This week's five highlights

Chinese Military Drills Should Not Increase Taiwan Risk

U.S. Q1 GDP revised lower

U.S. May Consumer Confidence Rebound

USD/JPY Restrained by Intervention Concern

Tokyo CPI Foreshadow Rebound of Inflation to 2%

The Taiwan overall country risk score of medium-low reflects economic strength and only moderate and intermittent tensions with China over reunification. China gray warfare has continued in 2024 with military aircraft intermittently flying close to Taiwan and China naval exercises in May. However, the gray warfare has not escalated compared to recent years, nor has it been as intense. China will likely be pleased that a pro-China politician from Kuomintang, Han Kuo Yu, has been elected speaker of the Taiwan parliament. Additionally, parliament has passed a bill that requires the president to make regular reports to parliament, which is seen to a China friendly policy. This could be a route to a more China friendly view in some sections of Taiwanese society, which China would want to play out in the coming years and avoid the alternative very high risk option of invasion.

The current parliamentary domestic focus is also on KMT proposed infrastructure projects for eastern Taiwan, rather than China. Thus China will likely to continue to pressure Taiwan but stop short of major escalation. Elsewhere, structural economic indicators remain strong helped by a well-balanced economy/controlled inflation and a huge current account surplus. This leaves exchange transfer at a low rating, while the risk of doing business remains at a low rating. Risk of sovereign non-payment is medium-low, which reflects the low government debt/GDP trajectory.

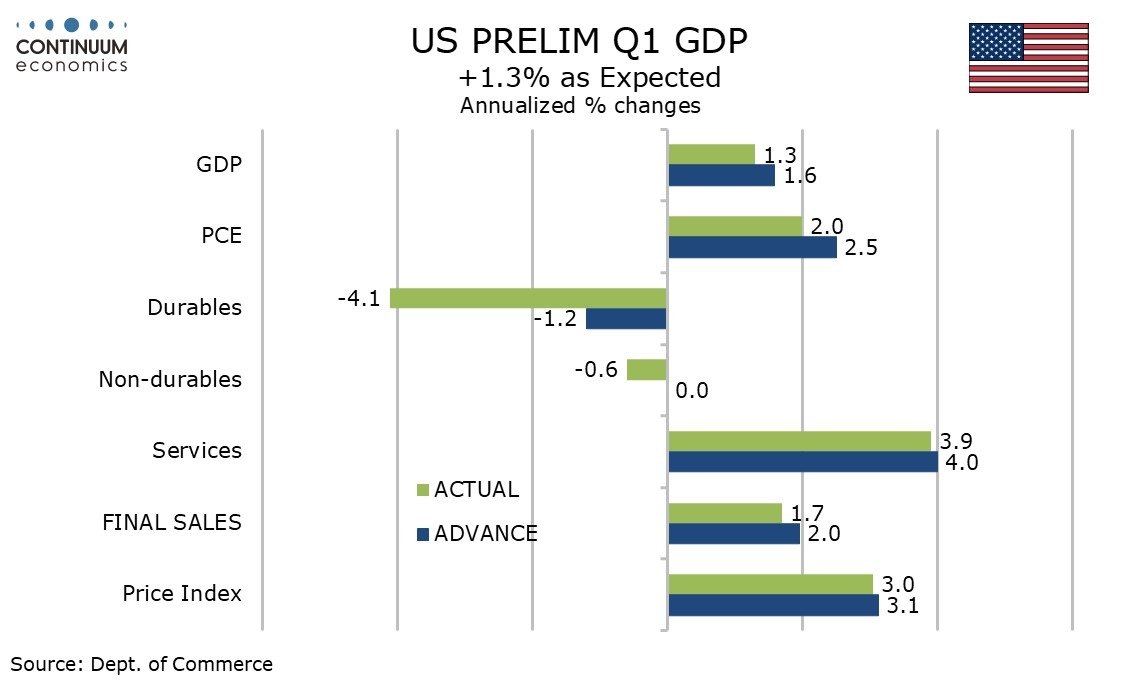

A downward revision to Q1 GDP to 1.3% from 1.6%, led by consumer spending was as expected, through a marginal downward revision to core PCE prices to 3.6% from 3.7% was not. Initial claims at 219k from 216k are only marginally higher and still imply a strong labor market. However a sharp rise in April’s advance goods trade deficit to $99.4bn from $92.3bn is a surprise and will degrade Q2 GDP forecasts with an outcome similar to Q1’s looking plausible.

The GDP detail saw consumer spending revised down to 2.0% from 2.5%, mostly on retail revisions which had been flagged by downward revisions to February and March retail sales with the April release. Services however saw a marginal downward revision to 3.9% from 4.0%. Real disposable income was however revised up to 1.9% from 1.1%, making income look consistent with spending rather than continuing to underperform. Gross domestic income, this the first estimate for Q1, rose by 1.5%, close to consistency with GDP. Inventories were also revised lower as we had expected but the revisionsto final sales (GDP less inventories) to 1.7% from 2.0% was similar to that seen for GDP. Elsewhere revisions were modest. Business investment was revised up to 3.3% from 2.9% led by intellectual property with equipment revised down. Housing was revised even higher to 15.4% from 13.9% and government up marginally to 1.3% from 1.2%. Net exports were revised slightly lower with an upward revision to imports exceeding that seen for exports.

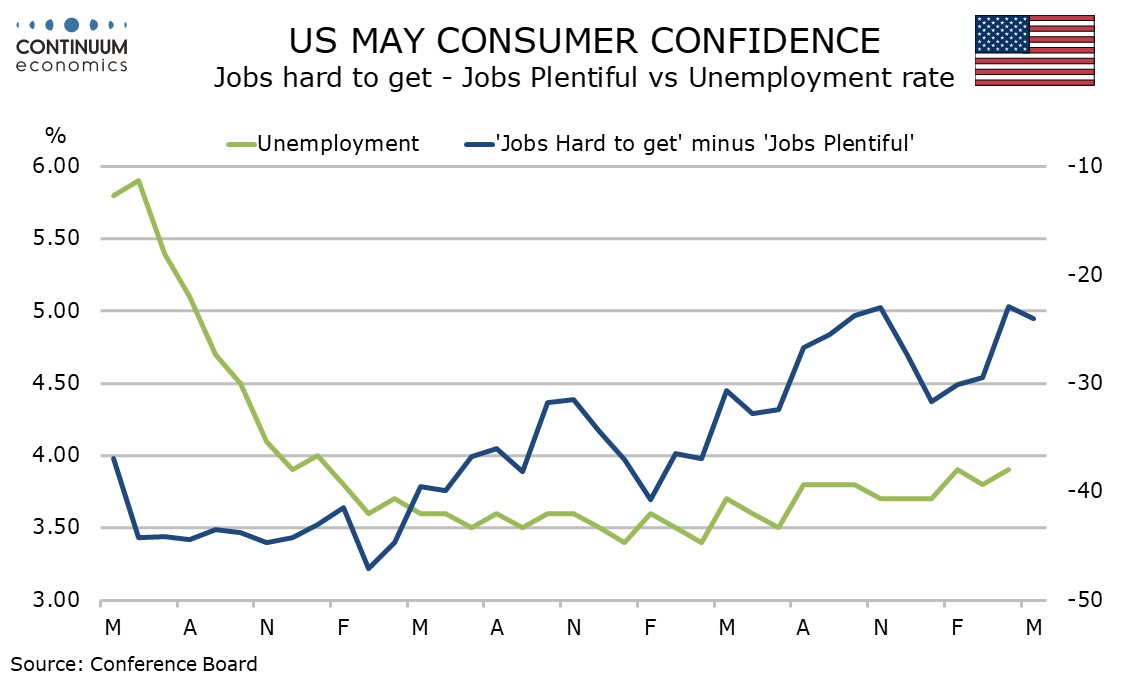

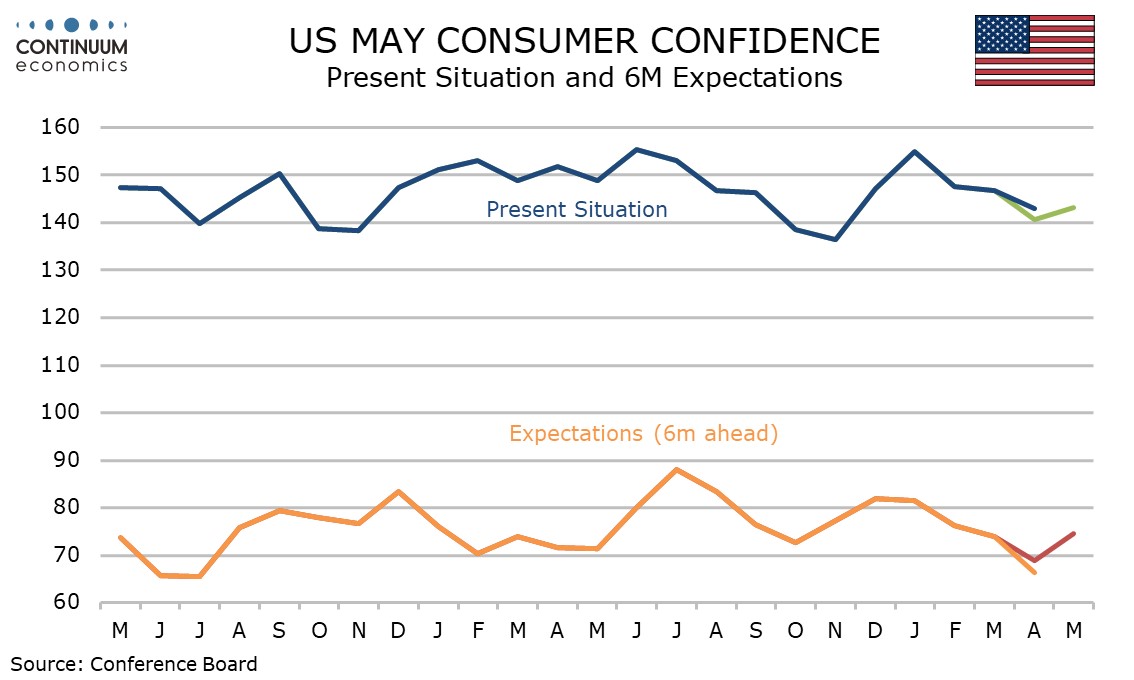

May consumer confidence has shown an unexpected rebound to 102.0 from April’s weaker 97.7, and is now only marginally below March’s reading of 103.1. Details however show only a modest improvement in labor market perceptions and an increase in inflation expectations. The jobs differential showed an excess of 24.0% in these seeing jobs as plentiful less those seeing them as hard to get, which is up from 22.9% in April but well below 29.5% in March and even further below the differentials seen in January and February, so the labor market signal is not a strong one. The increase was stronger for future expectations, to 74.6 from 68.8, than it was for the present situation, to 143.1 from 140.6. Expectations moved above their March level.

The detail for future expectations on income, employment and business conditions all show the improvement led by fewer pessimists rather than an increase in the number of optimists. The number expecting things to stay as they are increased.

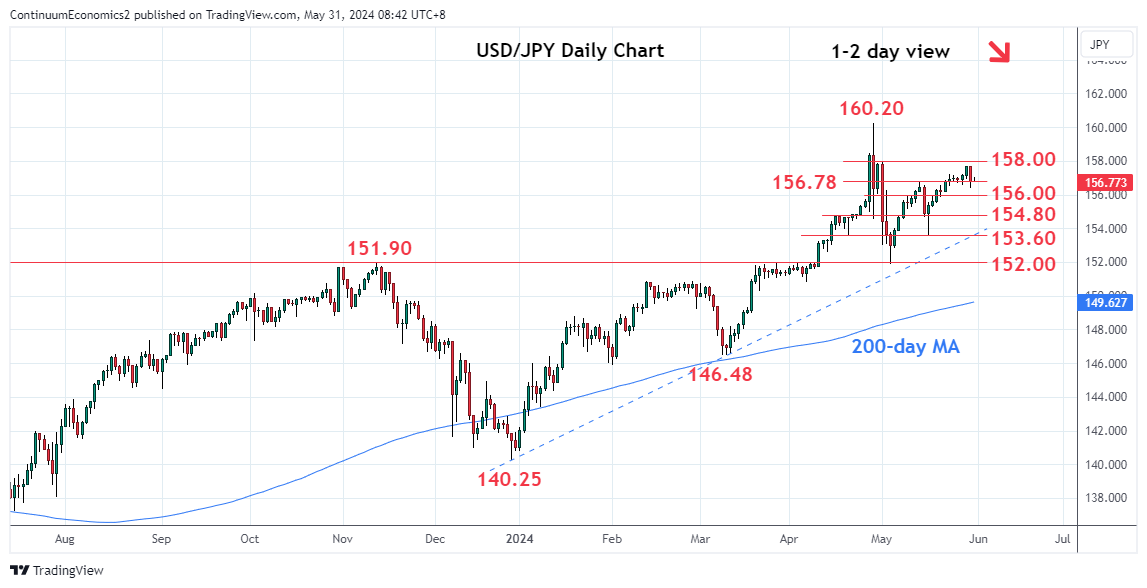

As USD/JPY rally towards the top side of 157 figure, which was where the BoJ did the second round of intervention in late April, tension begins to build with longs begin to take profit of the table. The move was exacerbated by narrowing yield differential for 10yr JGB yields are steady above 1%. The softer risk sentiment attracted a few bids for the JPY but we are not seeing waves of haven seeking action just yet. While in a medium run we should see much strength in the JPY, I am afraid we will not see a major turn until more tightening in June or a major correction in the equity space.

On the chart, USD/JPY is consolidating at the 156.78 support following pullback from the 157.71 high. Clear break here will open up deeper pullback to the 156.00 congestion. Daily studies are unwinding overbought readings and suggest scope for break here to open up deeper pullback to the 154.80 support then the 154.00/153.60 congestion and 16 May low. Meanwhile, resistance at the 157.20 and 157.71 highs now expected to cap. Would take break here to see room for extension to resistance at the 158.00 level and 158.44, 26 April high

The May Japan Tokyo headline y/y CPI has rebounded above 2% to 2.2% from 1.8%, so as ex-fresh food and energy. Ex fresh food y/y CPI stays below 2% at 1.9% but also rebounded from 1.6% in April. While Tokyo CPI likely come in National CPI most of the time, we are forecasting National CPi to also rebound to 2% y/y on accelerating wage growth. If such does not materialize, it may affect the BoJ's inflation forecast significantly in the short run and changes major policy forecast.