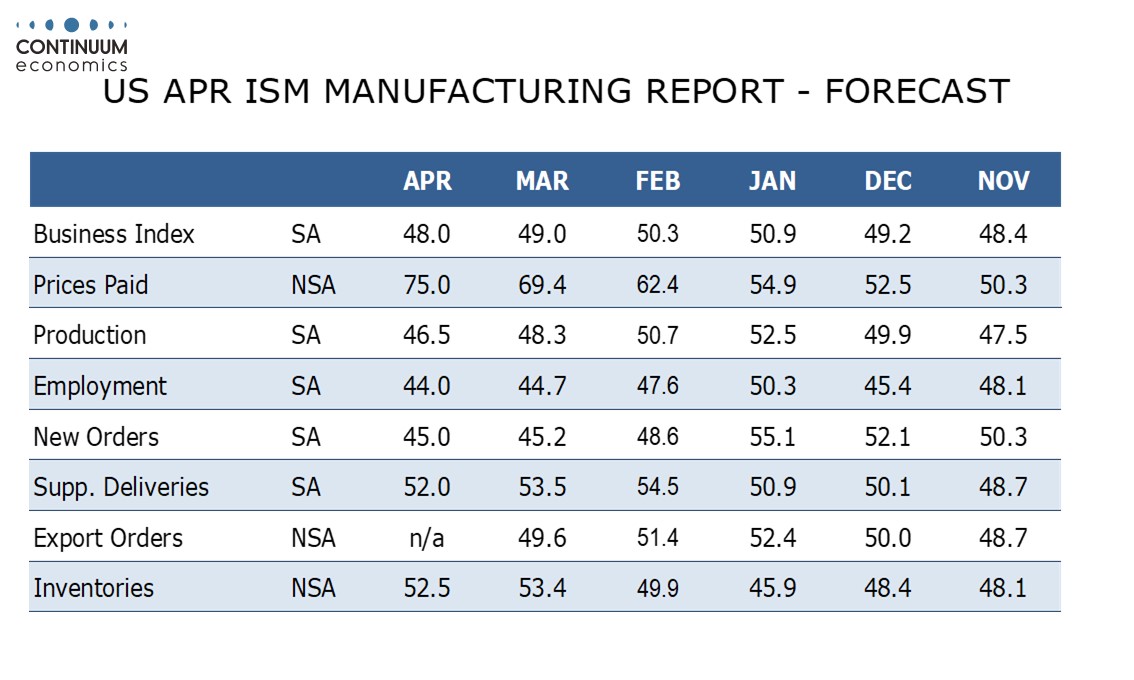

Preview: Due May 1 - U.S. April ISM Manufacturing - Further slippage seen

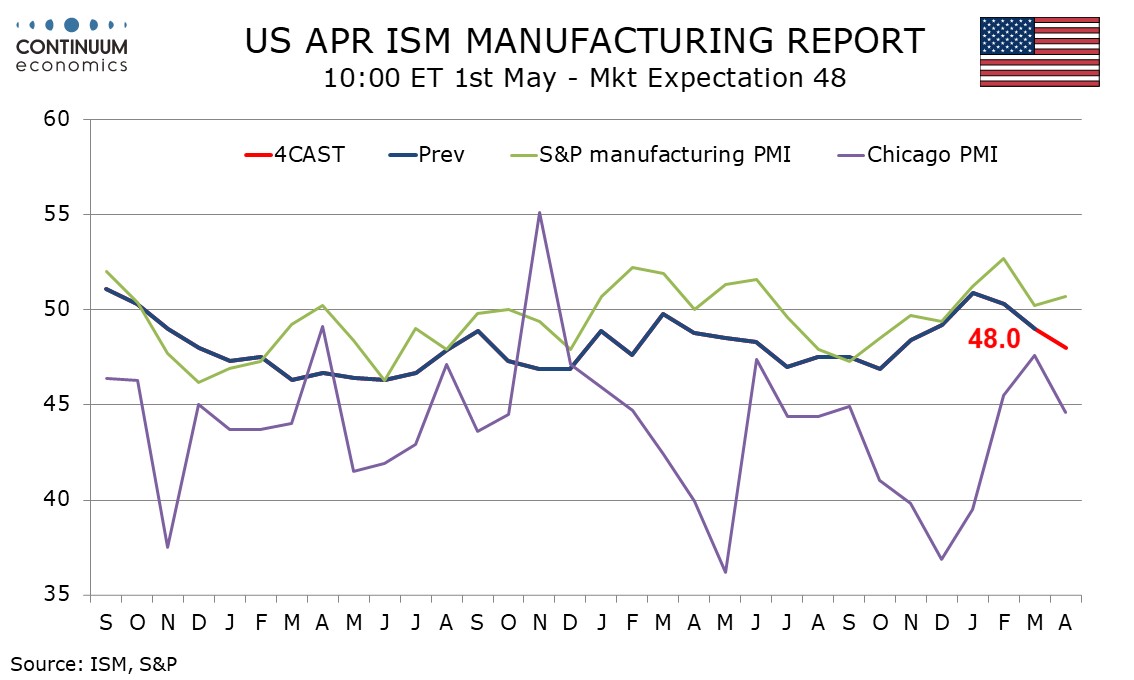

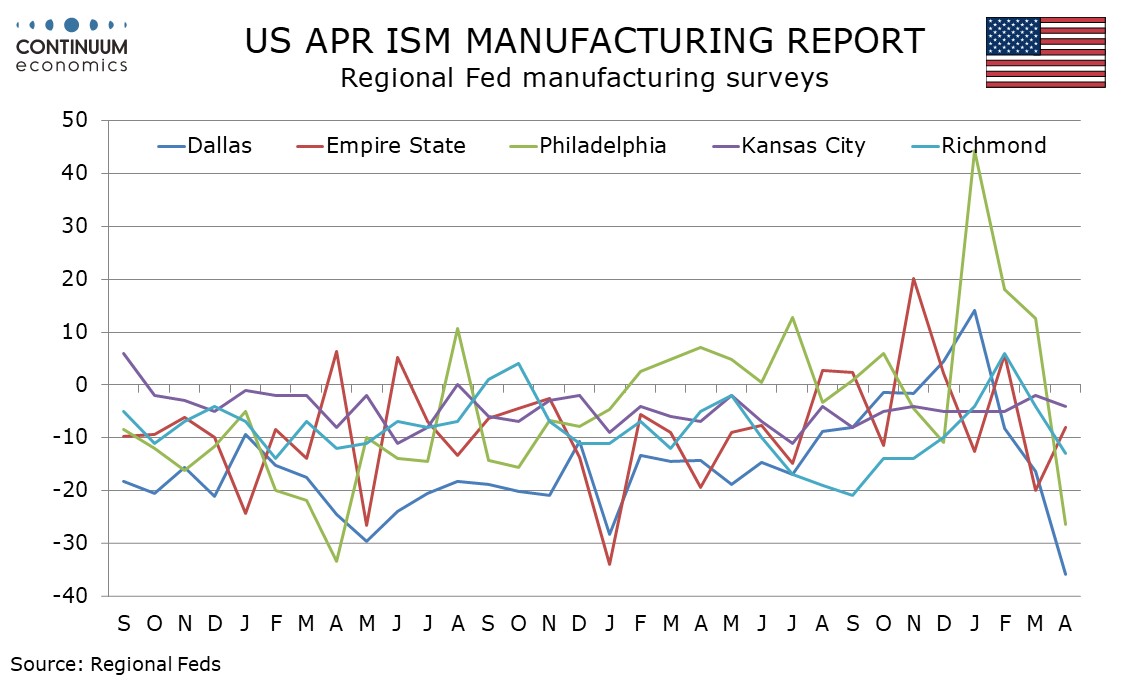

We expect an April ISM manufacturing index of 48.0, which would be the weakest since October. While the S and P manufacturing index saw an unexpected rise in April most regional manufacturing surveys have been weak, the Philly and Dallas Feds particularly so.

We expect declines in all five of the components that make up the composite, though only modest slippage in the two components that fell the most in March, new orders and employment. That new orders in March at 45.2 were their weakest since May 2023 is a negative signal.

Production is set to respond to weakness in new orders, falling to 46.5 from 48.3. Deliveries and inventories were positive in March, probably as a consequence of the tariff threat, but deliveries have already moved off February’s high and inventories probably have little upside from March’s 53.4.

Prices paid do not contribute to the composite and here we expect a further increase in response to tariffs, even with lower oil prices, to 75.0 from 69.4. This would be the highest since June 2022.