JPY flows: Risks of sharp JPY gains

JPY remains very cheap and risks of sharp gains are increasing

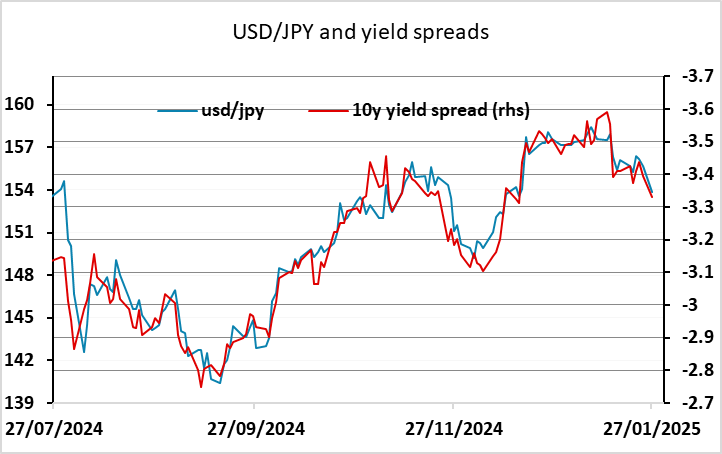

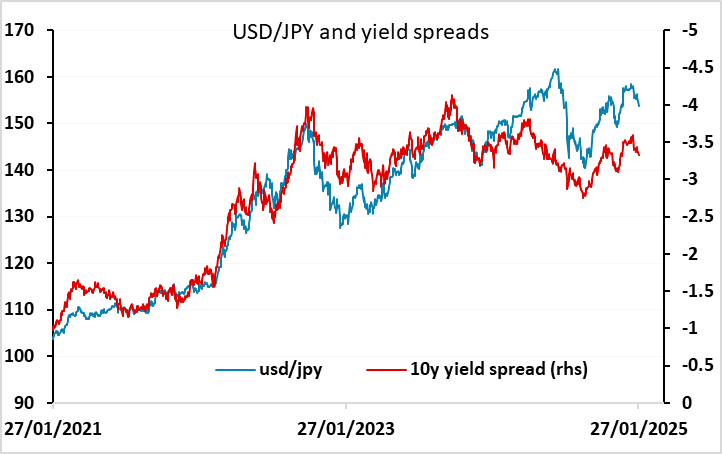

USD/JPY continues to stick closely to the correlation with 10 year yield spreads that has held since last August. Before that, the correlation was similarly tight, but the correlation implied lower levels. The shift came around the time of the Japanese intervention, but it isn’t clear why the JPY was seen as less attractive after that at the same level of yields. This provides one possible reason for further JPY gains.

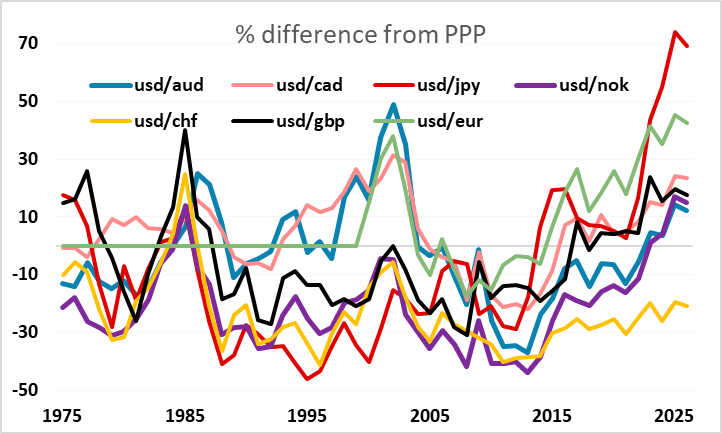

The correlation with nominal yield spreads has generally been strong over the years in the short run, but periods of relatively low Japanese inflation, such as we saw over the pandemic, ought to lead to JPY gains relative to the normal yield spread correlation. If the market ignores relative price moves, Japanese prices will move lower relative to prices elsewhere. While this is possible for short periods such real exchange rate moves don’t normally last indefinitely. This provides a second possible reason for JPY strength.

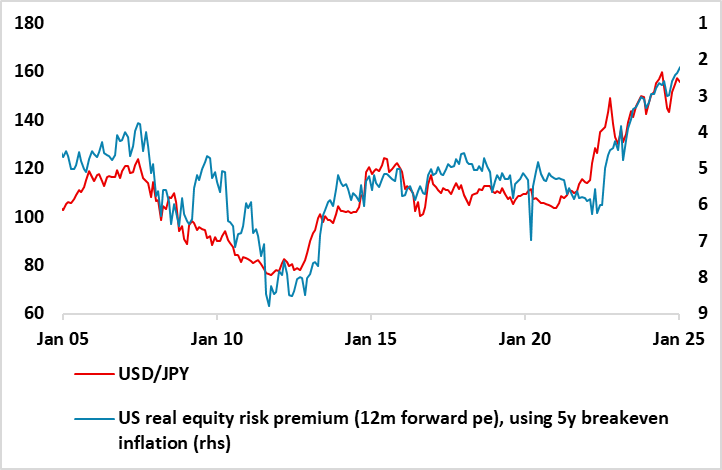

As well as the correlation with nominal yields, and the fundamental tendency for currencies to correct relative price moves, the JPY has tended over the years to be treated as a safe haven, declining when risk appetite is strong and rising when it is weak. There is a strong long term correlation between USD/JPY and real US equity risk premia. We suspect that the big JPY move higher is only likely to come when these equity risk premia rise to more normal levels, from the current level close to 25year lows. This is a third reason for JPY strength if we see equities start to weaken.

In this environment, with USD/JPY so extremely undervalued, the risks of a sharp JPY rise are large and investors and traders should be wary. The JPY has a history of very sharp moves higher when risk appetite turns sour.