This week's five highlights

Bank of Canada Eases by 25bps on Improved Inflation Picture

ECB Clearly No Policy Pre-Commitment But Policy Entering New Phase

U.S. May Employment trend may be starting to slow

Previewed by Slower U.S. May ADP Employment

Other U.S. Economic Release

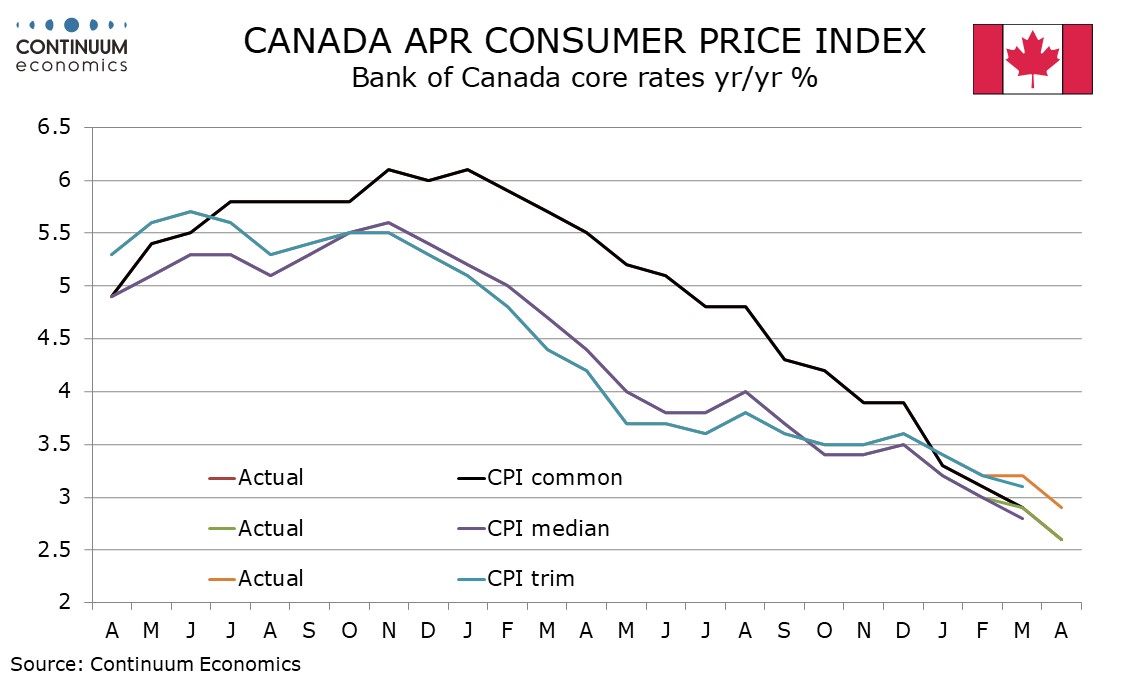

The Bank of Canada delivered a 25bps easing to 4.75% as expected and the tone of the statement and particularly the press conference was somewhat dovish, giving some detail on why it is pleased with progress on inflation. However easing at each of the remaining four meetings this year looks unlikely. We continue to expect 25bps moves in September, October and December, after a pause in July. In his opening statement to the press conference Governor Tiff Macklem outlined first the declines in headline CPI (to 2.7% in April from 3.4% in December) and the core measures (to around 2.75% from around 3.5%). Less obviously he stated three month rates had fallen below 2% from about 3.5% in December and the proportion of components increasing above 3% is close to the historical average. However, the statement noted that shelter inflation remains high and that risks to the inflation outlook remain.

Macklem stated that if inflation continues to ease and confidence that it is headed to the 2% target continues to increase it is reasonable to expect further cuts in rates. However he warned that lowering rates too quickly could jeopardize the progress made. The BoC will be aware of the recent history in the US, where two straight target-consistent quarters from core PCE prices were followed by disappointment in early 2024. That 3-month Canadian core measures have fallen below 2% on an annualized basis could be similarly overstating how much progress has been made. Macklem said rate decisions would be taken meeting by meeting and the pace of rate cuts was likely to be gradual. Macklem expects further progress on inflation to be uneven and if so the path of easing is unlikely to be smooth. Which of the future meetings will see easings and which will see pauses is likely to be dependent on incoming data and forecasts for individual meetings should be treated cautiously. There are two more CPI releases (for May and June) due before the July 24 meeting and if both are subdued we could see a further easing, but disappointment on one of the releases could bring a pause, and that is our current leaning. Only one further CPI (for July) is due before the September 4 meeting, so if July sees an ease we would expect September to see a pause, though if July sees a pause easing would likely to resume in September, provided the majority of the inflation releases were moving in the right direction. We expect that by Q4, progress on inflation will be sufficiently clear to allow easing in both October and December.

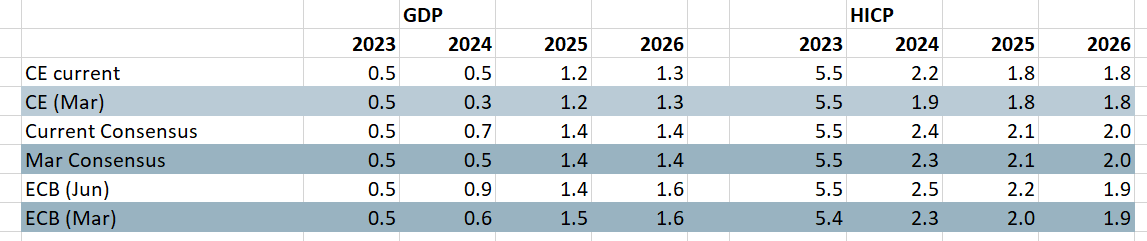

Figure: Little Change in the Real Economy Outlook?

As has been the case with many recent ECB verdicts, markets are keener to hear what is being said by the Council rather than what has been done. In regard to the latter, and given the almost unanimous hints from Council members, all policy rates were cut by the expected 25 bp, with the key deposit rate falling from at an unprecedented 4.0% for the first reduction since 2019. But markets were more focused on hints on the speed and timing of further moves. Given splits within the ECB Council, it was no surprise that no formal guidance was forthcoming, save to underline that policy will be data dependent and clearly not pre-committing to a particular rate path not least alongside upgraded forecasts for this year and next and to ‘keep policy rates sufficiently restrictive for as long as necessary’. But those updated and possibly optimistic (GDP) forecasts (Figure) do corroborate market thinking of rates falling well below 3%, even given the slightly later, but still clear, undershoot of the inflation target being flagged. ECB Lagarde also appeared to back ECB Lane’s clearer guidance in a speech earlier this week. We still see two more 25 bp moves this year and even the anticipated four further cuts in 2025 will hardly take policy out of a restrictive stance.

Repeating the theme offered at its last meeting in April, the ECB Council made it clear that, after what have been nine months since the last hikes, it is now appropriate to ‘moderate’ the current level of monetary policy restriction. Admittedly, while this view was unanimous save for one, others on the Council may have had reservations, but not steadfast enough to scupper market expectations that had been fed a clear message from the ECB itself.

Even so, there is probably still a view that policy has been hiked relatively aggressively in both speed and extent in what Lagarde referred as the first policy phase. This is something we have underlined by suggesting that recent monetary tightening (which also encompasses unconventional moves) has not only been extensive, but possibly excessive. Supporting this notion is a chart offered in a recent presentation by Chief Economist Lane which shows not only the unprecedented speed of recent (conventional) hikes but the even-more unprecedented repercussions in terms of credit growth weakness

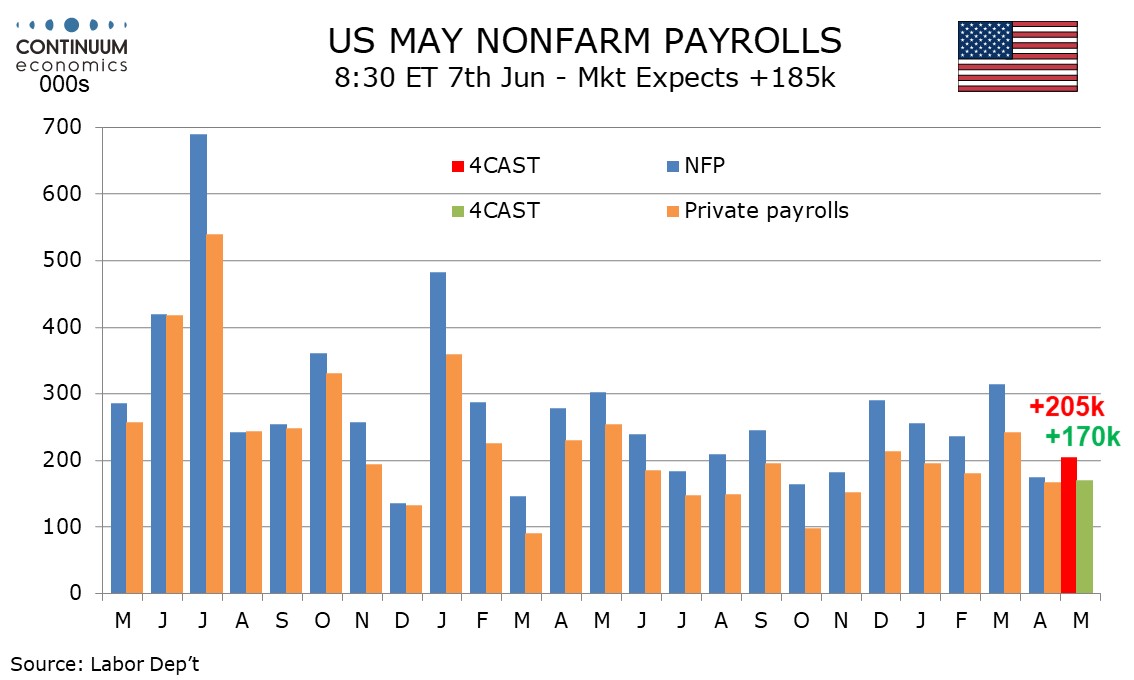

We expect a 205k increase in May’s non-farm payroll, a little stronger than April’s below trend 175k but closer to that than March’s above trend 315k. We expect average hourly earnings with a 0.3% increase to also be a little stronger than in April, when a below trend 0.2% increase was seen, but we expect unemployment to be unchanged at 3.9%, sustaining an increase from March’s 3.8%. We believe the economy is losing momentum and seasonal adjustments are negative in May, compensating for improving weather, though cooler than usual weather in early May this year may prevent some of the usual seasonal hirings taking place. This argues for a below trend payroll, though most evidence, including initial claims, suggests any easing of the labor market is likely to be modest.

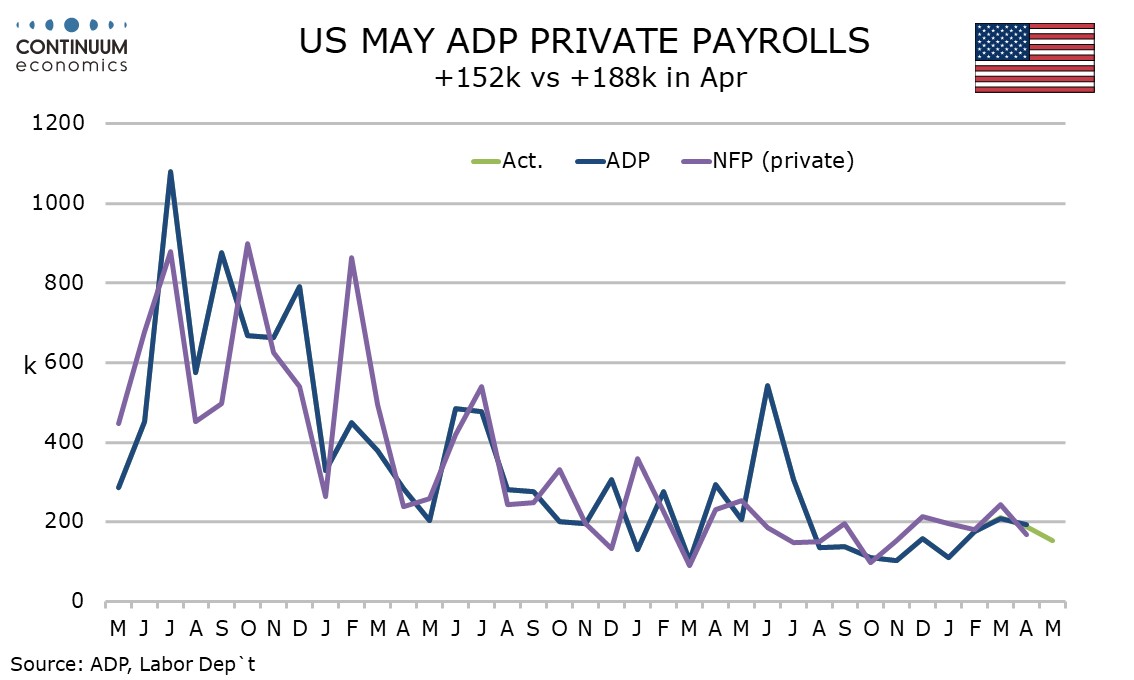

ADP’s April estimate for private sector employment growth of 152k is on the low side of expectations and if matched by private sector non-farm payrolls would be consistent with a loss of labor market momentum. However, the data is in line with the ADP trend. ADP data in April with a rise of 188k (revised only marginally from 192k) outperformed a below trend 167k rise in private sector non-farm payrolls, breaking a recent tendency for ADP data to underperform non-farm payrolls. We expect ADP to underperform in May, with our private sector payroll forecast being 170k, with overall payrolls at 205k. These would be slightly firmer than seen in April payroll data but still consistent with trend starting to lose momentum.

Most recent months have shown leisure and hospitality as the strongest sector in the ADP breakdown, but in May the sector rose by only 12k, with trade transport and utilities leading with 55k, with education and health at 55k (below where that sector has been trending in payroll data) and construction at 32k. Manufacturing was weak with a 20k decline. Wage data showed a 5.0% rise for job stayers for a third straight month but for job changers the data slowed for a second straight month to 7.8%. This is consistent with a moderate slowing in the labor market which is what we also expect payroll data to imply.

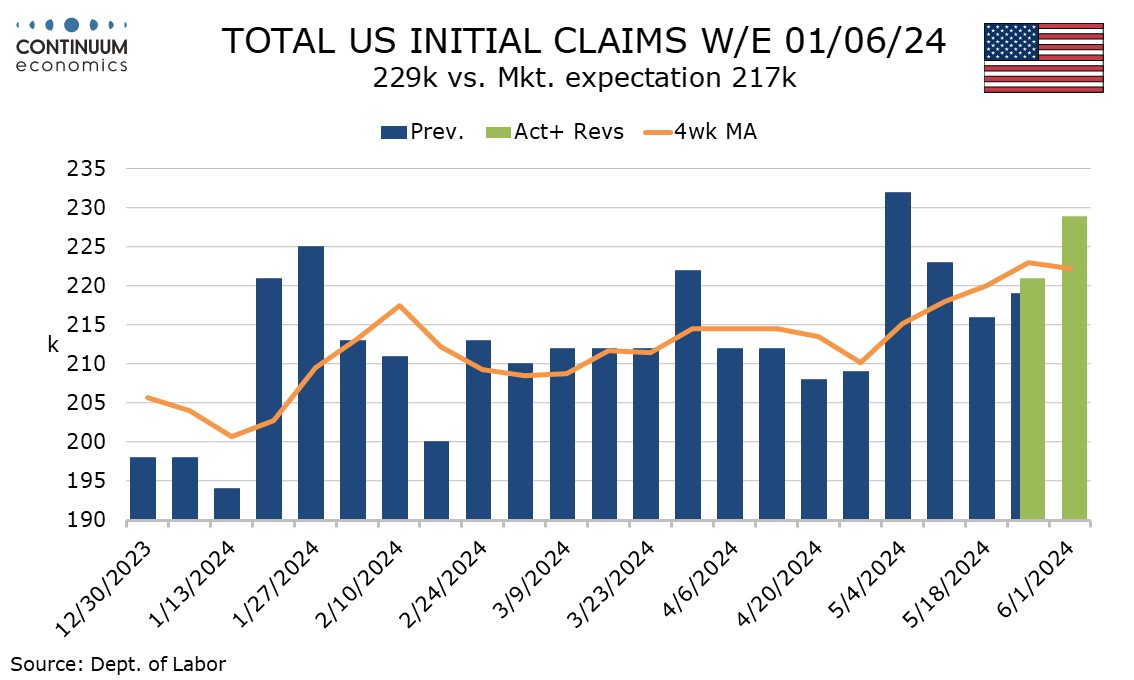

Initial claims are a little higher at 229k in the week to June 1 (two weeks after May’s payroll was surveyed) hinting at some labor market slowing. A downward revision to Q1 unit labor costs to 4.0% from 4.7% was unexpected while April’s trade deficit of $74.6bn from $68.6bn deteriorated a little less than expected. While the initial claims rise is moderate and fully explained by seasonal adjustments trend does appear to be moving higher, though the 4-week average of 222.25k is slightly down from 230k in the preceding week, which was the highest since the highest September 2023.

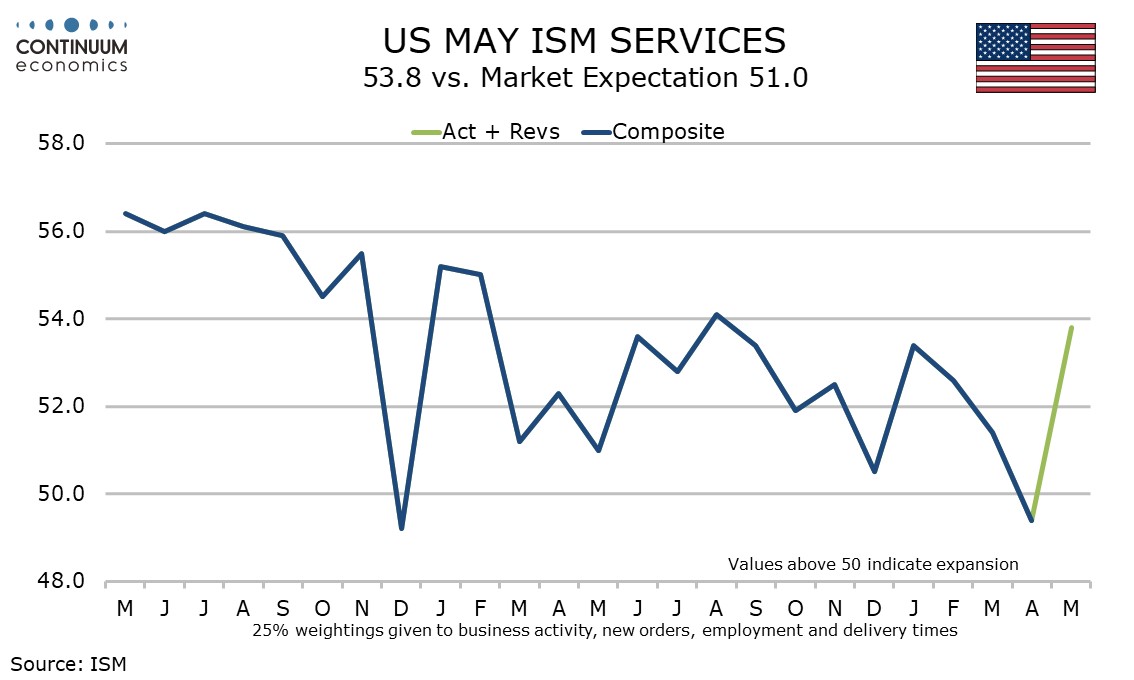

Like May’s S and P services index (unrevised at 54.8), May’s ISM services index has also exceeded expectations, rising to 53.8, its highest since August 2023, from a weak 49.4 in April. Probably not too much should be made of an above trend number in May or the below trend number in April. April’s outcome as the weakest since December 2022. The biggest contrast was business activity, weak in April at 50.9 but strong in May at 61.2.