Preview: Due December 5 - Canada November Employment - Correcting from a strong October

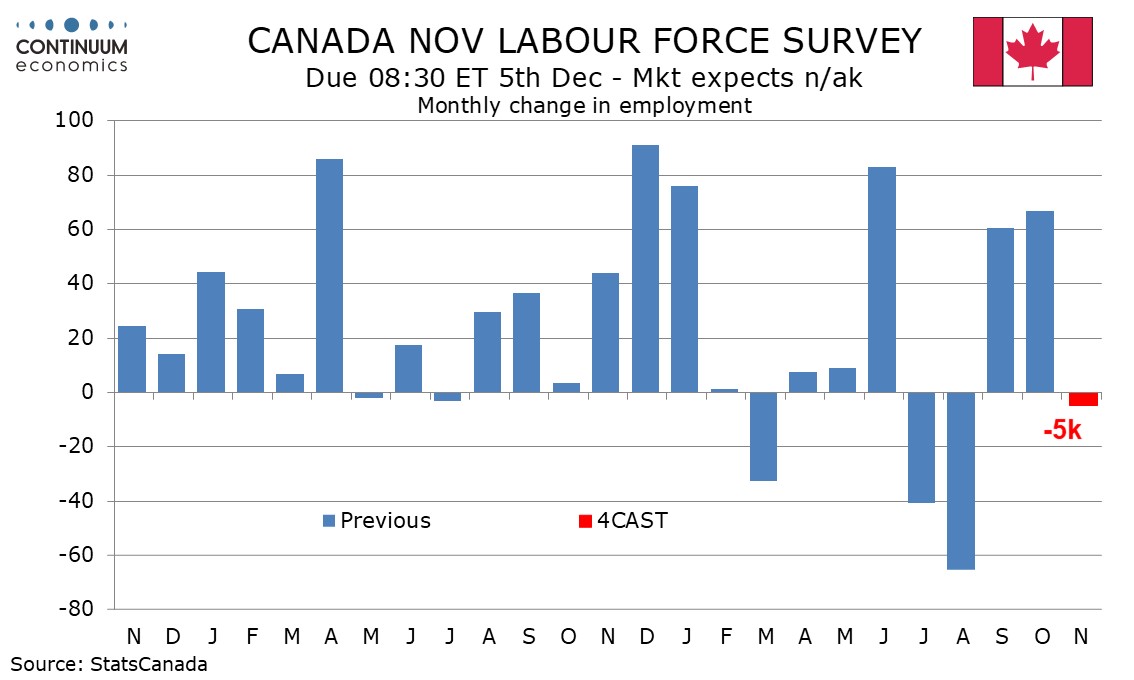

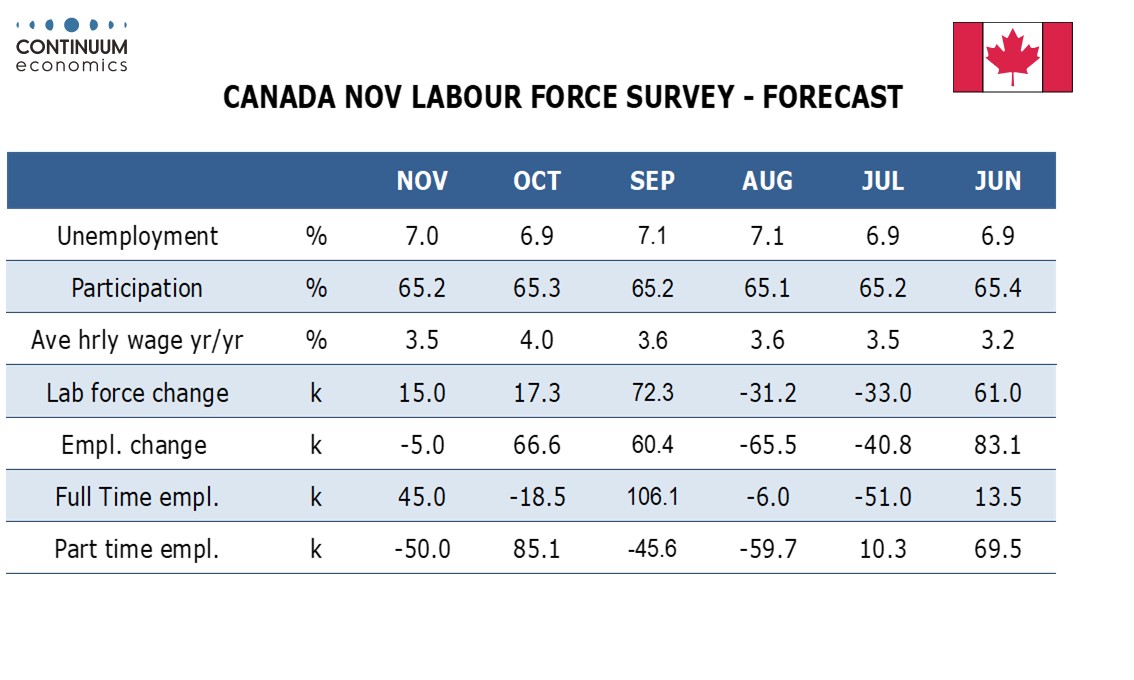

Canadian employment data has been volatile in recent months. Underlying trend still seems modestly positive, but after two strong gains in excess of 60k we expect a modest decline of 5k in November. This would lift unemployment to 7.0% from 6.9% in October, still below the 7.1% seen in August and September.

Three and six month averages for both labor force and employment growth are all close to 20k, though the latter looks a little stronger than would be justified by expected annualized GDP growth of around 1.0% in Q4, and it is likely that trend will slow somewhat, but without turning negative. We expect a 15k increase in the labor force in November, in line with October’s 17.3k, but employment is vulnerable to a correction from a 66.6k rise in October, a second straight strong gain that followed two straight sharp declines.

Within the employment breakdown manufacturing, after two straight gains, looks vulnerable given its sensitivity to tariffs, while a 40.7k increase in wholesale and retail in October also looks unlikely to be fully sustained. October’s employment rise came fully from a surge of 85.1k in part time work. In November we expect slippage in part time work to marginally outweigh a rebound in full time work.

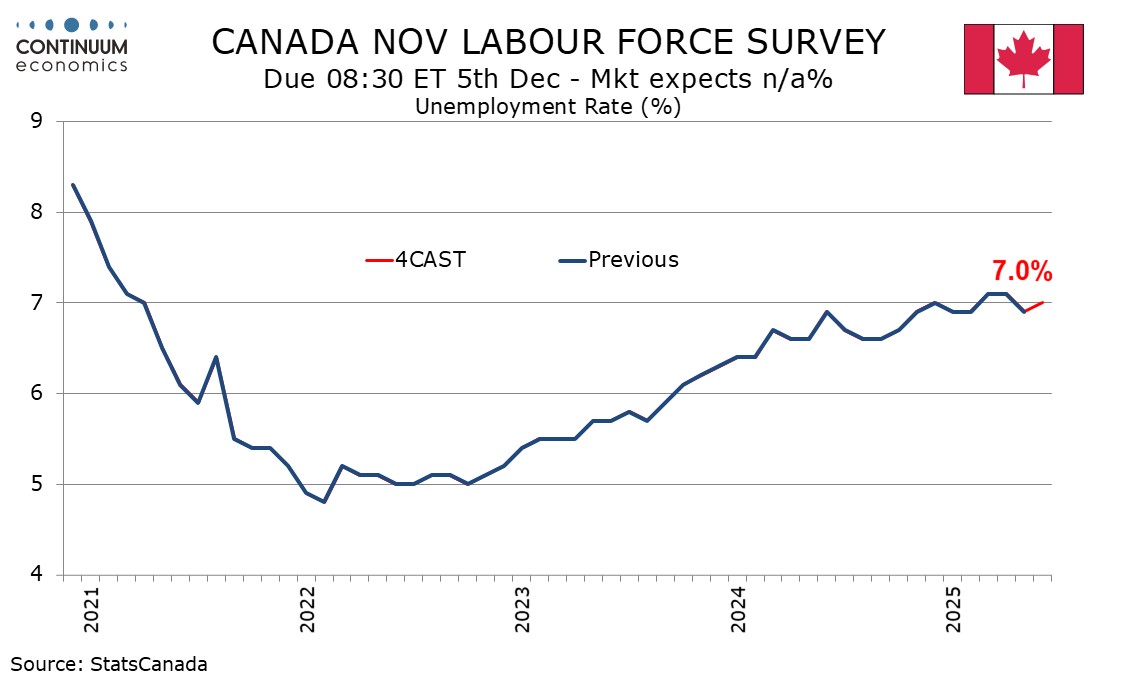

The unemployment rate has been trending higher from near 5.0% at the start of 2023 but now seems to be stabilizing near 7.0%. However, significant declines in the rate are likely to require GDP growth closer to 2.0% than 1.0%. A bounce in the average hourly wage of permanent employees to 4.0% in October from 3.6% in September looks unlikely to be sustained. We expect a slowing to 3.5% in November.