RBNZ Review: Turning Point?

RBNZ cut its cash rate by 25bp to 3.25% but vote is 5 to 1

The RBNZ cut its cash rate by 25bp to 3.25% in the May meeting, revised OCR forecast to indicate more rate cut in 2025 and keep terminal rate at sub 3% after 2026, along with revision in other economic forecast. However, the vote to a cut is 5 to 1 where market participants take that as a more hawkish signal.

Some key takeaways:

More Cuts to Come: The May OCR forecast see a revision from the February forecast and see one more cut in 2025. While the terminal rate in a two year time frame did not change at sub 3%, the estimate now see the lowest rate in 2025 to be below 3%.

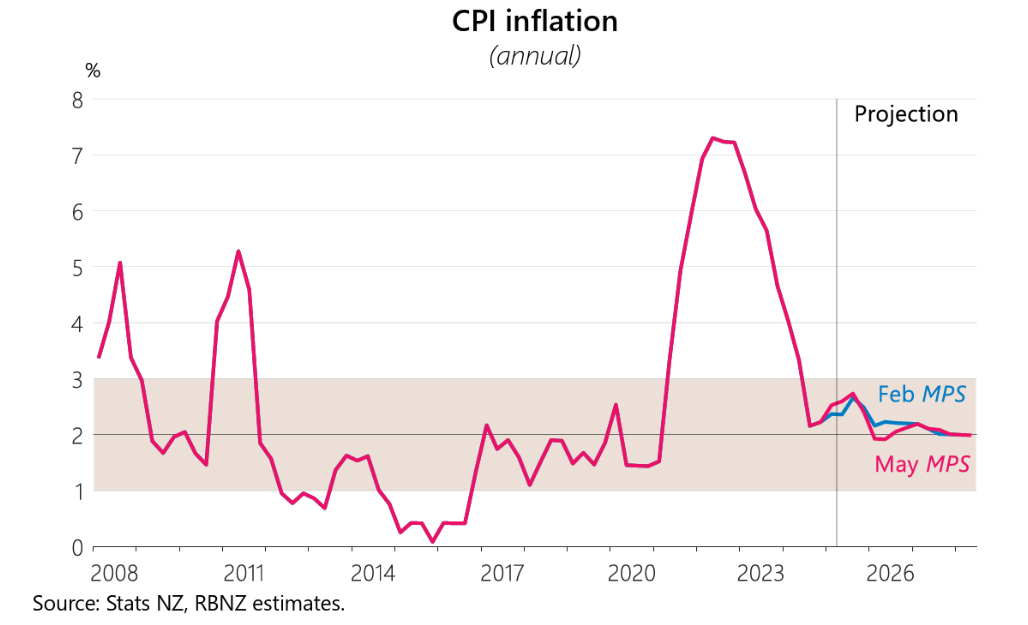

Inflation Expectation: The RBNZ sees headline CPI to be higher in the first half of 2025 and lower in the first half of 2026. They see the latest tariff shock to be balanced from the demand and supply side. Moreover, the core inflation forecast is seen to ease.

Uncertainty in Forward Guidance: The RBNZ committee voted 5 to 1 for the 25bps cut. They have discussed both scenarios of a cut and a hold but is tilted towards more cutting. The forward guidance suggest little commitment for the RBNZ to continue cutting and may remain fluid depending on data. RBNZ Gov. Hawkesby is citing such decision to be a turning point, which further confirms the potential changes to forecast meeting by meeting.