USD, CAD, JPY flows: Trump comments push CAD down, JPY up

Late comments from Trump that 25% tariffs on Canada and Mexico would be implemented as scheduled on Tuesday sent USD/CAD, which had earlier seen a brief move below 1.44, well above 1.45 overnight, and USD/JPY plunged to a low of 149.10.

Late comments from Trump that 25% tariffs on Canada and Mexico would be implemented as scheduled on Tuesday sent USD/CAD, which had earlier seen a brief move below 1.44, well above 1.45 overnight. This also sent equities, already hit by the ISM data, sharply lower, and USD/JPY plunged to a low of 149.10.

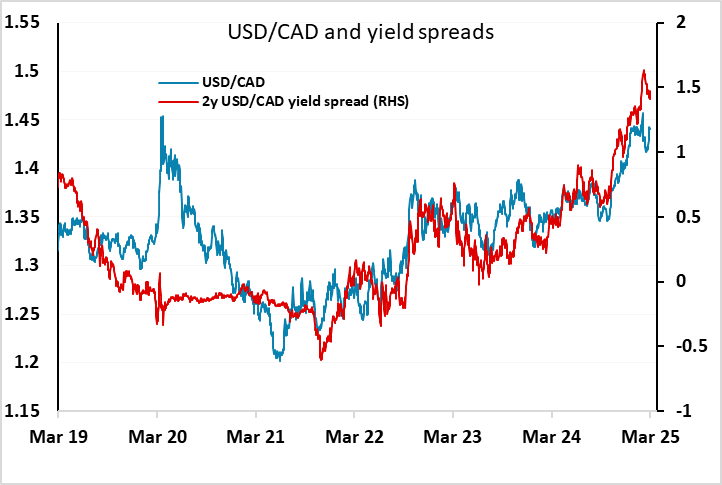

The tariff announcements will be the main focus today, and after Trump’s comments anything other than the 25% would be a surprise. However, the market is still not fully pricing in the likely consequences of such a move, suggesting there is still an expectation that the tariffs are not put in place for long. If a 25% tariff on Canada was expected to persist, the CAD would surely be significantly weaker, as at this stage USD/CAD is still below the level suggested by current yield spreads. With the BoC indicating that a 25% tariff would lead to a 2% decline in Canadian GDP, spreads would likely widen further if this tariff is imposed, even if Canada retaliates. A retaliation would push up Canadian prices and limit the BoC’s room to respond, but any retaliation is likely to be quite targeted and we would expect the growth effect on policy to dominate.

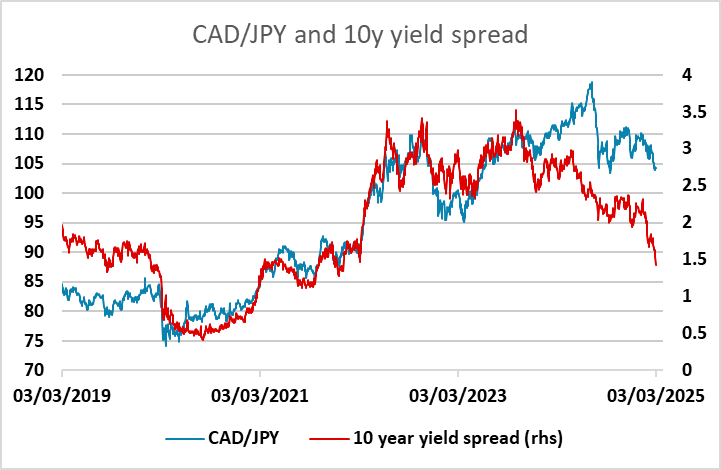

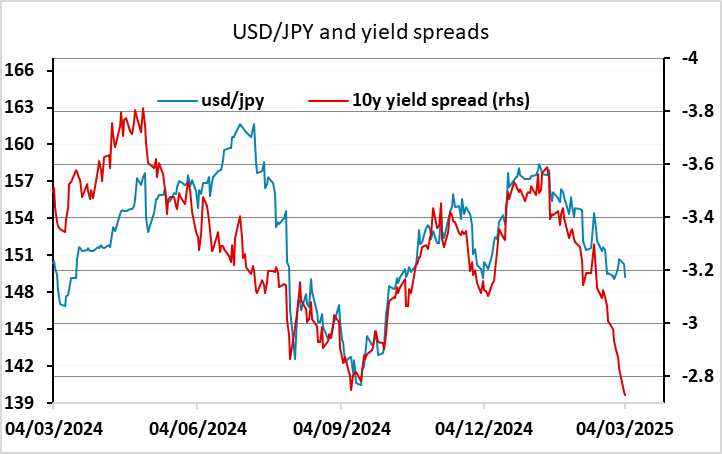

Trump’s comments also hit equities and led to lower US yields and a higher JPY. The US/Japan yield spread is now suggesting scope for a very large USD/JPY decline, and we could see a clear break below the 148.55/65 support area if the equity market falls back further today on the tariff announcement. CAD/JPY is perhaps the most vulnerable here, with the 10 year Canada/Japan yield spread the lowest for 3 years and CAD/JPY still above last year’s August low.