U.S. May PPI - Soft but recent revisions have been large, initial claims picking up

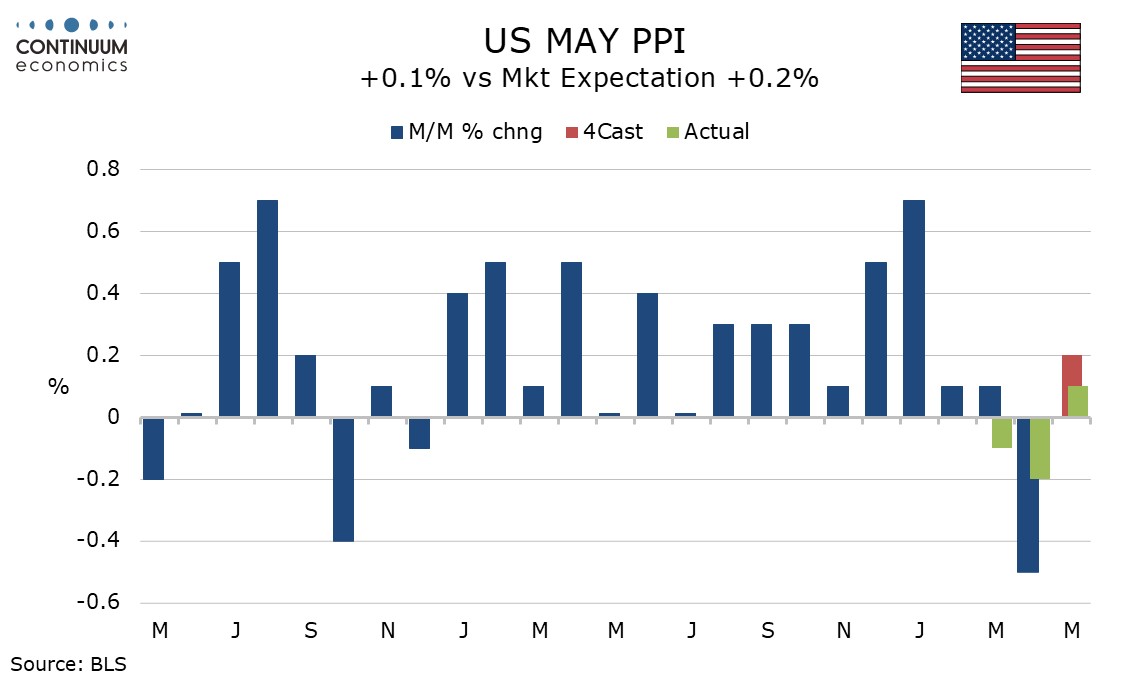

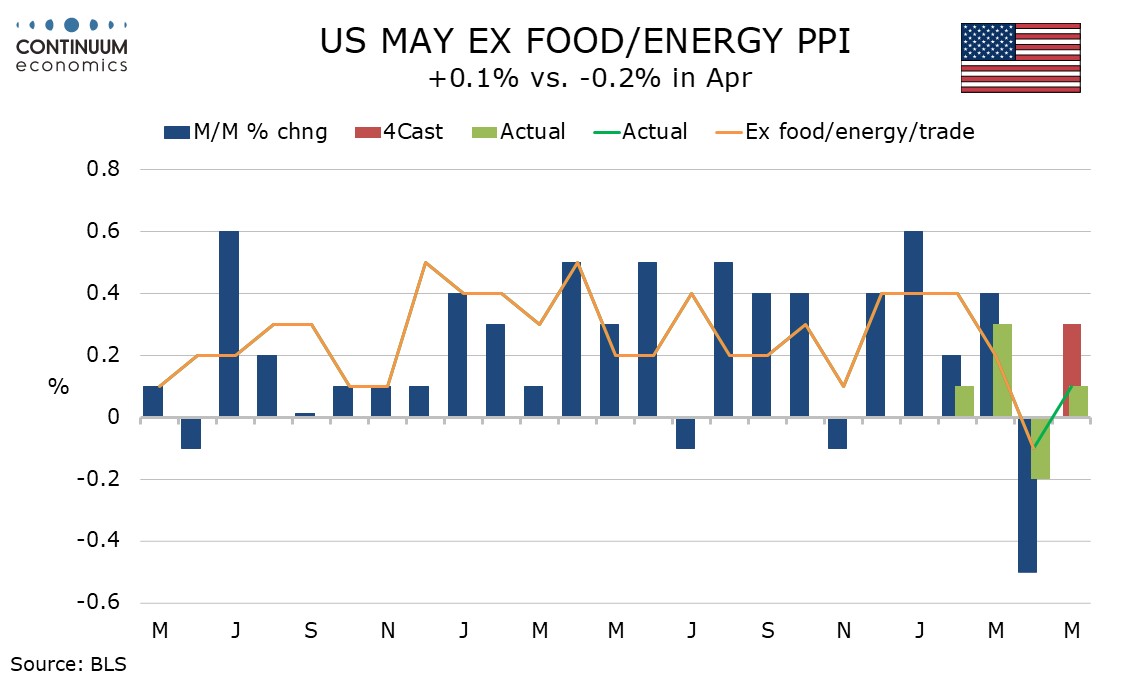

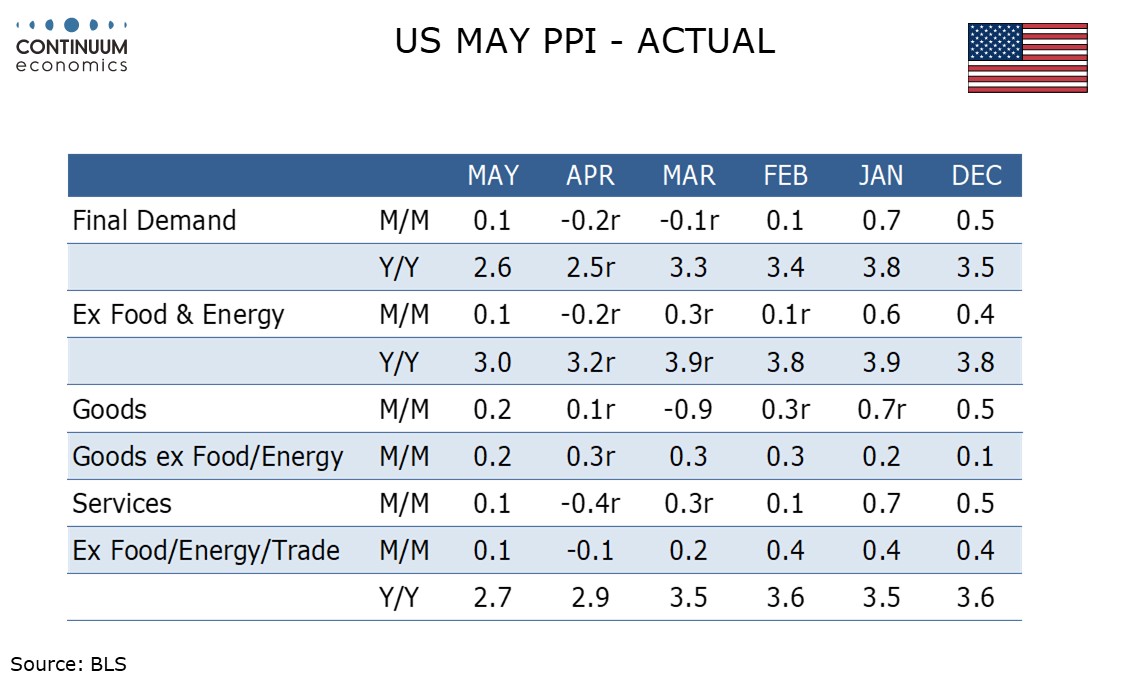

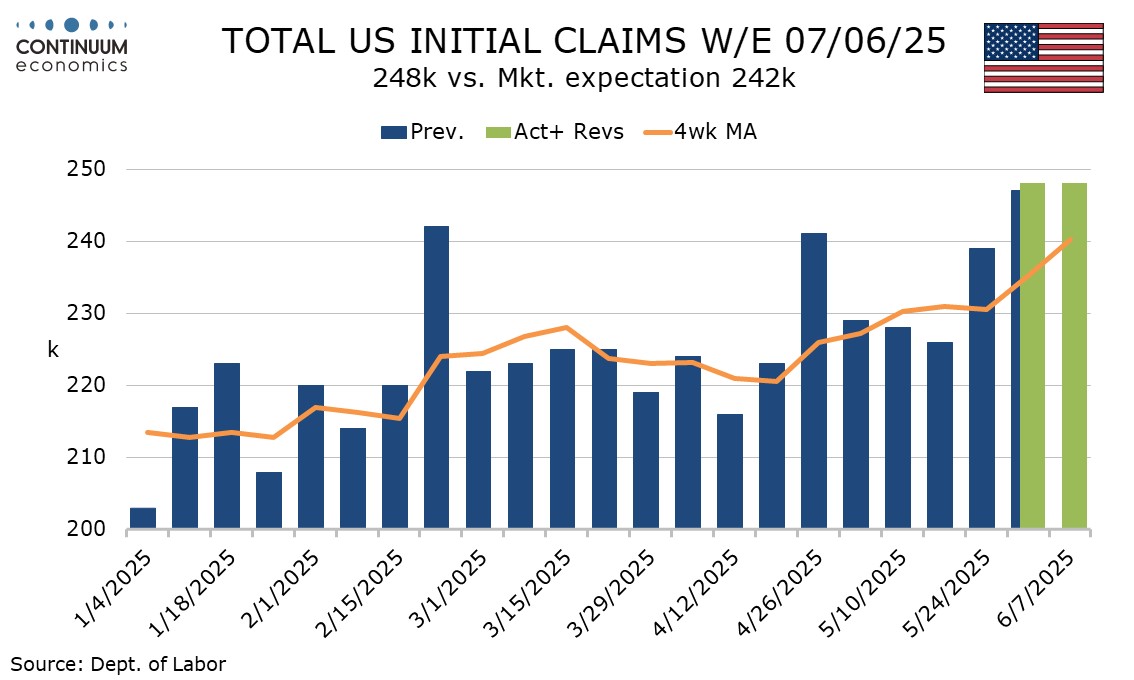

May’s PPI, matching May’s CPI, has come in softer than expected at 0.1% and in both the core rates, ex food and energy and ex food, energy and trade, though the downside surprise is partially offset by upward revisions to April, overall and ex food and energy both to -0.2% from -0.5% and -0.4% respectively, though ex food, energy and trade is unrevised at -0.1%. Initial claims are unchanged at 248k, but trend is showing signs of picking up as we enter June. June’s payroll may be less resilient than May’s.

Recent PPI data has been subject to significant revisions. The upward revision to April’s weakness follows an upward revision to a weak March in April’s report, from -0.4% to a 0.1% increase, though with May’s report March has been revised back down to -0.1%. Concern has been raised over staffing shortages reducing the accuracy of Labor Dep’t measurement, most vocally regarding CPI data, which is not subject to revisions. However large recent revisions to PPI data amplify these concerns.

Recent PPI data has been on the firm side in goods ex food and energy, which rose by 0.2% in May after three straight gains of 0.3%. Services data, after a strong start to Q1, has been very soft in Q2 to date, unchanged in May after a 0.3% fall in April. Food rose by 0.1% and energy was unchanged.

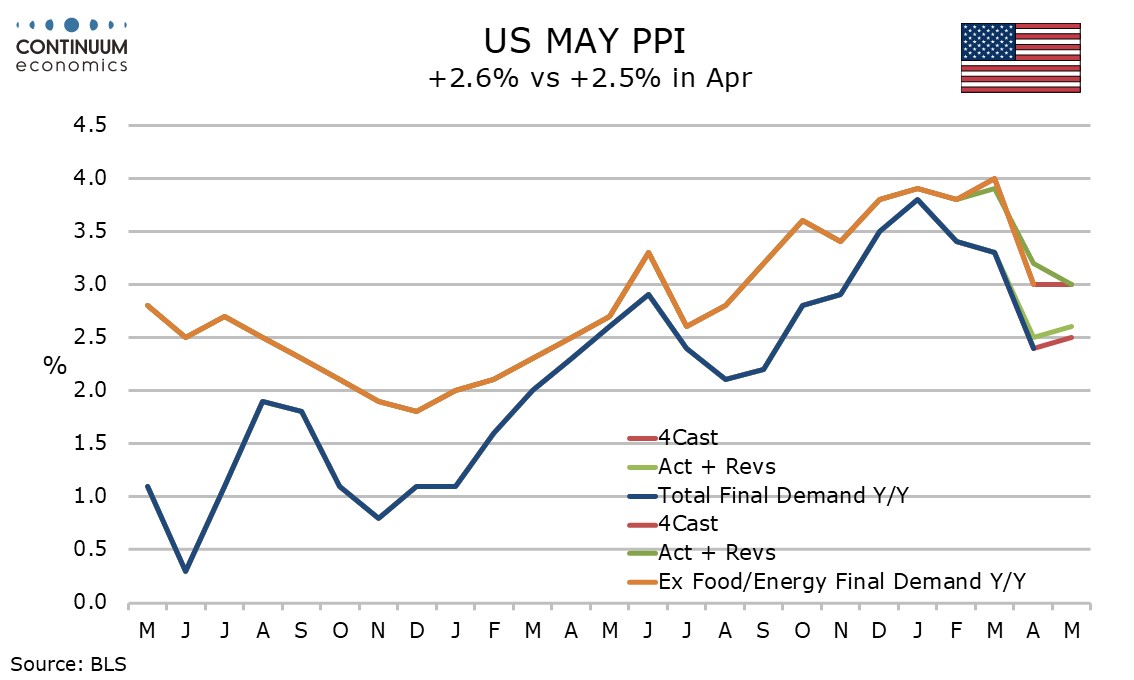

Yr/yr data picked up to 2.6% from 2.5% overall but slowed to 3.0% from 3.2% ex food and energy and to 2.7% from 2.9% ex food, energy and trade. These rates are still higher than the Fed would like but have slowed significantly from the start of the year.

Processed intermediate goods rise by a modest 0.1% overall but a solid 0.4% ex food and energy. Unprocessed goods however fell by 1.6% overall and by 1.4% ex food and energy, while intermediate services rise by only 0.1%. The intermediate picture is consistent with that for finished PPI.

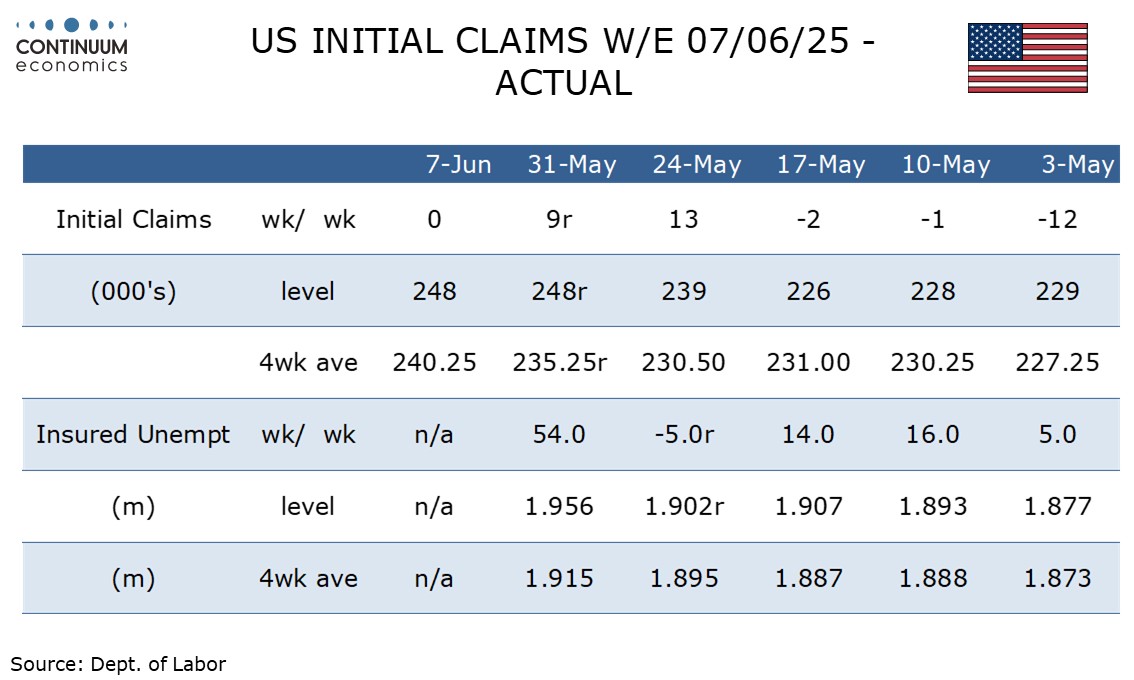

Initial claims at 248k are unchanged on the week but in the week before the survey week for June’s non-farm payroll are well above a 226k outcome three weeks ago when May’s non-farm payroll was surveyed. The 4-week average of 240.25k is the highest since August and has seen a significant recent acceleration.

Some of the recent above consensus initial claims data have come in weeks that saw holidays, and thus seasonal adjustment difficulties. That included last week in which Memorial Day occurred. There are no obvious issues that can explain this week’s continued high level.

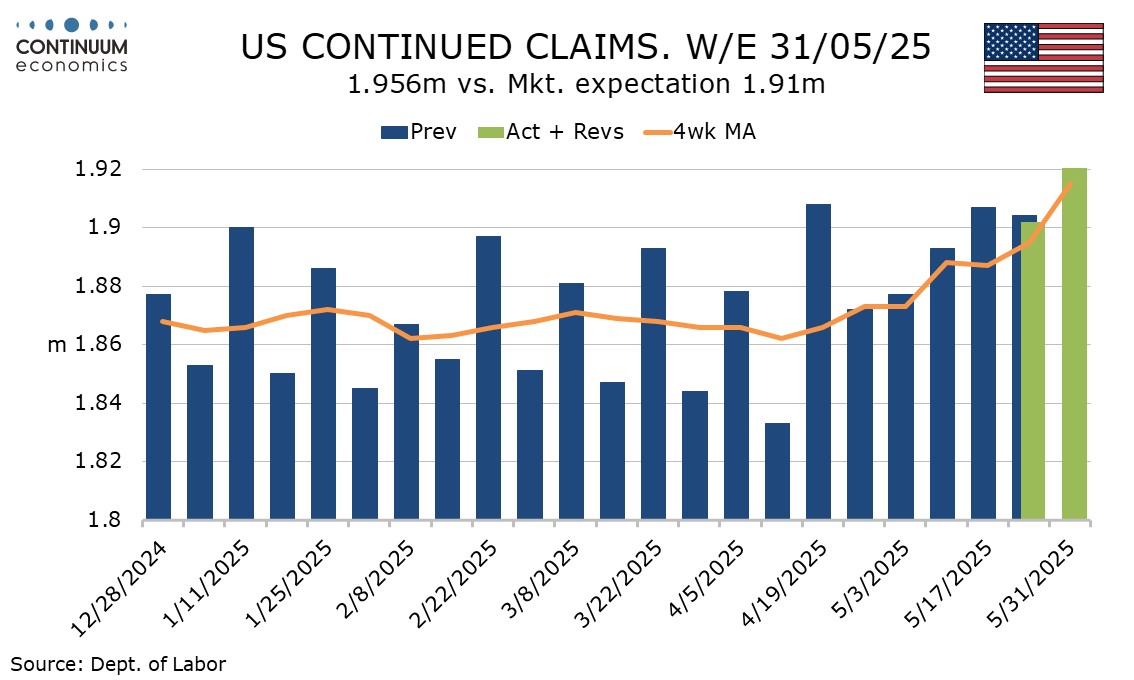

Continued claims cover the week before initial claims and saw a sharp 54k increase to 1.956m to follow a 5k preceding decline which was the first fall in four weeks. The latest level is the highest since November 2021.