Preview: Due November 17 - Canada October CPI - Slower if still above target

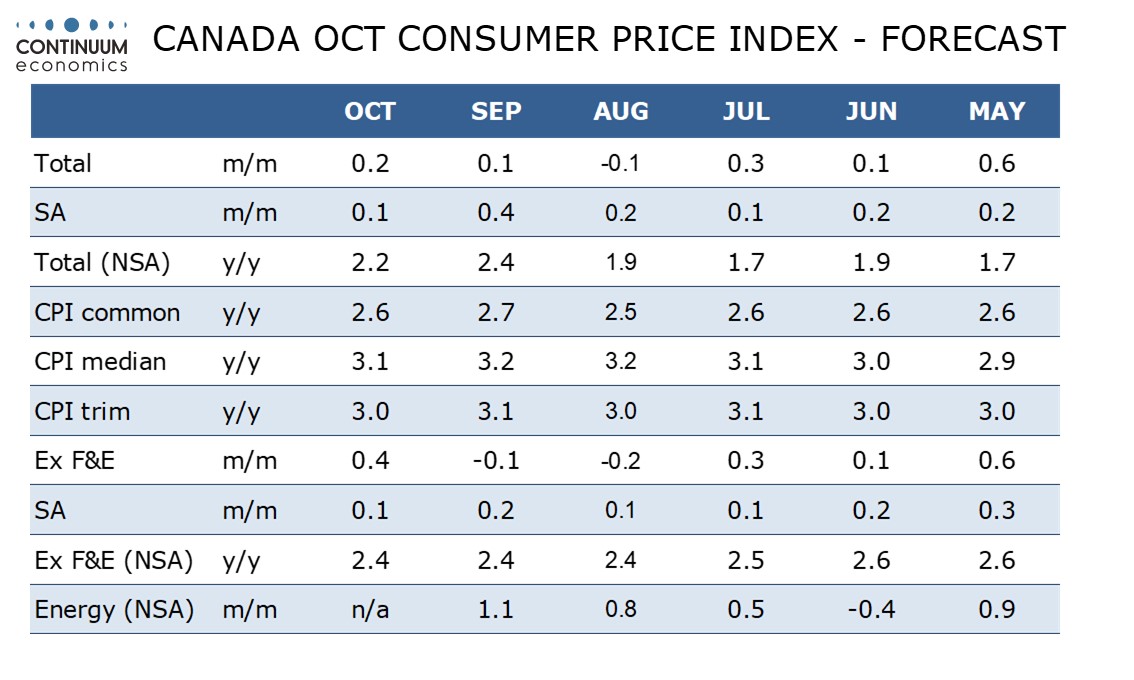

We expect October’s Canadian CPI to slip to 2.2% yr/yr from 2.4% in September, though this will remain above August’s 1.9% and a Bank of Canada forecast for Q4 of 2.0%. We expect modest slippage in the Bank of Canada’s core rates too, though they will remain above the 2.0% target.

On the month we expect seasonally adjusted gains of only 0.1% in both overall and ex food and energy CPI, with the overall on the low side of 0.1% but the ex food and energy rate slightly above before rounding. Recent months have seen seasonally adjusted ex food and energy CPI lose momentum, with a 0.2% rise in September following gains of only 0.1% in July and August.

Unadjusted the monthly gains are likely to look stronger, with a 0.2% increase overall with ex food and energy CPI up by 0.4%. We expect the yr/yr ex food and energy rate to remain at 2.4% for a third straight month. The yr/yr headline rate will remain restrained by around 0.7% due to April’s abolition of the carbon tax. Without this, energy prices would be higher than a year ago.

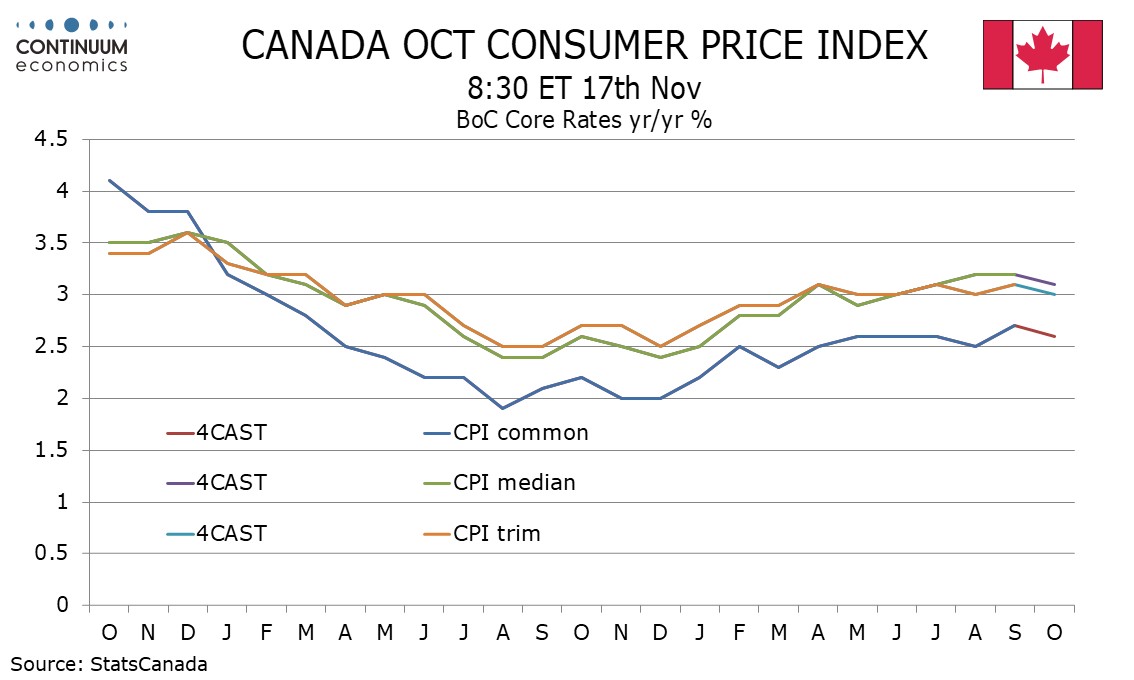

The ex food and energy rate is not one of the BoC’s three core rates, which are likely to see some slowing as acceleration in October 2024 drops out. We expect CPI-Common to fall to 2.6% from 2.7%, CPI-Median to fall to 3.1% from 3.2%, and CPI-Trim to fall to 3.0% from 3.1%.