JPY flows: JPY under pressure again

EUR/JPY on an unprecedented ninth consecutive week of gains as risk sentiment remains buoyant, but valuation is extreme

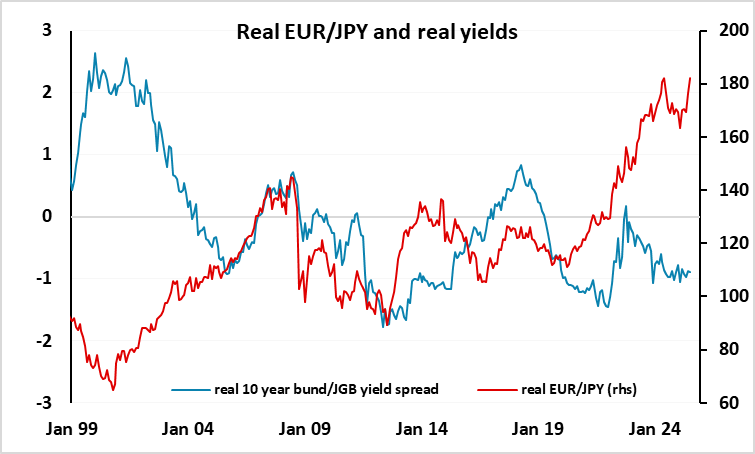

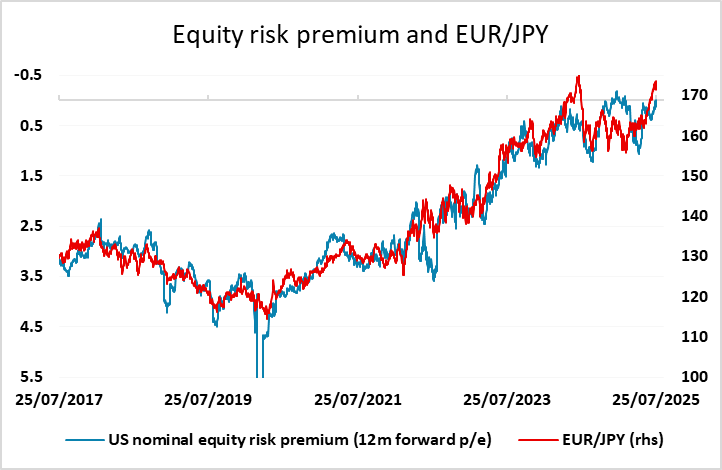

The JPY has fallen back sharply in early European trade, with EUR/JPY hitting another new 1 year high and now heading for its ninth consecutive week of gains. This would be the first time in the history of the EUR that we have seen 9 consecutive weeks of EUR/JPY gains. It is also coming at a level of EUR/JPY which is close to all time highs, and without any real justification from any moves in yield spreads. The support for EUR/JPY seemingly comes entirely from the (inverse) correlation with risk premia. The resilience of equity markets, bolstered by talk of trade deals in recent days, has mean that equity risk premia are heading towards their recent 23 year highs seen at the beginning of the year.

Can the trend continue? Certainly, it seems that as long as risk premia continue to fall it will be hard to break the trend. Value is a weak attractor in FX markets, and there is no immediate likelihood of any policy action intended to halt the EUR/JPY gain. While the JPY is still very weak on a real trade-weighted basis, the focus tends to be more on USD/JPY as far as intervention is concerned. The ECB is becoming more concerned about the gains in the EUR, but the EUR is still not particularly strong in fundamental terms. Nevertheless, 9 consecutive weeks of gains is unprecedented, and a pause seems likely soon. The most likely trigger for a turn would be news that there was no EU/US tariff deal and the EU would be paying 30% tariffs. While the implications for EUR/USD of such news would be unclear, the JPY seems likely to benefit from the risk fallout that would result.