GBP flows: GBP firm but downside risks

GBP firm overnight but risks on the downside

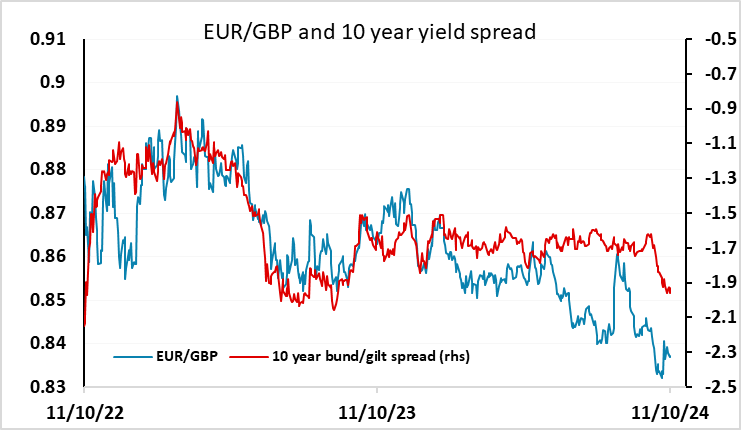

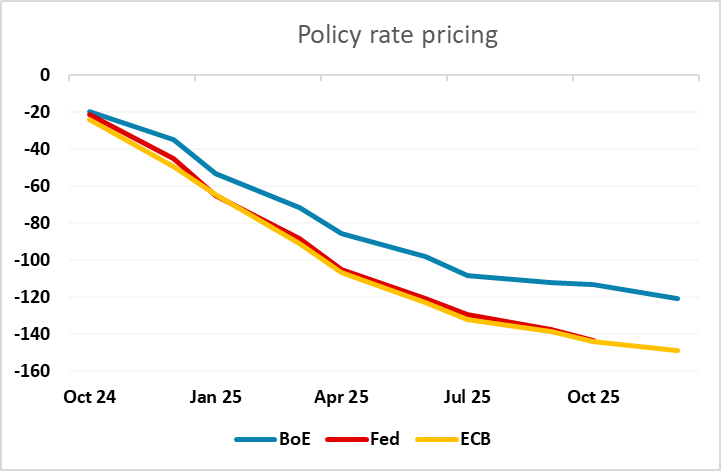

A quiet start in Europe after a fairly quiet overnight session. There isn’t much on today’s calendar that looks likely to move markets, but we do have the UK MPC’s Dhingra speaking at 0830GMT. She is very clearly a dove on the MPC, having been the only one to vote for a rate cut in September, so we can guarantee that she will be dovish, with the recent comments from BoE governor Bailey suggesting that the MPC as a whole is shifting towards her stance. GBP has been firm overnight, with EUR/GBP dropping around 10 pips to 0.8360, but Dhingra may help encourage GBP bears. The market is currently pricing a November rate cut as around an 85% chance, but this is still below the expectations for the Fed and ECB, and there is still scope for UK yields to drop to bring the expected UK rate path closer to the paths in the US and the Eurozone.

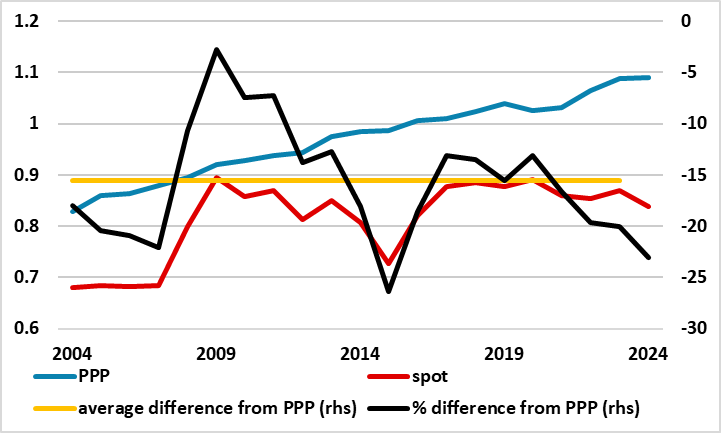

The upcoming UK budget on October 30 is also a factor, with recent talk suggesting it might be more expansionary than previously expected, although there are also rumours of some big tax increases. However, we doubt it will be sufficient to prevent a BoE rate cut, and see upside risks for EUR/GBP from here, with 0.83 likely to prove a strong base. From a longer term perspective, EUR/GBP is historically cheap, and if the expectation of relatively tight UK policy faded, there is plenty of upside scope.