GBP flows: GBP slips back after Pill comments

GBP moves lower as BoE chief economist Pill indicates possibility of a summer rate cut

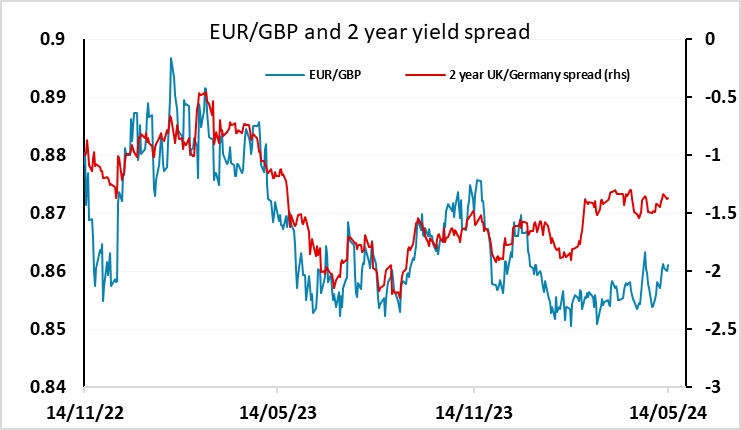

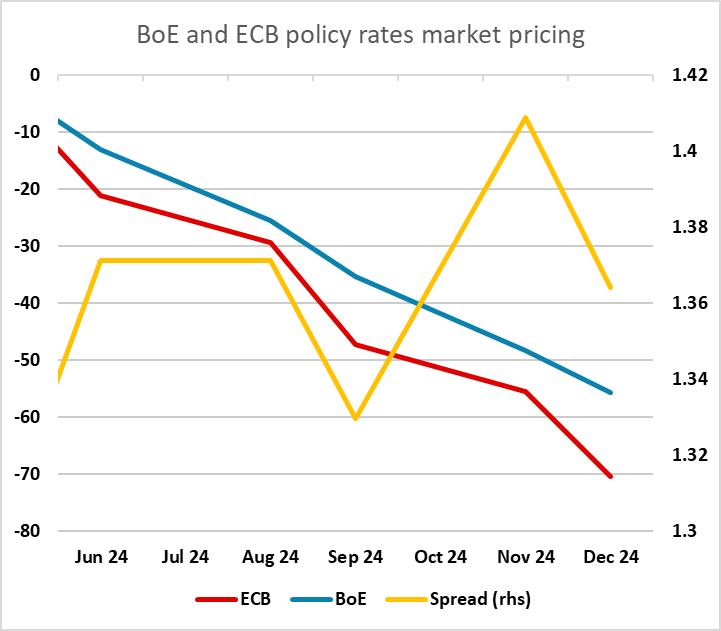

Despite the stronger than expected UK earnings data, GBP has fallen back after comments from BoE chief economist Pill who said it’s “not unreasonable to consider rate cuts over summer”. Although he also noted that the labour market remains tight, he said that the BoE can cut interest rates while maintaining a restrictive policy stance. EUR/GBP has more than reversed the modest losses seen after the labour market data and has moved back above 0.86. The market’s view on the June meeting has edged slightly more dovish, with a rate cut now seen as a slightly better than 50-50 chance from slightly favouring no change, but the move has been small. But a cut is now fully priced for August. We would still tend to expect the MPC to wait until August given today’s stronger than expected average earnings data, but the CPI data next week could change that if weak.