Preview: Due July 16 - U.S. June PPI - Stronger if still mostly subdued

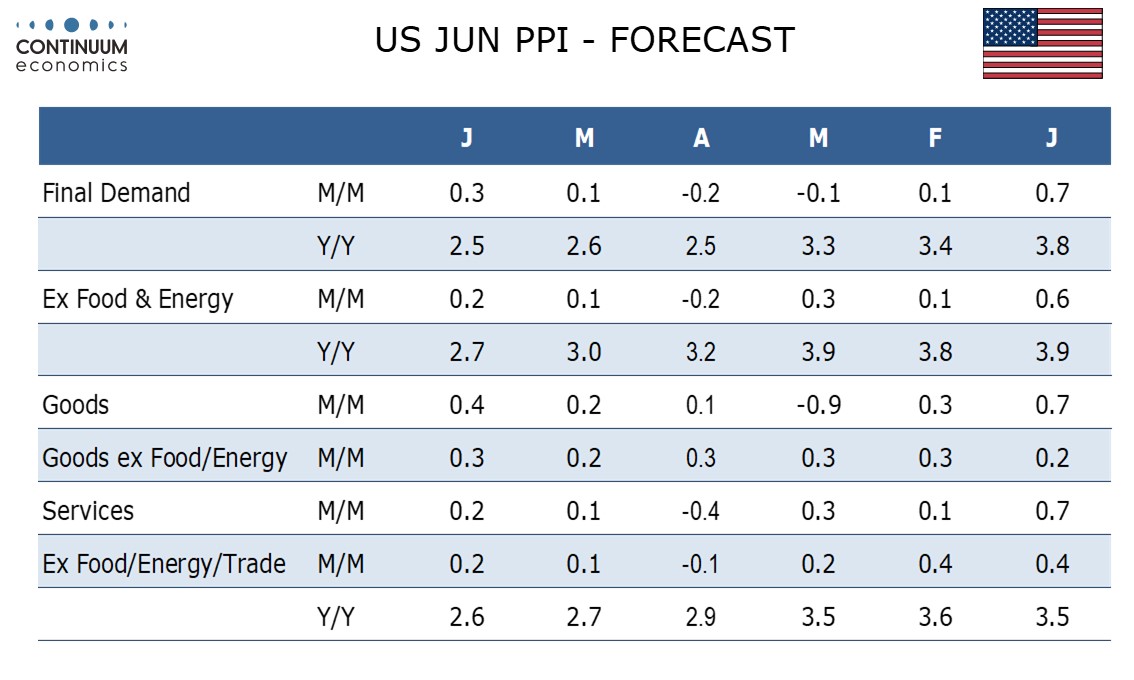

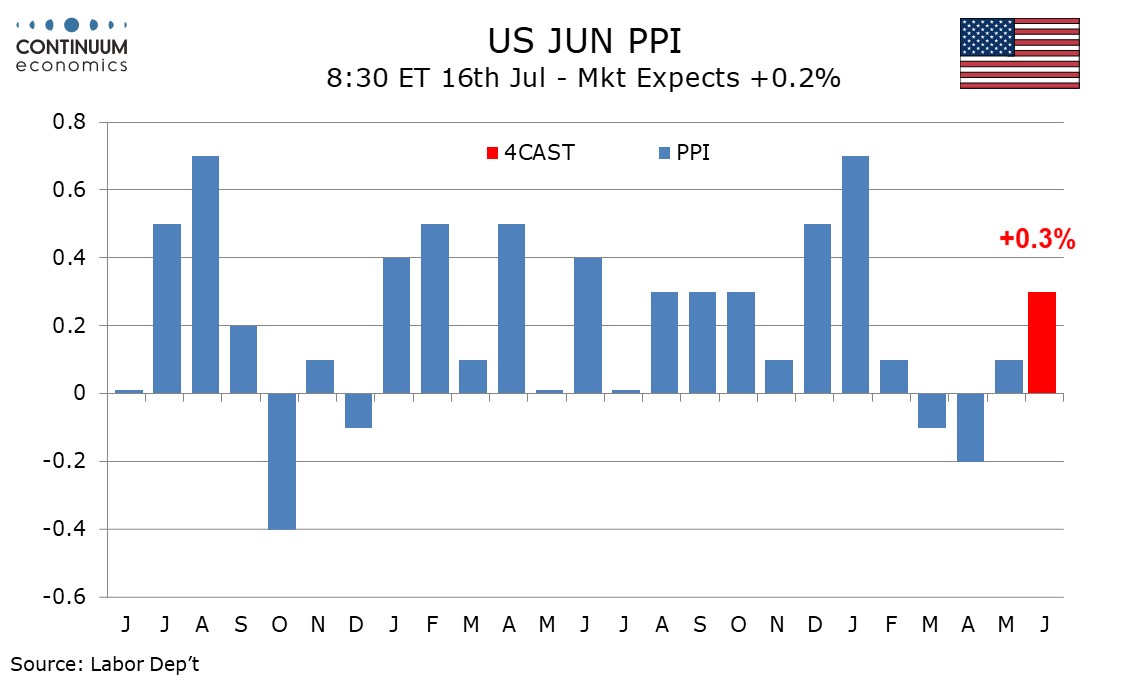

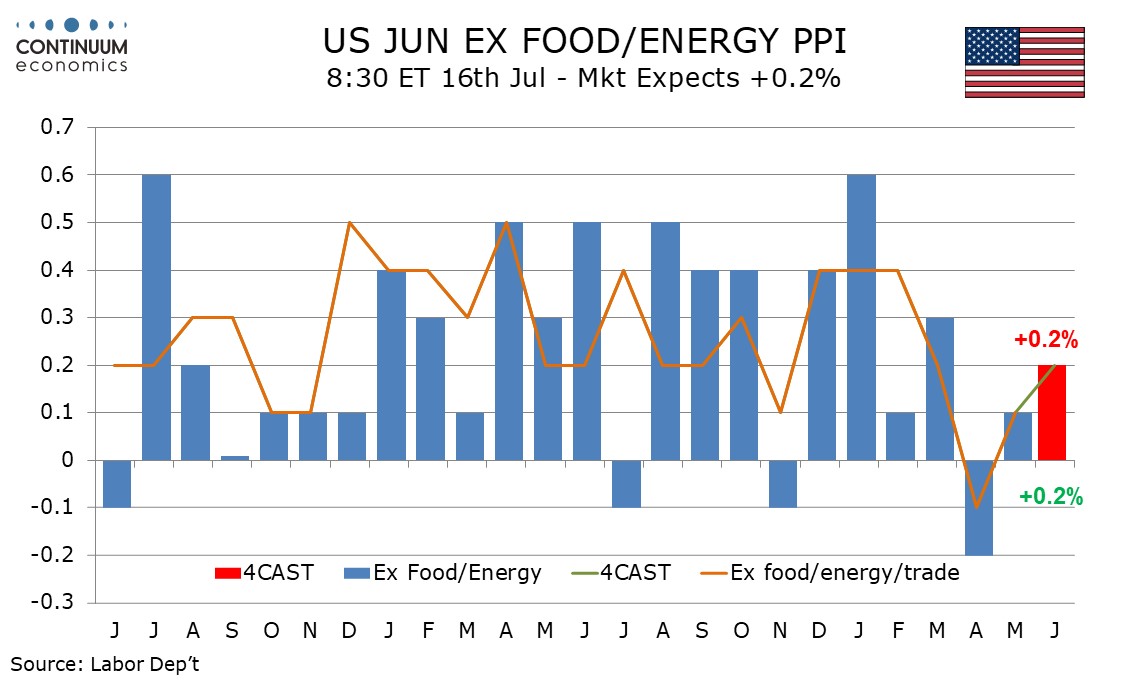

We expect June PPI to rise by 0.3% overall, which would be the strongest increase since January, with gains of 0.2% in each of the core rates, ex food and energy and ex food, energy and trade. The core rates would be the strongest since March, though still quite subdued.

We expect goods prices ex food and energy to rise by 0.3%, up from 0.2% in May which followed three straight gains of 0.3%. Trend in core goods has seen some acceleration this year and tariffs are likely to have fueled this and to sustain it. We expect moderate gains of 0.5% in both food and energy, the former seeing some lift from tariffs, lifting overall PPI marginally above the core rates.

Service inflation has been very soft since a 0.7% increase in January, April particularly so at -0.4% which saw only a modest upward correction of 0.1% in May. April weakness was broad based while March and May saw weakness in transport and warehousing but strength in trade. Transport and warehousing may have been hit by tariffs reducing imports but we expect a more balanced if still subdued picture in June when the tariff picture saw some stabilization.

Yr/yr growth will be restrained by strong data from June 2024 dropping out. We expect overall PPI to slow to 2.5% from 2.6%, ex food and energy PPI to slow to 2.7% from 3.0%, with ex food, energy and trade PPI at 2.6% from 2.7%. The ex food and energy pace would then be the slowest since November 2023.