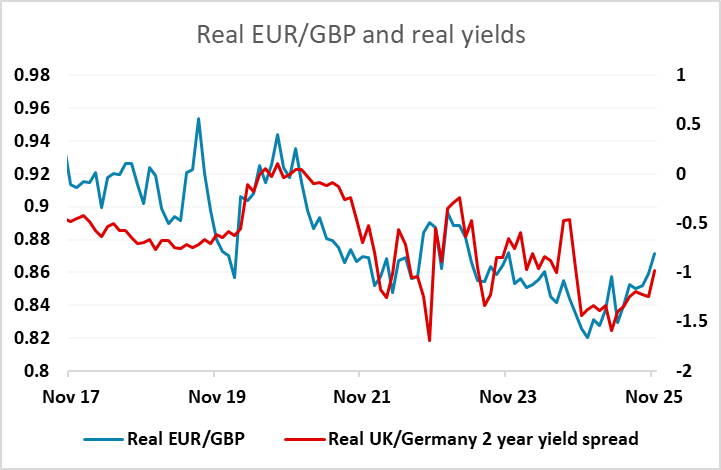

In practice, this is unlikely to make much difference to BoE policy, so we wouldn’t expect it to have a persistent impact on GBP. But the GBP tone remains weak, with the upcoming Budget expected to introduce significant fiscal tightening and likely leading to a BoE rate cut in December. The political picture is also unsettling, with the rumours of a leadership challenge to PM Starmer now triggering calls for resignations of senior aides. Even so, we wouldn’t expect any sharp GBP decline, as a tight Budget, while likely leading to easier monetary policy, might also calm some of the nerves about the UK fiscal position. So while we favour the GBP downside, EUR/GBP gains through 0.8850 are likely to prove difficult near term.