Published: 2025-03-07T17:10:55.000Z

Preview: Due March 18 - Canada February CPI - Firmer even on the core rates

5

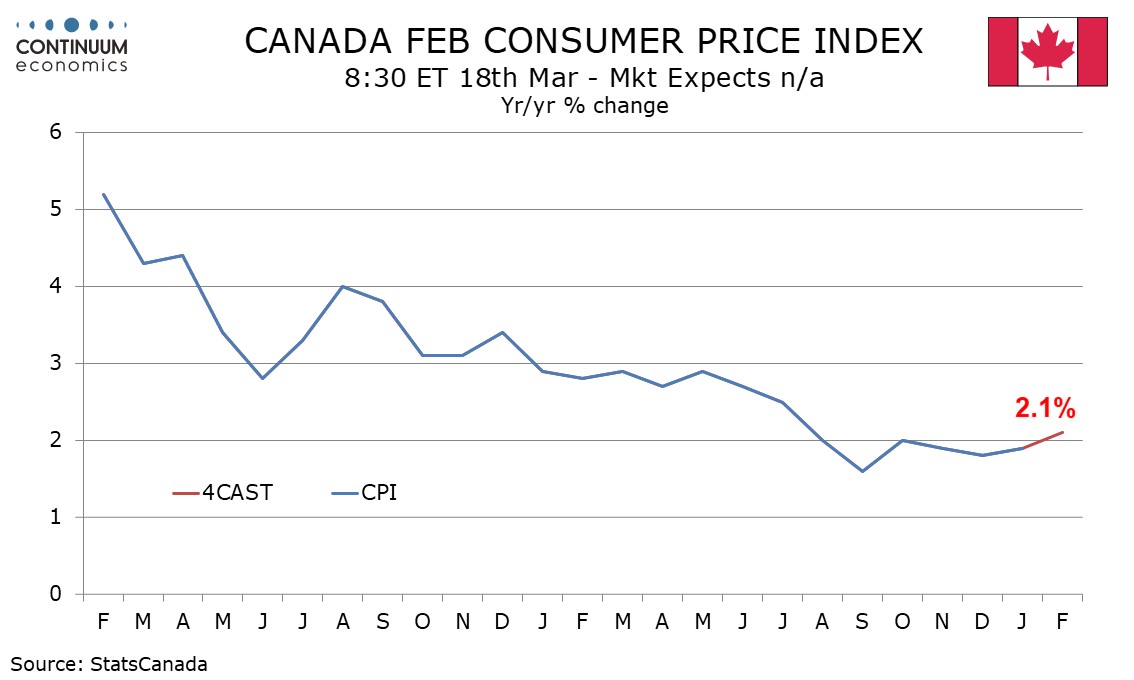

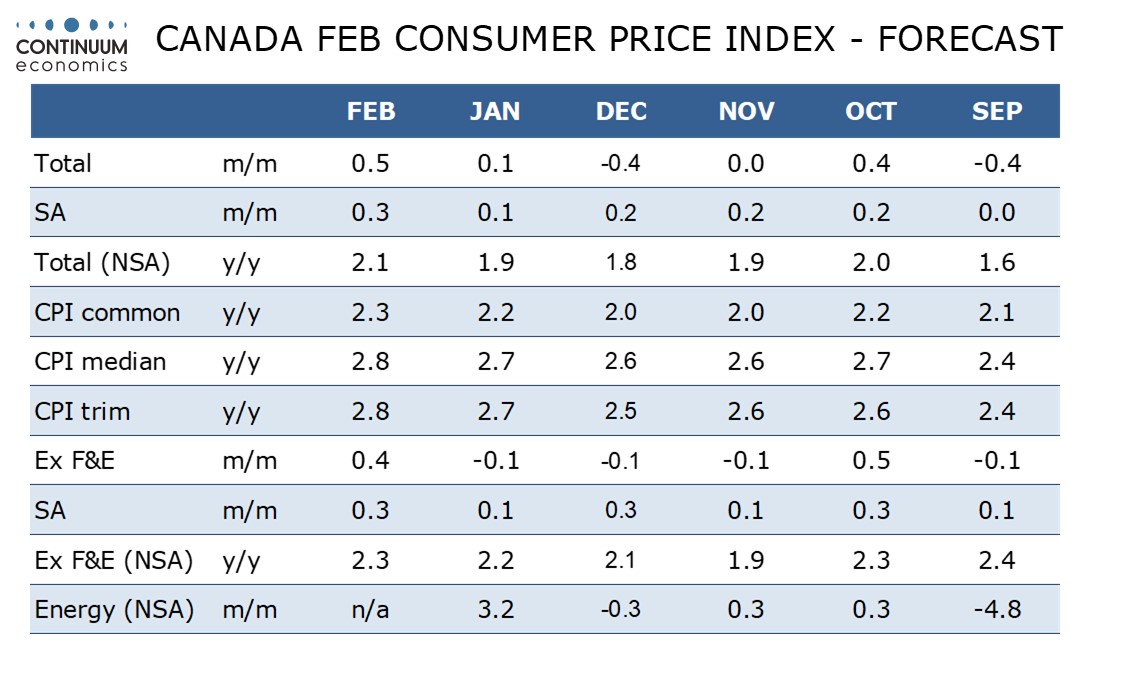

We expect Canadian CPI to increase to increase to a 7-month high of 2.1% yr/yr from 1.9% in January. We also expect the Bank of Canada’s core rates to move higher, moving further above the 2.0% target.

A sales tax holiday which ran from mid-December through mid-February will start to unwind in this report. The holiday depressed CPI less than was expected, probably because of CAD weakness, but its ending still means upside risk in February and March.

We expect CPI to rise by 0.3% seasonally adjusted both overall and ex food and energy. Unadjusted the gains are likely to be a little stronger, at 0.5% overall and 0.4% ex food and energy.

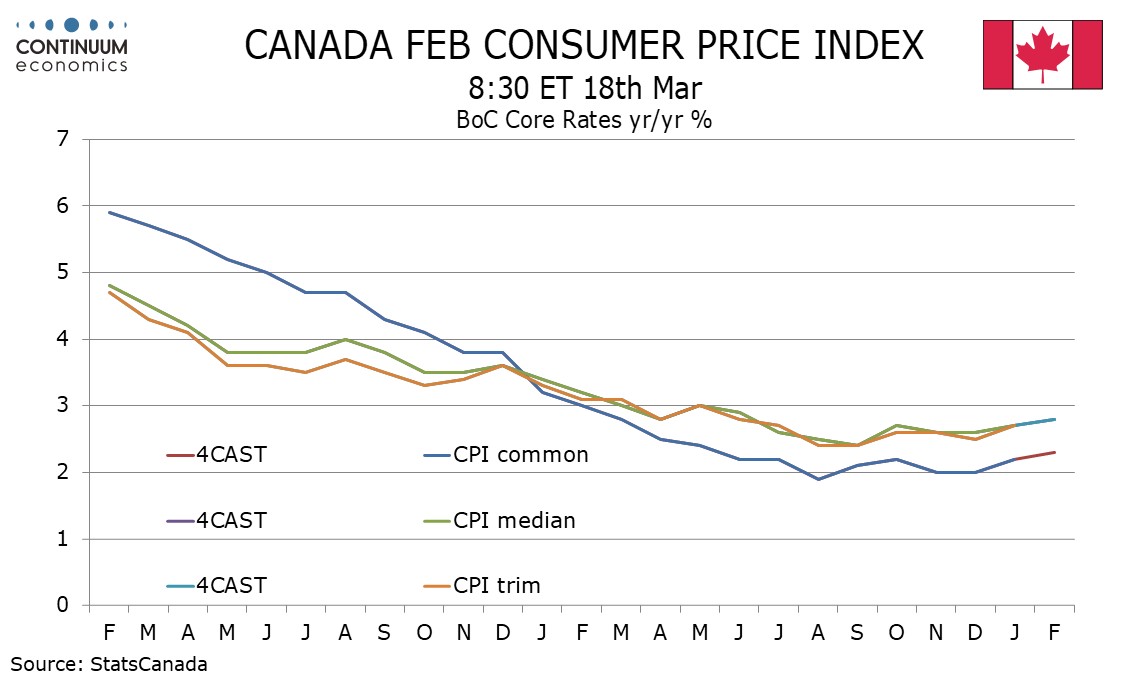

Despite their being less sensitive to the tax shifts, subdued year ago data means upside risk for the Bank of Canada’s core rates. We expect CPI-Common to rise to 2.3% from 2.2% while CPI-Median and CPI-Trim rise to 2.8% from 2.7%. These would all be the highest since June 2024.