EUR, JPY flows: EUR upside limited by weak EUR data

French GDP rises, but only due to inventory build-up. EUR/USD upside limited by weak Eurozone growth prospects

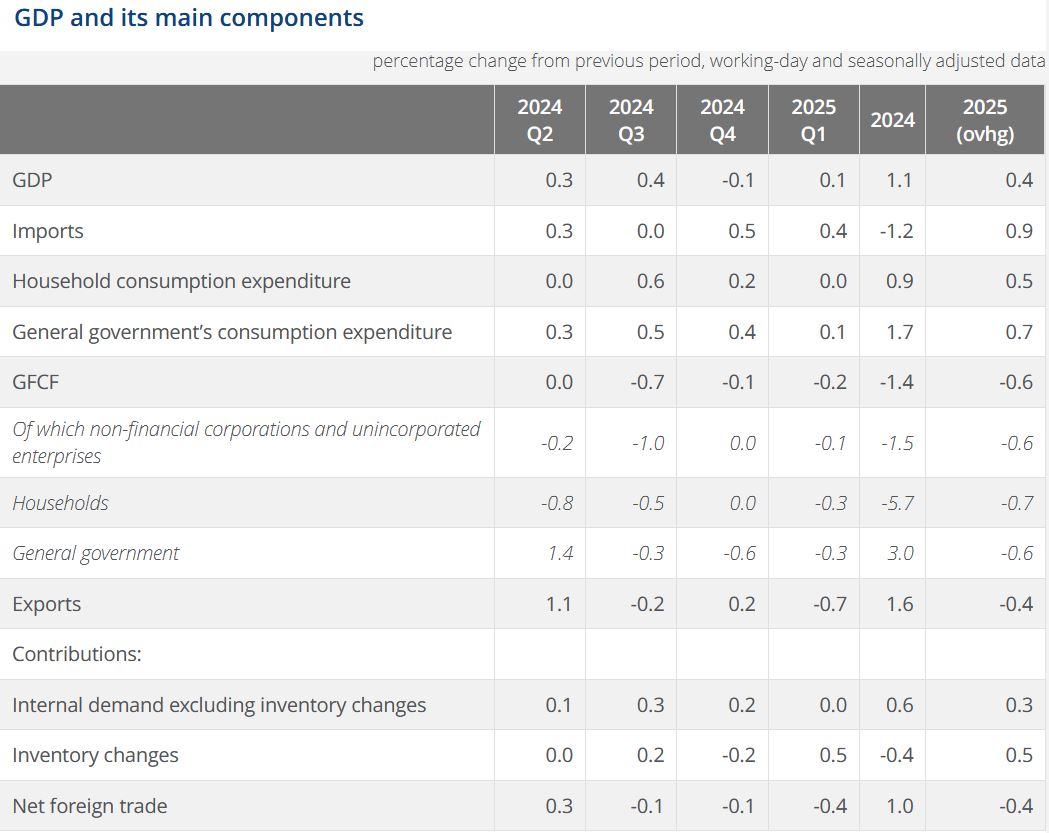

French Q1 GDP rose 0.1% q/q, in line with consensus, but the breakdown was weak, with consumption flat, investment negative, and net trade subtracting from GDP. Only a rise in inventories and government spending contributed positively to GDP. The French household consumption of goods data for March was also weak, with a 1% m/m drop and a 0.6% q/q decline. So there’s nothing very encouraging in these numbers for the French economy going forward, and EUR/USD has slipped a little lower after the data.

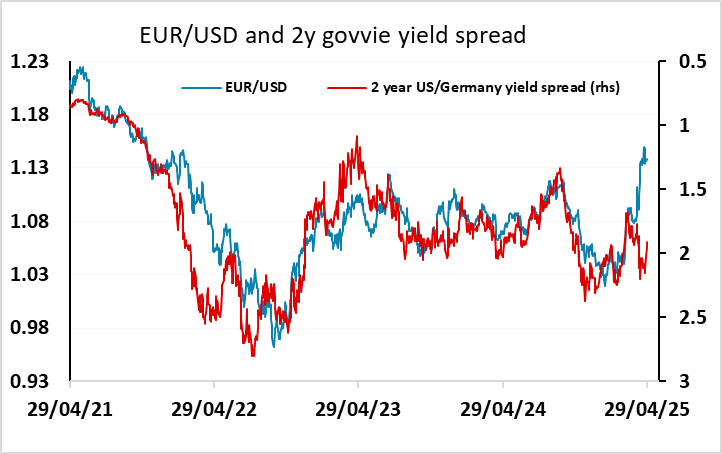

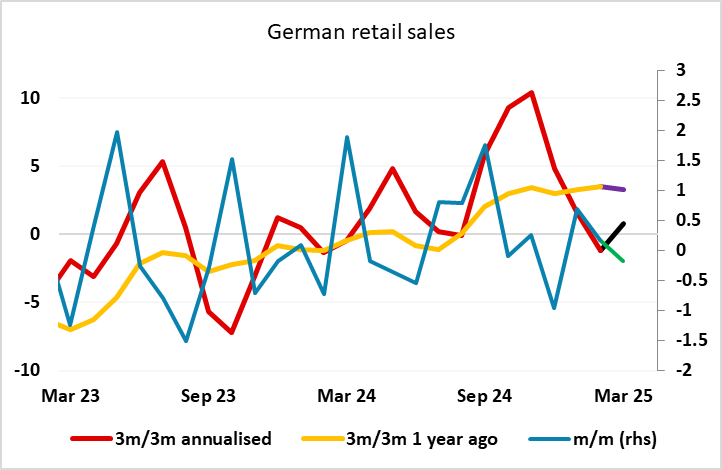

The German retail sales data also released this morning is slightly less weak, but the 0.2% decline in March indicates a very flat trend. The market expectation of a 0.2% rise in Eurozone Q1 GDP is based more on Spain’s 0.6% rise than any strength in France and Germany, but it’s hard to take a particularly optimistic view of Eurozone growth with these numbers. So while the EUR is the USD’s antipole, and has benefited from the market falling out of love with the USD in recent weeks, the money that has moved into the EUR may head for sunnier climes in the coming weeks, suggesting short term limited upside in EUR/USD. We continue to prefer the JPY, due to its low valuation and its tendency to benefit from risk aversion.