Published: 2024-12-02T15:27:03.000Z

U.S. November ISM Manufacturing - Bounce led by positive new orders

3

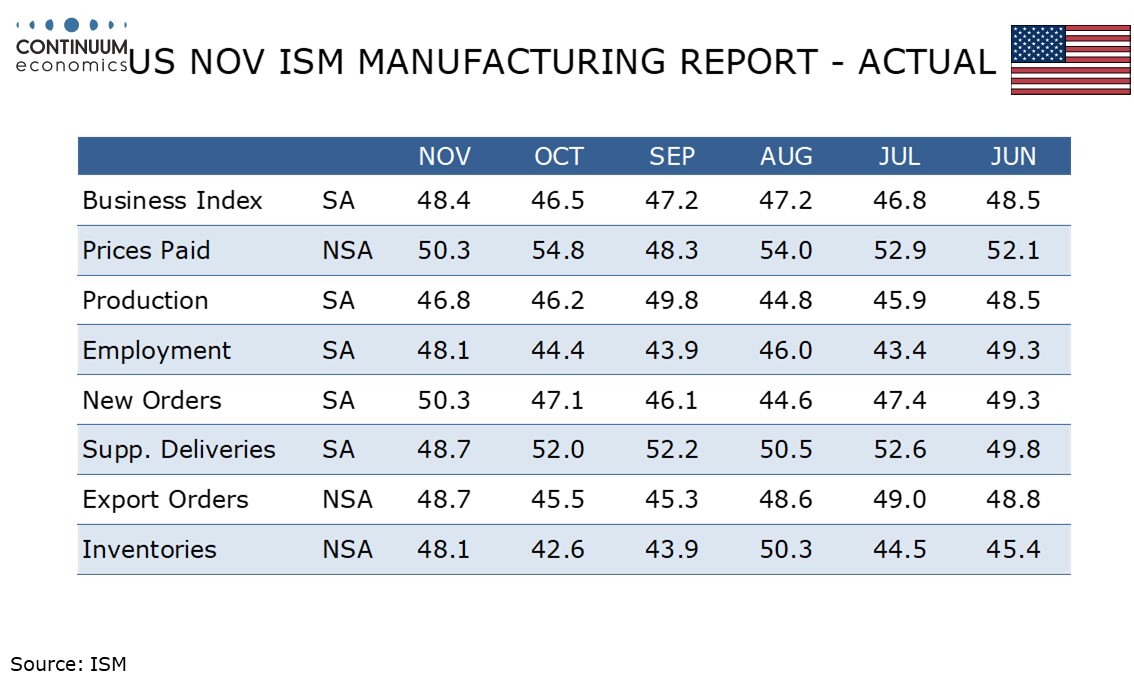

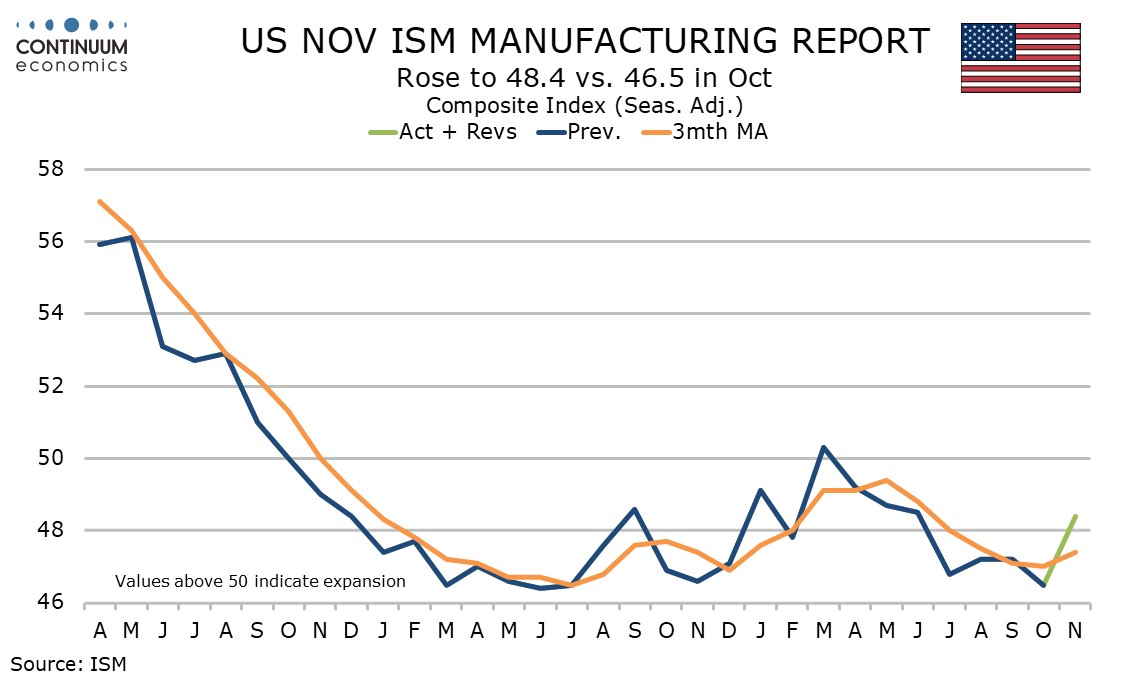

November’s ISM manufacturing index at 48.4 from 46.5 is the highest since June and follows an upgraded final S and P manufacturing index of 49.7, also the highest since June, from a preliminary 48.8 and 48.5 in October.

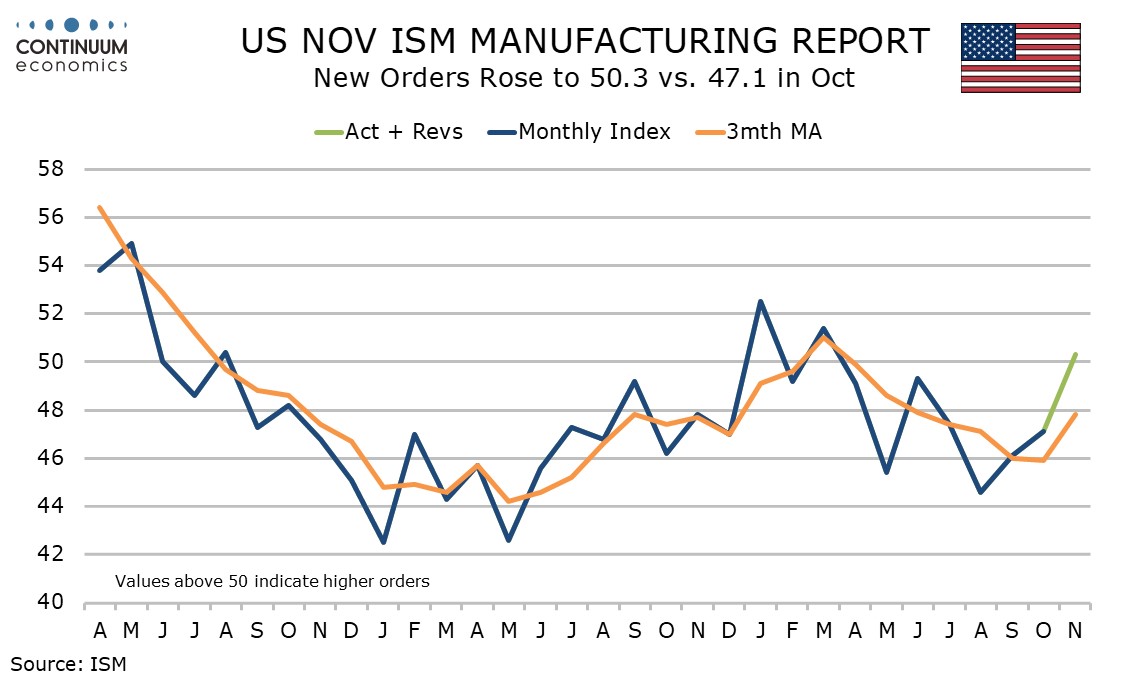

The details of the ISM manufacturing report are mostly constructive, the rise led by new orders which at 50.3 from 47.1 saw is first positive reading since April. Employment also saw a significant bounce, to 48.1 from 44.4, as did inventories, to 48.1 from 42.6.

Production was less impressive, up only marginally to a still weak 46.8 from 46.2, while deliveries corrected lower to 48.7 after four straight positive readings.

Slower delivery times suggests easing inflationary pressures, as does a prices paid index of 50.3, down from 54.8 in October. Prices paid, unlike the other five components outlined above, do not contribute to the composite.