GBP/USD, EUR/GBP: BOE to Deliver Weaker GBP v EUR

We see EUR/GBP to 0.90 by end 2026, but 1.3330 on GBP/USD due to a slightly weaker USD v EUR.

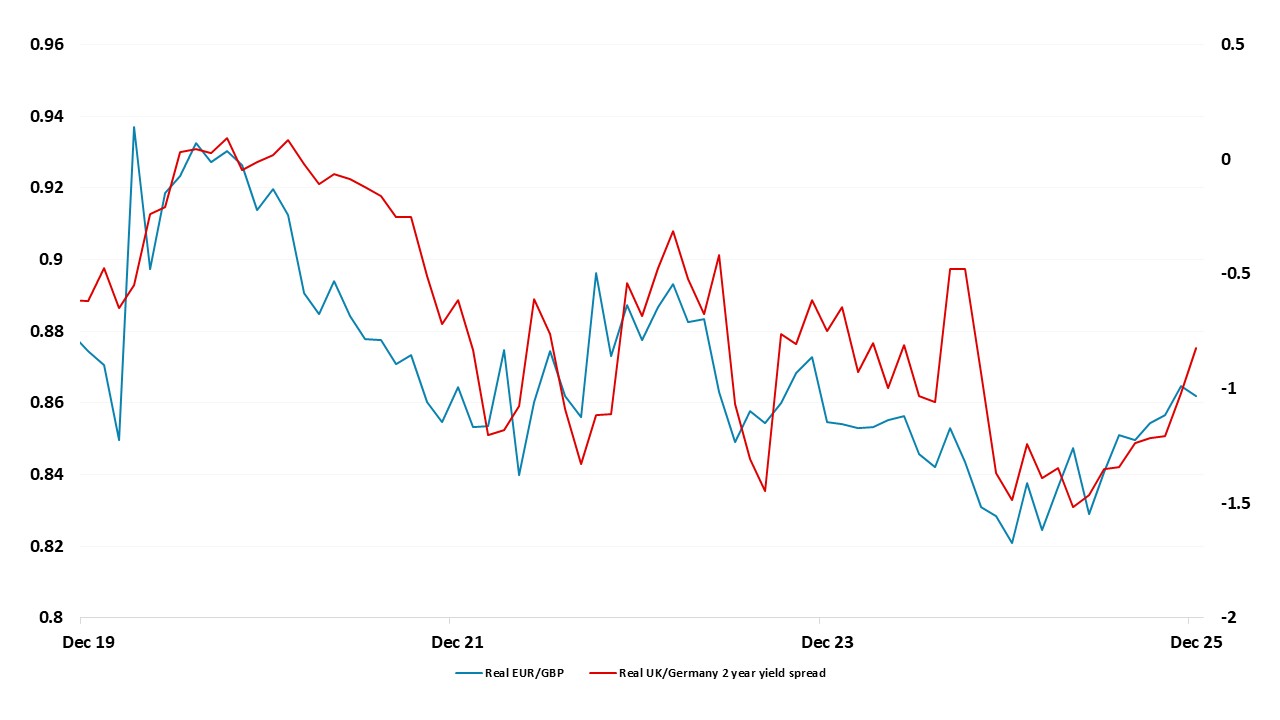

We expected GBP to continue the gradual decline against the EUR seen through this year. We expect the Bank of England to cut rates somewhat more than the market is pricing in, with the latest data on GDP, wages and prices supporting a more dovish stance. While we also see potential for the ECB to ease again, while the market is pricing in no change in policy rates for the next year, there should still be potential for real UK yields to fall slightly relative to the Eurozone. GBP might also suffer form any correction in U.S. equities which causes some general sell off in riskier currencies. Even so, GBP weakness is unlikely to be dramatic, with gains above 0.90 likely to be modest.

Figure 1: Real EUR/GBP and real 2 year yield spread

Source: Datastream, CE