Published: 2025-05-09T15:47:27.000Z

Preview: Due May 22 - U.S. April Existing Home Sales - Pending home sales suggest a rise

4

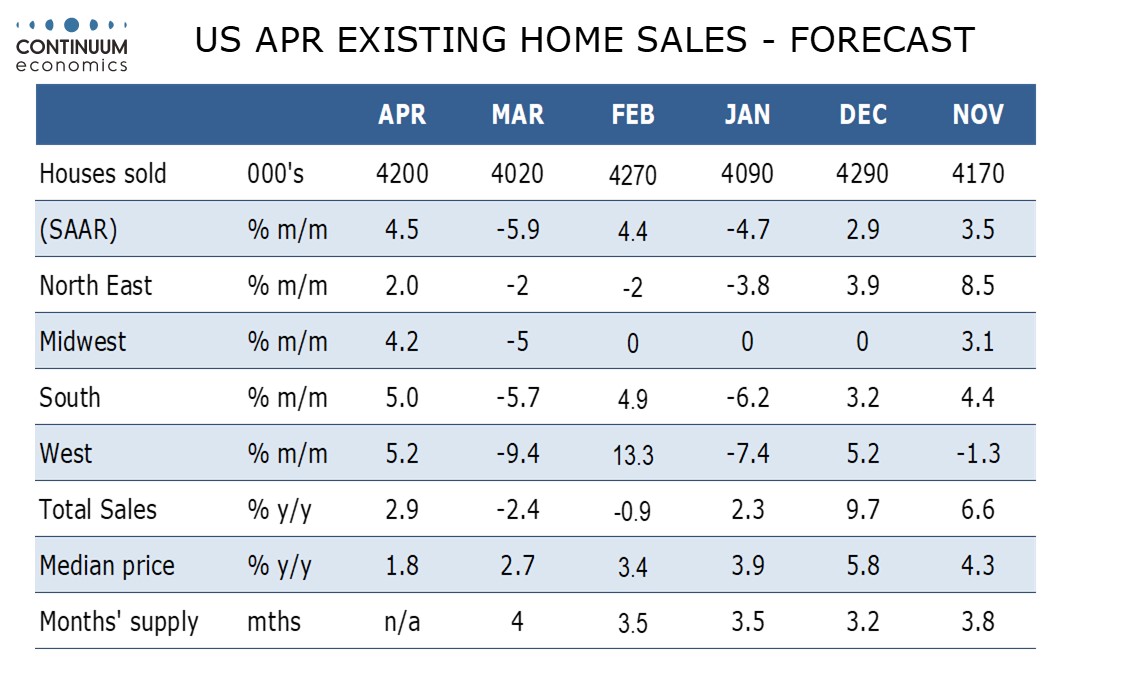

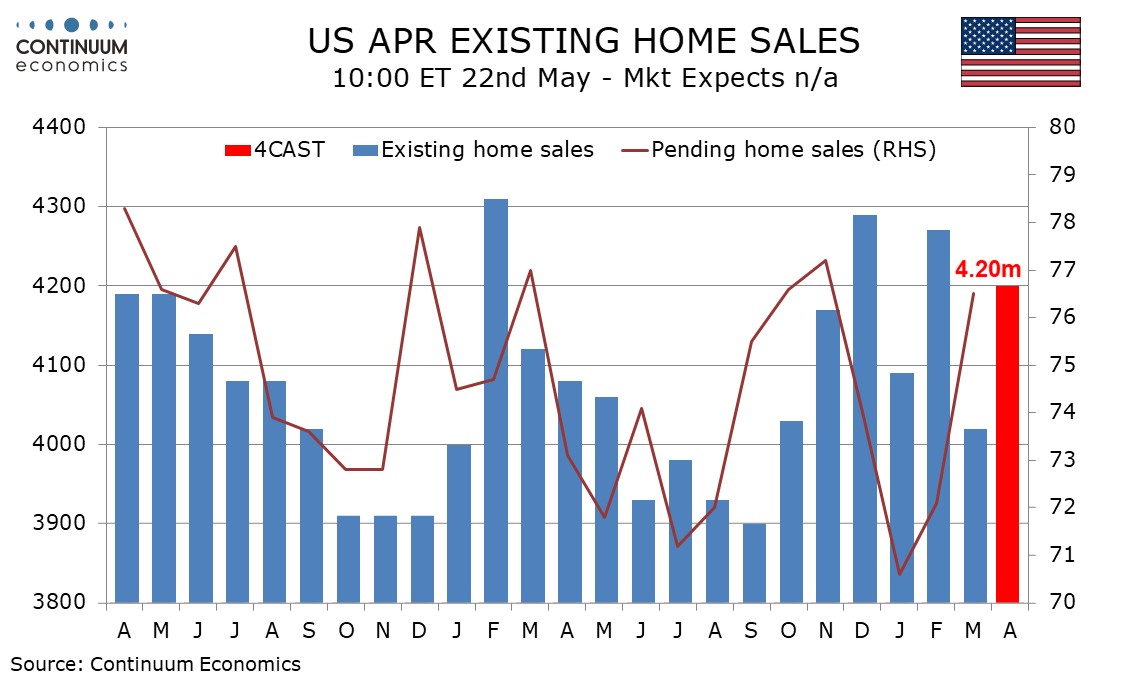

We expect April existing home sales to rise by 4.5% to 4.20m, which would not fully erase a 5.9% decline seen in March. Sales would then be up 2.9% on a yr/yr basis, after two straight negatives.

Pending home sales, designed to predict existing home sales, saw a strong 6.1% increase in March. However we do not see existing home sales quite returning to February’s level with February data having had a recent tendency to come in above trend. Pending home sales are still below November’s level and we expect April existing home sales to underperform December’s 4.29m pace. April data from the MBA and NAHB surveys did show some improvement, but gains were far from impressive.

We expect the median price to see a 2.5% increase on the month, but this would be largely seasonal. We expect yr/yr growth to extend a recent slowing, to 1.8% from 3.7%. This would be the weakest since July 2023.